Renminbi Me

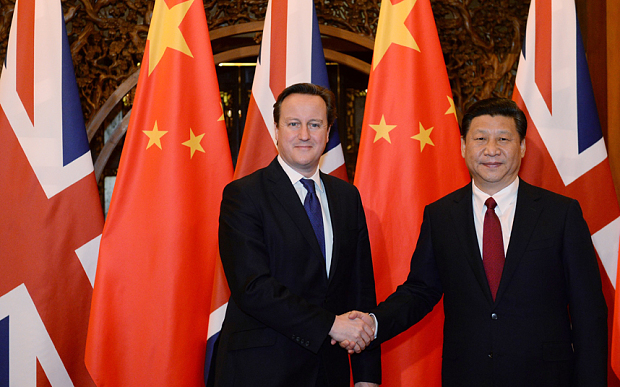

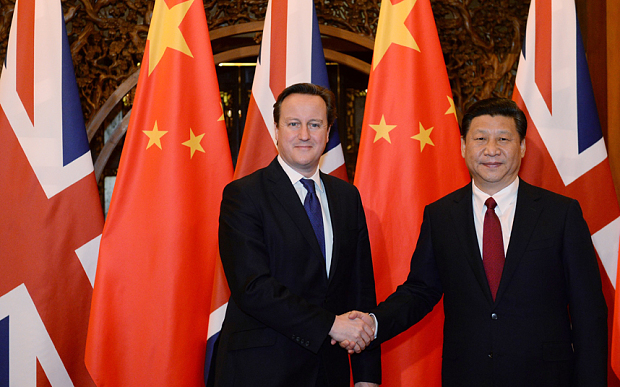

This must be a poignant moment for the Chinese people. Just over 150 years after Britain humiliated China in the Second Opium War, forcing them to accept our narcotics imports, the British Government has been reduced to kowtowing as though its life depended on it.

The crown jewel of this week’s trade deals is meant to be the bizarre decision to give a Chinese state energy company a 1/3 stake in the new Hinkley Point C nuclear reactor. 2/3 owned by the French state energy company EDF, it isn’t so much a Private Finance Initiative as a Foreign Governments Finance Initiative. Hinkley Point is massively expensive, with a 35-year contract guaranteeing the electricity will be bought at around double the current wholesale price. The only two other reactors built to this design have run over budget and over time, and both remain unfinished.

Furthermore, Hinkley Point is a serious problem for Scotland. The Scottish Government’s economic strategy is to transfer our world-leading marine engineering skills from oil to offshore wind. With 1/4 of Europe’s wind energy potential, and interconnectors to Norway and perhaps even Canada being planned, renewable energy could be a goldmine for Scotland – and give us real economic independence from Britain. Unfortunately for us, nuclear is the hardest power source to combine with wind, because while wind power is intermittent and unpredictable, nuclear power stations have to run 24/7 at a high proportion of their capacity.

It’s no surprise that a Tory chancellor would casually wreck the environment and regional economies, but why hand over nuclear infrastructure to China in particular, and why now? The answer, as ever, is banking.

To compete with America, China needs to be able to borrow at cheap rates across the globe. Ever since Nixon ended the gold standard in the 1970s, the dollar has been- the currency central banks hold on to in case of emergencies. That has allowed America to borrow at staggeringly cheap rates, funding its Far East import addiction.

Now China wants to join the party, and the City of London wants in. Far more important than the infrastructure projects is the sale of RMB30bn ($4.7bn) of Chinese debt in London – the first-ever foreign sale of Chinese debt. The Financial Times explains:

As renminbi internationalisation accelerates, the UK and China have implemented initiatives to link their financial markets, including plans to formally connect London and Shanghai stock markets.

“A highlight of China-UK economic relations is London’s potential role as a top offshore renminbi centre in Europe. This will further strengthen London’s position as a predominant global financial centre,” wrote Shen Jianguang, chief Asia economist at Mizuho Securities, last week.”

Once again, the future of Britain has been auctioned off to keep money flowing into the London banking ponzi scheme.

Well…. I think it is quite simple.

No one else will lend Westminster the money.

They are a bad risk.

Yeah, but I wouldn’t like to be anyway near Hinkley when they start fracking in earnest.

