Contagion Spreading

To get geeky, a decade of the US central bank flooding the world with cheap dollars (designed to keep US capitalism afloat) has resulted in foreign companies and governments running up $3.7 trillion in dollar-denominated debt since the 2008 Crash. But as interest rates and the value of the dollar shoot up, these debts have turned crippling. This contagion is now spreading to Europe, particularly Italy – whose banks are very shaky indeed. A couple of years back, I went on a parliamentary, fact-finding visit to the Bank of Italy, where they assured us every Italian bank was rock solid. When central bankers lie in your face, you know trouble is around the corner.

PROGRAMMED FOR GOVERNMENT?

The SNP Government’s new legislative programme promises to establish a new Scottish National Investment Bank next year. Hooray says I, though everything is down to what it will invest in. Separately, the small print of the SNP programme also promises to lever an extra £1.5bn per annum in fresh infrastructure investment by tapping private funds, using new financial mechanisms. That should get annual public infrastructure investment as a proportion of GDP to near the European average, though only by 2026.

Incidentally, Scottish Labour’s 2017 manifesto promised an extra £2bn per annum in infrastructure spending, funded by their new investment bank. The current SNP proposals improve on that £2bn figure. But the real issue is what to spend any extra cash on – something everybody is too vague about. Labour’s manifesto mentions investing in nuclear power – which can only mean a new reactor at Torness. With new atomic stations costing an insane £25bn plus (e.g. Hinkley Point) that would soak up a lot of the new cash. Yeh, I know the private sector is supposed to pay for these things but invariably the taxpayer and electricity consumer get stuck with the bill (e.g. Hinkley Point again).

Memo to Financial Secretary Derek Mackay: Scotland needs to break ground by setting up a Planning Commission that will consult the public on what Scotland needs in the way of new investment. The Planning Commission should then draw up a long-term, rolling plan matching investment to need. In addition, the new Scottish Investment Bank should not be overseen by a committee of cautious commercial bankers but instead by engineers and proven entrepreneurs who will take risks.

RBS is halving what’s left of its branded network in England and Wales. Don’t be surprised because more is to come. RBS boss Ross McEwan is determined to turn the bank into a mainly internet operation, the better to compete with the new, online challenger banks. The drip-feed closures will go on and on till there are only a few, glossy front-of-house RBS branches left.

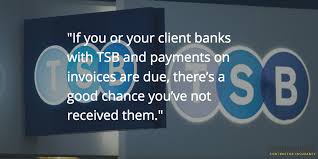

Next, Paul Pester quit as boss of Spanish-owned TSB after yet another failure in the bank’s computer system left customers up the creek. But our Paul left with a tidy severance pay of £1.7m despite leading TSB to a £107m loss, never mind the bad customer service. It’s worth explaining why UK banks are so crap at IT. The heavily-monopolised UK banking system is the result of a series of aggressive mergers and take-over bids in recent decades. But merging banks meant patching together a host of different and basically incompatible IT systems. Rather than invest the cash to do this properly (which would have reduced profits and bonuses) the banks resorted to short-term patches. Result: inevitable IT meltdowns.

I mention this because a number of folk have suggested keeping RBS Group (including NatWest in England) in public ownership but splitting it up into a series of region “people’s banks”. There is theoretical merit in this idea but, alas, it won’t work as advertised. This is because a bank (at heart) is its IT system. Breaking up RBS Group is impossible commercially unless you can split its commuter networks, which is virtually impossible and certainly expensive. I heartily agree we need to de-monopolise the Scottish and UK banking system by creating local, not-for-profit saving institutions. But I think that can only be done from the bottom up. Of course, we can still retain RBS in public ownership and give it a remit to support small firms. But without Ross McEwan.

Bad Banks? Ever asked a 10 year old child for their thoughts on banks and banking???

This is an extract from a post here: http://www.facebook.com/TheScottishHand/ …

Currency – instead of listening to experts, have you ever thought of asking a child or grandchild, say one under about 10, what they think???

This may be wrong, but most of them will have a piggy bank or jar where they have any money they have saved from birthdays or the like. While that money is in that piggy bank or jar – it is their money.

When as perhaps many parents or grandparents will do, they suggest the child opens a bank or building society account, the money ceases to belong to the child, it becomes the Bank’s money, and what was once safe in the jar is now at risk – just like in 2008. (That is the legal position – as confirmed in the Supreme Court as recently as 2009).

– So here is a question you could ask your child or grandchild:

Did you know if you take that money you have saved, and put it into a Bank, and leave it there, it is no longer your money, and it might not be there if one day you want to ask for it back, not one penny? Are they happy with that idea?

Maybe ask yourself the very same question. Are you happy with that position? Every salary, wage packet, welfare benefit or pension we pay into a Bank is no longer the property of the person who put it there, and when as in 2008 austerity is announced, we all suffer, adults and children, so that the Banks can be saved. There is a real irony when we are told that they are too big to fail!!

