Kondratiev – Riding the Economic Wave

LET’S escape Brexit and see what’s happening in the wider world. Most forecasters are gloomy about global economic prospects. According to Schroders, doyen of UK assets managers: “We forecast a more stagflationary environment in 2019 with global growth set to slow and inflation to rise”. The Davos World Economic Forum predicts a “sharp drop-off in world trade growth, which fell from over 5 per cent at the beginning of 2018 to nearly zero at the end”. Forbes business magazine warns: “The biggest problem for the global economy in 2019 will be massive business failures that could also lead to bank failures in emerging markets”.

LET’S escape Brexit and see what’s happening in the wider world. Most forecasters are gloomy about global economic prospects. According to Schroders, doyen of UK assets managers: “We forecast a more stagflationary environment in 2019 with global growth set to slow and inflation to rise”. The Davos World Economic Forum predicts a “sharp drop-off in world trade growth, which fell from over 5 per cent at the beginning of 2018 to nearly zero at the end”. Forbes business magazine warns: “The biggest problem for the global economy in 2019 will be massive business failures that could also lead to bank failures in emerging markets”.

Of course, the forecasters have been wrong before but it is clear that the main analysts of the global capitalist economy are pessimistic about current trends. They are right to be worried.

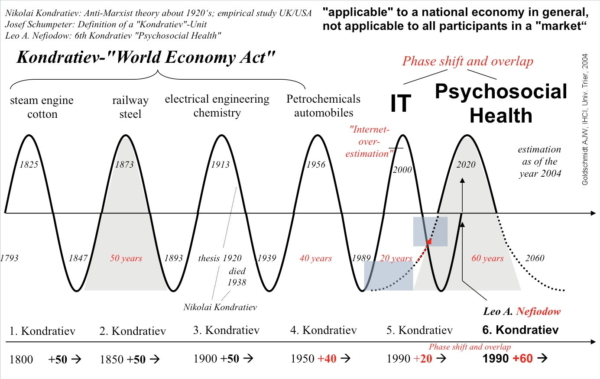

The international economy operates in pulses christened Kondratiev waves after Nicolai Kondratiev (1892-1938), the Russian economist and statistician who first identified them. These K-waves consist of an expansionary upswing lasting normally 15-20 years, followed by a downswing of similar length. We are now in such a downswing that could last till the 2030s.

What causes Kondratiev pulses? There is a rich literature trying to identify the cause, in particular the work of the Belgian economist, the late, great Ernest Mandel. Crudely, it works like this. Social and economic conditions mature to spark a runaway investment boom in the latest cluster of new technologies. After a period, excess investment and increased competition lower rates of profitability, curbing the boom.

At the same time – because this is as much a sociological as an economic process – growth expands the global workforce, both in numbers and geographically. The new, militant workforce launches social struggles to capture some of the wealth created in the boom. This, in turn, adds to the squeeze on profits. The peak and early down wave are characterised by violent social conflicts, whose outcome determines the length of the contraction.

To date each K-wave has seen a crushing of social protest and a halt to wage growth, if not a fall in real incomes for the working class. Thus conditions accumulate for a fresh investment boom, as profitability recovers. The ultimate trigger for the new upcycle is investment in the next bunch of new technologies, which simultaneously provide monopoly profits and a new set of markets.

UPSWING OR DOWNSWING: WHERE ARE WE ON THE K-WAVE?

UPSWING OR DOWNSWING: WHERE ARE WE ON THE K-WAVE?

Where precisely are we in the Kondratiev cycle? There is a dispute about this. Economists convinced by the Kondratiev theory largely agree there was a strong up-phase following the Second World War, lasting till the early 1970s. This was driven by the collapse in European wages imposed earlier by the Nazis and by the universal adoption of Fordist, mass production techniques. This expansion turned into a downswing in the 1970s and early 1980s, as profitability declined and the revived European economies (linked through the early Common Market) eroded American competitiveness.