The Tories don’t give the proverbial shit about having an energy strategy. The Chinese are getting out of nuclear, and funding huge renewable projects. Meantime, the first worker to be diagnosed with cancer from Fukishima was announced this week.

“The Chinese are getting out of nuclear…”

They currently have 27 reactors, 24 under construction, a further 35 planned, and proposals for 170 more.*

If that’s “getting out of nuclear” I hope we start getting out too.

*http://www.world-nuclear.org/info/Country-Profiles/Countries-A-F/China–Nuclear-Power/

My bad. That link is very interesting. Everything was suspended following Fukishima, for a safety review. They reviewed and restarted.

I’m assuming they have found some way to stop earthquakes? The graphic towards the bottom scares the shit out of me.

Fair, sorry to disappoint, but I’m pretty sure there are no plans for nuclear in Scotland.

Germany sensibly abandoned any ideas for more nuclear not long after Fukishima. They now have a phase out plan for the reactors still in use.

I seriously don’t know why people think it’s worth the risk.

So instead of displacing coal (they use lots of coal), their renewables are displacing nuclear. Not only is coal the worst fuel for co2 emmissions it also several orders of magnitude more deadly than nuclear power*

*http://www.forbes.com/sites/jamesconca/2012/06/10/energys-deathprint-a-price-always-paid/

http://www.telegraph.co.uk/news/earth/energy/11942200/Its-renewable-energy-where-the-Chinese-can-really-help-us.html

Valerie, you seem to be confusing Japan & China. JAPAN suspended all nuclear power, it is Japan who have earthquakes, Fukushima is in Japan, not China.

China has earthquakes too, lots of them. It sits between two seismic plates. See:http://earthquaketrack.com/p/china/recent

However, it does not require an earthquake to cause a nuclear accident at a nuclear power plant. Neither Three Mile Island nor Chernobyl were caused by earthquakes. Human error will do it too, something along the lines of ‘I wonder what happens when we do…OOPs!’

What price future Electricity will be to the UK Consumer, no more Government price freeze options , likely signed away as part of the deal , what future for UK Manufacturing and their fuel bills. I don’t see any reference to any consumer price guarantees.

If future Green energy is available to the Scottish market and at a more attractive cost then surely Scotland’s future energy needs are best served by continuing on our current path. I can’t accept that this is a problem for Scotland ,I see it as an fantastic opportunity. If our Green/Renewables ambitions are to be hindered or disadvantaged it’s yet another arguement in favour of our future Independence.

I guess the deal for construction will require Chinese manufactured Steel.

What a capitulation.

“http://www.telegraph.co.uk/news/earth/energy/11942200/Its-renewable-energy-where-the-Chinese-can”

Yes, using a mix of all available low carbon technologies is a sensible approach.

I’d recommend this book for anyone interested in the subject. It does a very good job of explaining the pros and cons of the available technologies.

http://www.amazon.co.uk/Sustainable-Energy-Without-Hot-Air/dp/0954452933/ref=sr_1_1?ie=UTF8&qid=1445508309&sr=8-1&keywords=david+mackay

It’s available for free here – http://www.withouthotair.com/

Just noticed this on twitter…

http://www.forbes.com/sites/jamesconca/2015/10/22/china-shows-how-to-build-nuclear-reactors-fast-and-cheap/

“By 2050, nuclear power should exceed 350 GW in that country, include about 400 new nuclear reactors”

”

It seems as though 5 years and about $2 billion per reactor has become routine for China”

Its commonly referred to as “cutting corners”. Usually and inevitably with health and safety. Probably with waste disposal as well. Then of course China has its own supply of Uranium. It doesn’t have to import it.

http://www.world-nuclear.org/info/Country-Profiles/Countries-A-F/China–Nuclear-Fuel-Cycle/

You know the little things.

Do you have any actual evidence of corner cutting?

I suspect it has more to do with choice of reactor design, skilled workforce and economies of scale.

Also, I dont see how waste disposal practices or uranium supply affect the speed of construction or capital cost of reactors.

“Do you have any actual evidence of corner cutting?

I suspect it has more to do with choice of reactor design, skilled workforce and economies of scale.

Also, I dont see how waste disposal practices or uranium supply affect the speed of construction or capital cost of reactors.”

You cant be serious?

The choice of reactor design? Are you telling us there is a specific reactor design which nobody else uses because its cheaper and faster to install?