Extract ends.

However, also at the above link you will find details of an initiative for Yes Grassroots to show how to create, adopt and use an independent currency – now – not after independence, by adopting a not for profit Scottish Payments system to offer a competitive alternative to Vocalink. The Payments System is currently under initial trials in Scotland.

(Details of this initiative as it has developed , over both the currency and payments system, have been notified to each of our 129 MSPs on a regular basis, the latest note being delivered earlier this week.)

“When central bankers lie in your face, you know trouble is around the corner.”

I get the same feeling with Politicians.

Especially SNP ones.

Was at a comedy show the other evening and the girl came out with a fantastic observation on the wee Eck sexual harassment allegations.

She thought it was only a matter of time before he used his TV show to declare “I did not have sexual relations with those women!”

The place erupted!

Anyway back to the topic of the day.

Last year the Scottish “government” underspent by £500m.

It has been revealed today they have over estimated the tax take by £500m.

They have now promised to exceed Labour’s planned spend on everything!!

SNP good? Labour bad??

But we are in the middle of all this Tory austerity so where is all the money coming from?

The UK ?

Well I never.

Jamsie,

It’d all be very interesting to hear your thoughts on the article at hand, but you seem unable to do anything but make unconnected observations about the SNP, and Scottish Government which have only slightlymore relevence than the point you made about Salmond.

Here’s the thing. Salmond has already fully denied any sexual harassment. It really is that simple.

As for the ‘underspend’ you whined about, let me explain this to you, although I am running out of crayons and patience. The underspend comes because no department in Scotland that is devolved to Holyrood is allowed to exceed its budget. This causes the various departments to ensure they come in on, or under budget. The various amounts of underspend across the various elements of the Scottish Government departments adds up to the £500m approximately that was reported. It isn’t unusual, and neither is it anything more than careful accounting, which is what we want from our governments. Interestingly, a portion of the underspend came from councils not taking up funds, many of which are run by incompetent unionist bampots.

And the shortfall of £500m on tax take wasn’t compensated for by ‘England’ at any time. England runs a deficit which means it cannot pay its’ own way, never mind Scotland. You do get that very simple concept, don’t you?

Now, next time, do try to keep on subject and give everyone the benefit of your wit and wisdom.

A McG

The word is relevance.

You and your RBS shares are irrelevant.

My view on the article at hand is that it has no relevant content which is worthy of note or indeed of comment.

The writer is a failed MP who does not speak for the SNP or the Scottish “government” on financial or economic matters.

Like you he has a very inflated view of the importance of his opinions most of which are not shared by others.

On the Scottish currency given the absolute nonsense being proffered on how it might be structured and perform perhaps it should be called the goat.

But let’s talk about Indy for a moment and see if there is any common ground between reality and the perspectives offered on here.

Firstly the Scottish Electorate does not want another referendum. Secondly the polls show a majority would vote naw anyway. Thirdly wee Nicola cannae call another referendum. Fourthly the so called mandate given by bring dragged out of the U.K. against her will is false and unfounded. Fifthly in any event despite her European jaunts France and Italy have advised when the U.K. leaves the EU Scotland as part of the U.K. also leaves. Sixth Scotland if it became independent would suffer extreme austerity for the next twenty five years and would be unlikely to be able to rejoin fir at least that according to Andrew Wilson the official SNP author of the GCR. Seventh in order to rejoin Scotland need to at least meet the standards required for membership of the single currency which in the view of the SNP would not be likely.

So tell me what is tha case for Indy?

There is none is there?

And just so that you are clear I never suggested England made up the shortfall in taxation caused by basic errors in calculation which can only be described as incompetence just like the budget underspend.

What I said was that it was made up by the U.K. as always just like all the extra spend made available via the block grant and Barnet.

It is hardly a commendable performance when having made Scotland the highest taxed population of any of the U.K. countries to fail to spend it in areas where Scots would benefit.

In fact the waste and profligation of this incompetent “government” is a sign wee Nicola is more aligned with right wing policies and us only patronising the hard left core of the electorate they have made so many false promises to.

The cracks are becoming wider.

In the heartlands where they were ejected by the Tories at the last general election the core SNP support longs for wee Eck to return and save the party.

Elsewhere the transient left wing support grows ever more impatient that she dilly’s and dallys on calling a referendum.

The economy and GERS is held up by bring part of the UK and there is no credible alternative to bring part of the Union as austerity would make us a third world country.

Wee Nicola knows it and hence she constantly threatens but does not act as it would not only be political suicide but the end of Indy for ever.

The Tartan Tories are utterly split and it is widening and I would not be surprised if the leak on Salmond and his escapades is traced back to Mr Sturgeon.

