Capital in the 21st Century by Thomas Piketty

Book Review by Michael Roberts. Cross posted from Brave New Europe.

Back in 2014, French economist Thomas Piketty published a blockbuster book, Capital in the 21st century. Repeating the name of Marx’s Capital, the implication of the title was that it was an updating Marx’s 19th century critique of capitalism for the 21st century. Piketty argued that the inequality of income and wealth in the major capitalist economies had reached extremes not seen since the late 18th century and unless something was done, inequality would continue to rise.

The book had a huge impact, not just among economists (particularly in America, less so in France) but also among the general public. Two million copies were sold of this monumental 800p publication which was full of theoretical arguments, empirical data and anecdotes to explain increased inequality of wealth in modern capitalist economies. The book eventually won the dubious honour for the most bought book that nobody read, taking over from Stephen Hawking’s The Brief History of Time. I suppose Marx’s Capital is also part of this club.

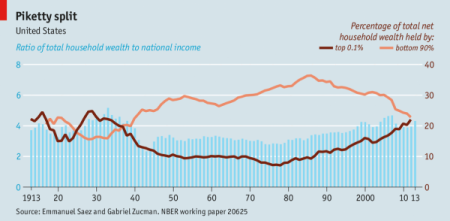

Many critiques of Piketty’s arguments followed, both from the mainstream and the heterodox. Piketty has made a great contribution in the empirical work that he, fellow Frenchman Daniel Zucman and Emmanuel Saez have made in estimating the levels of inequality in capitalist economies. And before that, there was the father of inequality studies, the recently deceased Anthony Atkinson, (whose work was the foundation of my own PhD thesis on inequality of wealth in 19th century Britain).

But, as I argued in my own critique of Piketty, which was published in Historical Materialism at the time, Piketty was not following Marx at all – indeed, he trashed Marx’s economic theory based on the law of value and profitability. For Piketty, the exploitation of labour by capital was not the issue but the ownership of wealth (ie property and financial assets), which enabled the rich to increase their share of total income in an economy. So it was not the replacement of the capitalist mode of production that was needed but the redistribution of the wealth accumulated by the rich.

Piketty’s fame among the mainstream soon faded. At the 2015 annual conference of the American Economic Association, Piketty was feted, if criticised. Within a year, all was forgotten. Now, six years later, Piketty has followed up with a new book, Capital and Ideology, which is even larger: some 1200pp; as one reviewer said, longer than War and Peace. Whereas the first book provided theory and evidence on inequality, this book seeks to explain why this had been allowed to happen in the second half of the 20th century. And from that, he proposes some policies to reverse it. Piketty broadens the scope of his analysis to the entire world and presents a historical panorama of how ownership of assets (including people) was treated, and justified, in various historical societies, from China, Japan, and India, to the European-ruled American colonies, and feudal and capitalist societies in Europe.

His premise is that inequality is a choice. It’s something ‘societies’ opt for, not an inevitable result of technology and globalisation. Whereas Marx saw ideologies as a product of class interests, Piketty takes the idealist view that history is a battle of ideologies. The major economies have increased inequalities because the ruling elites have provided bogus justifications for inequality. Every unequal society, he says, creates an ideology to justify inequality. All these justifications add up to what he calls the “sacralisation of property”.

The job of economists is to expose these bogus arguments. Take billionaires. “How can we justify that their existence is necessary for the common good? Contrary to what is often said, their enrichment was obtained thanks to collective goods, which are the public knowledge, the infrastructures, the laboratories of research.” (Shades of Mariana Mazzucato’s work here). The notion that billionaires create jobs and boost growth is false. Per capita income growth was 2.2% a year in the U.S. between 1950 and 1990. But when the number of billionaires exploded in the 1990s and 2000s — growing from about 100 in 1990 to around 600 today — per capita income growth fell to 1.1%.