Skilled workforce? It will be the same skilled workforce which works on all the reactors across the world. Contractors. Just like it is in the Oil and Gas industry. The same experts the same professionals used on different contracts all over the world. AT THE SAME COST!

Economies of scale? In what respect? They are bigger have more needs bigger costs bigger budgets so by default will take longer if economies of scale and not corner cutting is the approach.

You cant see the effect waste disposal and supply of Uranium wont enter into the overall planning and project management of the initial build?

Is that because you’re a stranger to reality or dishonest?

Most of us will be pushing up the thistles long before Hinkley clanks into action. It’s a prestige project, a fat cherry on top of a big cake that hasn’t been baked yet, but is being mixed up in the City. It imparts a whole new meaning to Great British Bake Off. Scotland should, and will, push on regardless with our ambitious plans for renewables.

Bankrupt UK borrows money from China. More bad debt and bad environmental policies for Englandshire. Scotland needs to get out of this melting reactor of a country.

“Unfortunately for us, nuclear is the hardest power source to combine with wind, because while wind power is intermittent and unpredictable, nuclear power stations have to run 24/7 at a high proportion of their capacity.”

Most people would see the ability to provide power 24/7 as a distinct advantage.

Read that China wants to build further Nuclear ststions in the UK, to their own design using their own software to control the station, apparently our Security a Service are up in arms at the prospect.

Read that China wants to build further Nuclear stations in the UK, to their own design,

using their own software to control the station, apparently our Security a Service are up in arms at the prospect.

It’s not actually the case that nuclear is poor at balancing wind because it can’t load follow. EDF plants in France vary their output all the time.

The reality is more that no regulator or Green organization has yet come up with a plausible piece of sophistry to explain why intermittent wind really ought to have grid priority over reliable, low marginal cost nuclear when both are on par in terms of emissions.

The 100% renewables vision is, frankly, so much cant and classic SNP tactical rhetoric. It’s time to face the inconvenient truth that offshore wind will never be an income generator to sustain the North Sea. The ScotGov, if it had vision, would steal a march on Westminster’s cronyist and conservative approach to nuclear and put our excellent universities into collaborations with the burgeoning number of innovative nuclear R&D firms.

“while wind power is intermittent and unpredictable, nuclear power stations have to run 24/7 at a high proportion of their capacity.”

This is consistent with the rhetoric of all those who would resist the development of renewables. It should long ago have been consigned to the status of myth. There are plenty of storage technologies in the pipeline that can and will allow for full reliance on solar and wind.

Could you kindly elaborate on what these technologies are?

You could make a start here:http://earthquaketrack.com/p/china/recent

Or here:http://www.windpowerengineering.com/design/unlocking-potential-wind-power-energy-storage/

We should reject nuclear power. I am currently on a project for removing waste from a well known plant and trust me the risks are far too high. I understand that once the reactor’s are up and running they do produce a lot of cheap energy but the start up and clean up costs are phenomenal to say the least. I personally believe that as a species we discovered nuclear energy way too soon, we think we have the know how and technology to manage it but the project I am on everyone is shitting themselves, to put it into perspective it could be 100x worse than Chernobyl. Wind, solar, tidal and hydro should all be pushed at big national level as well as locally in towns and villages including everyone’s own home where its practical. I understand that would take time and there has to be a mix through the transition but there has to be the will and a bit of strength to stand up to the big energy companies. Oil and gas is here fair enough but we have to phase our dependencies on it out. Yes we will need it for plastics etc so we will still need some fields but we simply can’t keep burning the stuff. Nuclear might have a place when we are zooming about in space ships and we know how to handle it but the clean up is still to risky and costly.

The UK owes China billions for cheap imports – the latest being steel. It is tough to balance this with a few tonnes of smoked salmon and a load of Scotch whisky, or even a partnership to make busses. This is not investment in the true sense, it is a method of paying off sovereign debt, hence the guaranteed prices for the electricity – and guess who will pick up the clean up bill for the nuclear waste?

Responsible government? Aye, that’ll be right…..

T

Follow the money!

The topic here is nuclear industry and the pros and cons pertaining to safety, cost, environment and security of electricity supply.