Certainly those are the rumours which are circulating.

Seriously, I’d have the above post from J*msie circulated as widely as possible. It is as good an example of the delusional, misinformed, lie ridden, cringe laden diatribe typical of so many unionists as you’ll ever see. Such things are pure gold when it comes to illustrating just how unhinged the unionist view is.

Forgot to include “spittle-flecked” in the above post. But then, it’s J*msie, so it’s kind of taken as read 😉

Actually MBP everything I have mentioned actually be referenced.

Chris Deerin only this week explained how wee Nicola has loads in common with Ruth.

The left wing socialist credibility of the party has started to fade and according to some fading quickly.

Areas like the north east of Scotland which were traditional SNP strongholds are voting Tory because they don’t like wee Nicola’s faux socialism and would welcome wee Eck back with open arms.

I suspect wee Eck was about to announce his return to save the party just as this scandal broke.

But what I found most comedic was the very quick assertions from Indy supporters that it was all a Westminster ploy via MI5 to discredit wee Eck.

And that Ms Evans partner was somehow probably involved.

Then it comes out he is actually an SNP activist with connections at the top of the party.

Given the police investigation looks as if it will have to go ahead or the complainants will go for a civil action.

How gullible must those Indy mouthpieces feel?

The civil service are adamant they did not leak, Police Scotland are also pretty positive.

Who does that leave?

I suspect the Daily Record would have been under severe pressure to reveal their source under normal circumstances in a case like this but there seems not to have been any.

Or any mention of a hunt for who their source was even by wee Eck.

I wonder why.

Seriously guys, this stuff is gold for the indie movement.

That the article mentions consulting the public on “what Scotland needs in the way of new investment” instead of what Scotland needs, tells you a great deal about what is wrong with this article and its ilk.

Not really. Scotland needs many things, including new investment after years of being at the back of the que under the Union. Mr Kerevan is a financial guy whose articles deal with that side of things. What’s wrong with that

@Me Bungo Pony, the framing is that whatever you think you need, the answer is “new investment”. Even if you need solutions to problems caused by old investment. Or if over-exploitation of resources is the problem. Or if syphoning of public funds into consultants is a problem. Or corruption (like a lot of foreign aid investment, apparently). Or gentrification. Or vanity projects. Or job-creating make-work. Or investment by foreign corporations where the profits disappear abroad to where the control is, projects can be cancelled or facilities closed for unaccountable reasons, and perhaps an alien culture of working conditions and relations imposed. Or you’re offered jobs making harmful things, or activity that damages the environment. Or puts highly-trained people into low-skill work. Or whose main function is political pandering or propaganda.

Everybody needs a thneed?

Well, at least you got to expand on your initial cryptic comment. Still not getting your point though. At a rough stab at your meaning; that Scotland needs the right kind of investment; is that not what the quote in your original post was asking for?

@Me Bungo Pony, was I that cryptic? Investment is an interesting term, what could be wrong with it? Although it is related to vested interests, and those seeking returns. Who would turn down investment? Well, as an example, a village in my area has been described as under siege by developers who have the planning system stacked in their favour. A sizable number of locals have rejected serial applications, but these keep coming. They don’t want more investment, they want a change to the planning system. In other words, they want good governance, and a say in what happens to their area.

Mr Kerevan is surely right to express concern at the upward charge of the dollar. Italy certainly doesn’t have its problems to seek with its banks holding close on £200 billion in bad debt loans which are nearly 20% of total lending, and truly staggering sovereign debt.

A salutory lesson that we Scots could learn from the Italian debacle is that the collateral for most of these non perfoming loans is in the form of property. If Banks were to call time on these loans Italy’s property market would simply melt down.

The $ rise does have ramifications for the Scottish currency debate. The real pain here will be inflicted upon those emerging market economies who for the benefit of unshackled decision making opted for their own currencies and those who pegged their currencies to the $ but generate most of their income in local money.

Indonesia, Zambia and so many others including mighty Brazil are staring severe job and income pain in the face as they struggle to pay off loans which were taken on for the noblest of reasons.

Now Andrew Wilsons report has had a shaky time of it and I don’t think Mr Kerevan agrees with its suggested currency path, but to me in these turbulent financial times which could be about to get worse, why not peg our new currency to the £?

Forget any macho stuff, that won’t fly.

Ten year pegging is little in the scheme of things, of course that’s in terms of economics. Unless of course you subscribe to the view that Westminster will use that time and financial power to wither our fledgling economy.

Politics and Brexit do complicate things mightily, but there’s no easy choices here and sooner or later that choice will have to be made.

Sterling is about to become very weak. It is likely to tank over the next few years which will be great for exporters but rubbish for the rest of us. Why tie ourselves to a currency that is about to go into the toilet?