The dispute concerns what happened next – the era of Reagan, Thatcher, neoliberalism and globalisation, running up to the present. In 1998, the American economic historian Robert Brenner published a hugely influential account of global capitalism which claimed to identify a super downswing running from circa 1970 to the turn of the millennium. Brenner rejected the notion global capitalism had (or was likely) to regain profitability, citing excess capacity rather than working class resistance as the primary driver. He pointed to the sudden stagnation in the Japanese economy, in the 1990s, as a precursor for the West’s future.

I have always believed that Brenner was not just wrong, but wildly wrong. The Reagan-Thatcher era created precisely the conditions for a new upswing, by smashing the trades unions and incorporating the former Soviet Union and Maoist China into an expanded capitalist market place, complete with hundreds of millions of new, cheap workers. The result was a boom based on investing in a cluster of new technologies: the silicon chip, the internet and mobile phone. On a political level, the social welfare gains of the working class won after WW2 were eroded, to reduce taxes and boost profits.

This upswing lasted till the Bank Crash of 2010. There were several significant features of the 1985-2010 up-wave. First, it was longer than the average, suggesting the current downturn could also be lengthy. Second, the neoliberal upswing involved a commercial and political victory for a rejuvenated US capitalism. Witness the current dominance of American high-tech. Europe, on the other hand, finds itself in decline, crushed between rival American and Chinese imperialisms. The crisis of the EU, Brexit included, results directly from this geopolitical shift.

The new downswing results from more than the 2010 financial crisis. There has been a wave of Chinese and Asian working-class resistance to exploitation, which has eroded profits. In the West, paradoxically, the historic defeat of the unions has flatlined wages. As a result, goods can be sold (and profits maintained) only by bolstering consumption through easy personal debt. That makes the Western capitalist model unsustainable and prone to endemic bank failure. The banks and their tame accounting firms are busy covering up this chronic instability via wholesale fraud. As a result, we are nowhere near the bottom of this K-wave.

What is the solution? I’ll discuss that next week.

Makes the decision to leave the EU nonsensical with the K Wave flashing Amber & the Bank of England warning of upto 10 years of self imposed economic difficulties. We really do have a major problem when a Conservative government can deliberately pursue a political ideology which will directly affect our national economy & social wellbeing .

AlasdairB, surely this is precisely why the very rich group like Messrs Banks, Rees-Mogg and the ‘dark money’ people pushed and continue to push for Brexi and No Deal?

Absolutely spot on. Brexit was never designed to benefit the country as a whole but driven by a few to the detriment of the many . Whatever Brexit is finally negotiated these patriotic leavers , who thought they would be ‘taking back control’ , have yet to realise they have been well & truly shafted & left to pick up the pieces of a broken society.

your not including the overwhelming effect of demographics in your equation, Regan and Thatcher could have done anything and still looked smart, as absolutely massive waves of young baby boomers stood ready to enter the market, they powered the next 40 years with demand as the families they came from typically had 4 children minimum here in Canada, creating demand for housing, cars, etc.

Canadas per capita baby boomer was the highest at 9 million of a 30 million total population. this boom cannot be repeated, the tax breaks brought in by Trump and the like will have little effect, not only are they funded with debt but the boomers are entering the final stage with no more consumption, please read Harry Dents work on Demographics with the age of 46 being peak consumption age.

The US used WW2 to eliminate is main manufacturing competition and gain market share ( the Russians are now hip to using your military to gain and protect market share)

The US destroyed their 2 biggest manufacturing rivals and dressed it up as a good versus evil battle using Hollywood, ( see William B. Williams book “future perfect ” 1999) as you will note they then had the glory years of the 1960’s which they squandered with inefficient manufacturing of 5 ton Cadillacs with fins and the like.

The 1970’s brought efficient Toyotas and BMW’s to the streets of North America as the 2 rivals Japan and Germany had rebuilt their capacities and had regained

their natural superior abilities.

The US then went off the gold standard and gave up manufacturing as it was no longer needed with a militarily enforced “petrodollar’ that required all

countries to send goods to the US in exchange for t bills and bonds to buy oil.

as you say by crushing the unions the wages have stagnated for 40 years, so in order to retain relevance to other nations sending goods to the US it had to lower the interest rate again and again so they could maintain consumption based on increasing debt from a fake wealth effect. you will remember George Bush 2 days after

9/11 telling Americans to go out and shop , a strange thing to say I thought at the time . they also lowered the interest rate then “because of the emergency”

As it turned out the boomers didn’t have many children so both the EU and N. America are shrinking despite the best efforts of their governments to supplement the population with aliens from other cultures enforced by political correctness.