For me nuclear energy is too high risk should an accident occur, costs too much, dirties the environment for millennium and should an accident occur the whole station has to close indefinitely. Furthermore, there is secrecy surrounding and bi-products of this industry that leave a lot to be desired.

Following the money leads us to the city, what a surprise. This is almost gangster type laundering of money that if included in the God Father would have been dismissed by critics as too far fetched. Well it’s not too far fetched, it sums up the singled minded determination the tories have to benefit their pals in the city who fund them. They don’t appear to care who knows it.

Strange how the press and media get into a frenzy over small sums subsidising cultural events or buying of properties, yet there is little investigation into the money trail here or who is benefiting!

A £92 per Kwhr kick back to the Chinese is evidence of this dimension.

£92/MWh.

Onshore wind is only 10% cheaper at an average of £82/MWh* – but as the article states, is inherently more unreliable.

*http://energydesk.greenpeace.org/2015/02/26/onshore-wind-solar-cheaper-nuclear-gas-uk-now/

Can the SNP confirm it is their policy there will be no Nuclear Power Generation as a replacement of EDF’s Torness Nuclear Power Station? The extension of Torness beyond its operational life is already sweating the asset with added risks. It was shut down four times in 2014 and problems continue this year. (http://www.heraldscotland.com/news/13207795.Radiation_leak_at_Torness_nuclear_power_station/). The reason I ask is so that the skilled workforce can plan to up-date and transfer their skills and knowledge to other industries such as railways and aerospace. In relation, I also have safety concerns for the type of replacement reactor that may be planned.

As George Osborne was smoothing deals in China, EDF was also negotiating with ” China General Nuclear Corporation and China National Nuclear Corporation — over their final shares of construction spending and roles in the building of up to three European Pressurised Reactor(EPR) plants in the UK. However, John-Bernard Levy EDF Chief Executive has just stated that they have been turned down by investors who will not commit because of continuing safety problems with the reactor design. (23/09/15) (http://www.ft.com/cms/s/0/67001140-6208-11e5-9846-de406ccb37f2.html#axzz3n78vHemY).

Moreover, Pierre- Franck Chevet, head of France’s nuclear watchdog ASN “shocked the country’s mainly pro-nuclear establishment in April when it disclosed that state-controlled Areva had found weak spots in the steel of its flagship European Pressurised Reactor (EPR) which is being built in Normandy” and called them ‘very serious’!. (http://www.reuters.com/article/2015/06/22/france-nuclear-watchdog-idUSL5N0Z13NO201506)

It is clear the British government’s Nuclear Power Generation options are limited to the seriously flawed EDF/China EPR. “Parts of the vessel contain too much carbon, which can weaken the vessel’s structure and breaches safety rules”. (http://www.theecologist.org/News/news_round_up/2829257/nuclear_reactor_flaws_raise_hinkley_c_safety_fears.html)

Naturally the workforce and the people of East Scotland should know the SNP position on any development. It is for The SNP confirm their policy that there will be no EPR Nuclear Power Generation as a replacement at EDF’s Torness Nuclear Power Station.

Is it really too much to ask that our governments start to seriously back energy production methods that don’t hold the potential to fry/drown us and our kids? FFS, how long are we going to put up with this?

Reply to Mike –

“You cant be serious? The choice of reactor design? Are you telling us there is a specific reactor design which nobody else uses because its cheaper and faster to install?”

No, I didnt say that. But some designs are cheaper and faster to build than others.

“Skilled workforce? It will be the same skilled workforce which works on all the reactors across the world. Contractors. Just like it is in the Oil and Gas industry. The same experts the same professionals used on different contracts all over the world. AT THE SAME COST!”

So the guys who bolt the pipe work together or pour the concrete travel the world do they? I think not. But in China they may well travel from project to project. And if they are building the same reactor design each time, it’s not hard to imagine them getting pretty efficient at it.

“Economies of scale? In what respect?…”

If you’re building tens of reactors (all the same design), rather than one or two, it’s not hard to imagine the cost per reactor will be less (tooling costs spread across ten or twenty rather than two reactors etc).

“You cant see the effect waste disposal and supply of Uranium wont enter into the overall planning and project management of the initial build?”

As stated, I cant see how they affect the capital cost or speed of construction. That is, how does where the uranium comes from or what you do with it afterwards affect the cost to build a reactor or the speed at which it can be built? If you do, please explain.