I don’t know about tanking. I’d go so far as to say that it won’t. Even if it does depreciate, isn’t that exactly the scenario that Mr Kerevan and many others want from a Scottish stand alone currency; the power to float? Because the float envisaged isn’t of the rising variety.

Let me say that if you want a stronger currency than our joined at the hip, relative to us gigantic in economic terms neighbour, you are courting economic disaster.

Our wonderful new Groat or call it what you will, would be out of Scotland buying established assets elsewhere faster than you could pour a dram.

Or do you think hard headed Scots financiers and individuals would miss that golden opportunity

Golden that is until it’s forced devaluation.

Imagine, just for a second, if the US $ was weaker than the Mexican peso. Mind boggling. No disrespect to Mexico but there would be nothing left in that country of wonder and beauty except cactus and sunshine. Every peso would be seeking [and getting] a better home in$ land.

Until it quickly collapsed

Or in the horrible real life situation suffered by the Greeks, who use an overvalued currency that is exactly the same as a German undervalued currency. Result….

devastation. How do the Greeks compete with to them is an overvalued currency called the Euro; well they don’t.

And neither would we, whatever we call it.

It seems like your saying, whatever we do, we’re doomed. Your scenarios are too apocalyptic. Real world situations where multitudes of currencies are all at different strengths have not lead to these dismal ends. The only apparent solution to the “problem” you foresee would be a single, one world currency ….. but then you see problems with that too.

This is my “problem” with what you say. You only see problems with currency while only seeming to offer a solution, for Scotland, that seems to fall foul of one of the “problems” you illustrate; ie Greece. Currencies, their values and the consequences of their use are far more complex than you would have us believe.

Other small European countries who opted for their own currency haven’t fallen into the abyss. I don’t see why Scotland, alone, should be the exception.

One of a series … Scotland (independent or not) as it trades has to address around 164 currencies none of which is static: http://www.facebook.com/TheScottishHand/posts/493322501079865

I always wonder why people insist on believing the market in money is a free for all.

The Danish still have their own CB, their own currency and trade internationally in many commodities which mean forex trading, as well as the internal EU market.

They have on occasion pegged their currency to the Euro to avoid fluctuations or to piggy back the Euro. It isn’t difficult to set up a CB system that operates the same way. The Chinese did it with the Yuan, tying it to the $ for decades.

I am a shareholder in RBS. A paltry amount, but a shareholder nonetheless. I often get invited to the AGM and always vote in the board election by post.

I believe the valu of RBS is being deliberately kept low. New scandals and law suits are in the offing, but which were all known about years ago and shoul have been dealt with then. The UK Govt under the Tories wants to keep the market capitalisation low, so the profiteers in their ranks can make a huge amount of money when it is floated off.

Good luck with implementing your thinking. Good luck with selling it to a small ‘c’ conservative population who worry monthly

how to service their debt, including mortgages. Debt held in £’s.

The currency incoherent fudge was tried in 2014 and failed.

These small new economies that you mention have never been intertwined with an elephant currency. Name one. Just one as a dicussion point.

Scotland has been at the heart of Britains banking system forever and a day.

To disentangle will not be easy.

You call me a doomster, Bungo, I’m an optimist, really; just wait till the ‘for-ex’ vultures start picking at your new currency. The Soros Harvard grads, who are only

there to short it into the deck. Who earn mega bonuses to do just that.

Know what that means? Simples You buy other currencies [normally$] at the artificially high set rate of your Groat and wait on, or force it to drop, then cash in.

Or you take a forward position, buy at todays rate but pay up at the rate in three months time, and spend that time forcing the drop.

The end result always is the host currency is screwed.

Tell us how the ordinary family then pay their £ demoninated debts with that devalued Groat.

Get real Bungo we would be tiddlers in a sharks pool.

So until the market dust settles on what really are the pros and cons of Scotlands economy, what is it to be, the £ or the Euro?

Really mince(sic)’n’tatties? Makes you wonder how the Czech Republic has survived all this time. Or Sweden. Or Switzerland. Or Denmark. Or Norway. Or Croatia. All these countries, and more, who have managed to avoid what you deem as an inevitability. Maybe apocalypse is not as inevitable as you seem to believe.

Yeah, yeah, yeah. The doorsteps await. Tell us how you get on. Blah the Czech Republic blah, blah.

But you won’t.

Better peddle guff.

Your currency answer is ?

All ears.

So, what you are saying is that the Project Fear, apocalyptic scenario you depict as inevitable for an independent Scotland that opted for its own currency will play better on the doorsteps of ordinary Scots than the reality, despite it being nothing more than fear mongering nonsense. At least your admitting it.

Maybe you actually really believe it’s true. If so, could you please explain to me why Scotland alone, among all the small, independent European countries with their own currrncy, would fall into the financial abyss? I’d really like to know what makes us alone prone to something none of our peers have suffered. Surely you have some evidence to back it.