Maybe if the western model wasn’t addicted to growth in order to function it would have worked, but alas people can take on no more debt no matter what the banks do now. I don’t see the upside of the wave. I’ve never been a fan of charts, they don’t take into account new realities , are usually after the fact, they only try to recognize patterns like “head and shoulders’ and other meaningless jargon, its all been caused by the demographics and the 35 year continuous drop in interest rates.

I recall learning all about Kondratiev some twenty years ago, and the Kondratiev winter. But there’s a global currency reset on the horizon that will put Kondratiev to bed. Soon (but not soon enough) banks will be no more, the Fed will be history, as will all central banks. Say good-bye to the BIS! To the IRS! To Swift! Each country will keep its own currency, but all currencies will be gold-backed. The White Hats are winning, people.

What, precisely is convincing about this analysis, for example?

“There were several significant features of the 1985-2010 up-wave. First, it was longer than the average, suggesting the current downturn could also be lengthy. Second, the neoliberal upswing involved a commercial and political victory for a rejuvenated US capitalism. Witness the current dominance of American high-tech. Europe, on the other hand, finds itself in decline, crushed between rival American and Chinese imperialisms. The crisis of the EU, Brexit included, results directly from this geopolitical shift.”

A 15-20 year ‘up-wave’ lasts for 35 years. Rather than testing the basis either of the proposition itself, or the interpretation of the theory to the evidence; the writer simply asserts its application now; and, we are to suppose, that it “suggests” that the downside will be as long. It might ‘suggest’ a lot of things. For example, it may imply the writer is proposing a cycle of 70 years, if I understand the writer’s measurement of the K-wave (apogee to apogee?), this is twice the scale of the writer’s implied 30-40 year cycle for K-waves. There is, in fact much debate and argument about the length of the supposed cycles, and of their application in the real world: which the writer appears just to ignore.

I may be wrong in my interpretation of the writer’s intention, but my fundamental point is the looseness of definition and of analysis that is being offered here. ‘Suggests’ is scarcely a term that should attach much confidence to the liklihood of the outcomes. The following list of other factors the writer proposes, apparently as affecting the wave does not illuminate the nature of the inter-relationships of each factor with his proposed cycle, or its likely effects: it is just a list. We thus start with a graphic representation of economic phenomena that presumably suggests a certain mathmatical rigour, but I do not see how this is being used to forecast anything substantive, still less a wave theory proved, or even much advanced by the article.

Seems to me that analysts are not taking into account the growing power of trading by both China & the African continent . In particular the formation of a pan Africa Free Trade Association with all countries on the continent, except Nigeria , having signed up .

China needs an ever increasing supply of fuels , coal & oil in particular , together with rare metals which Africa has in abundance in order to supply it’s high tech industries such as mobiles, computers, etc.

It employs a similar trading style as that practiced by the British in India…. Pay peanuts , export raw materials, use to manufacture goods in home country and sell back the finished goods . The Africa Free Trade Association will further ease trade intra Africa & world markets.

In addition there is the China Belt & Road initative which the EU is currently against. However Italy is for , with deals already agreed for China to upgrade both the ports of Trieste & Venice with easy onward road access to the heart of Europe. This takes weeks off delivery & avoids the Suez Canal route.

Germany is on the dge of recession, China is experiencing a slow down in exports due to Trumps trade wars , UK slowing down due to uncertainty of Brexit but Africa with its oil, minerals, rare metals , agriculture, & Chinese finance, expertise and aid is going from strength .

For better or worse the next 10’years is set to see a new world order

Another interesting article. Paul Mason’s book Postcapitalism is very enlightening on the subject too.

Sitting on the edge of my seat;

crash happened in 2008 not 2010 not sure why you keep saying 2010 Obama was not even in office. Getting that wrong kind of negates the rest of the article or at least means you playing fast and loose with the numbers. Or reinventing history