Piketty says that the type of free-market capitalism that has dominated the US since Ronald Reagan needs to be reformed. “Reaganism begun to justify any concentration of wealth, as if the billionaires were our saviours.” But; “Reaganism has shown its limits: Growth has been halved, inequalities have doubled. It is time to break out of this phase of sacredness of property.”

He does not want what most people consider ‘socialism’, but he wants to “overcome capitalism.” Far from abolishing property or capital, he wants to spread its rewards to the bottom half of the population, who even in rich countries have never owned much. To do this, he says, requires redefining private property as “temporary” and limited: you can enjoy it during your lifetime, in moderate quantities.

How is this to be done? Well, Piketty calls for a graduated wealth tax of 5% on those worth 2 million euros or more and up to 90% on those worth more than 2 billion euros. “Entrepreneurs will have millions or tens of millions,” he said. “But beyond that, those who have hundreds of millions or billions will have to share with shareholders, who could be employees. So no, there won’t be billionaires anymore.” From the proceeds, a country such as France could give each citizen a trust fund worth about €120,000 at age 25. Very high tax rates, he notes, didn’t impede fast growth in the 1950-80 period.

Piketty also calls for “educational justice” — essentially, spending the same amount on each person’s education. And he favours giving workers a major say over how their companies are run, as in Germany and Sweden. Employees should have 50% of the seats on company boards; that the voting power of even the largest shareholders should be capped at 10%; much higher taxes on property, rising to 90% for the largest estates; a lump sum capital allocation of €120,000 (just over £107,000) to everyone when they reach 25; and an individualised carbon tax calculated by a personalised card that would track each person’s contribution to global heating. He calls this moving beyond capitalism to “participatory socialism and social-federalism”.

This all smacks of returning capitalist economies to the days of the so-called ‘golden age’ from 1948-65, when inequality was much lower, economic growth was much stronger and working class households experienced full employment and were able to get educated to levels that enabled them to do more skilled and better paid jobs. There was a ‘mixed economy’, where capitalist companies supposedly worked in partnership with trade unions and the government. This was a myth. But if you accept Piketty’s premise that this social democratic paradise existed and its demise was brought about by a change of ideology, it is possible to consider that “redistributive ideas’ could gain support after the experience of the Great Recession and the rise of extreme inequality now.

Piketty argues that the social democratic parties dropped their original aims of equality and opted instead for meritocracy ie hard work and education will deliver better lives for the working class. And they did so because they had gradually transformed themselves from being parties of the less-educated and poorer classes to become parties of the educated and affluent middle and upper-middle classes. To a large extent, he reckons, traditionally left parties changed because their original social-democratic agenda was so successful in opening up education and high-income possibilities to the people, who in the 1950s and 1960s came from modest backgrounds. These people, the “winners” of social democracy, continued voting for left-wing parties but their interests and worldview were no longer the same as that of their (less-educated) parents. The parties’ internal social structure thus changed— it was the product of their own political and social success.

Really? The failure of social democratic parties to represent the interests of working people goes way back before the 1970s. Social democratic parties supported the nationalist aims of the warring capitalist powers in WW1; in Britain, the leaders of the Labour Party went into coalition with the Conservatives to impose austerity and break the trade unions in 1929. After WW2, social democracy moved from Attlee to Wilson to Callaghan to Kinnock and finally to Blair and Brown. It was a similar story in continental Europe: in France from Mitterand to Hollande; in Germany from Brandt to Schmidt.

This was not just because the composition of the SD parties changed from industrial workers to educated professionals. The very health of post-war capitalist economies changed. The brief ‘golden age’ came to an end, not because of a change of ideology (or as Joseph Stiglitz has put it, ‘a change of rules’) but because the profitability of capital plummeted in the 1970s (following Marx’s law of profitability as outlined in Capital). That meant that pro-capitalist politicians could no longer make concessions to labour; indeed, the gains of the golden age had to be reversed in the ‘neoliberal’ period. So ideology changed with the change in the economic health of capital. And social democratic leaders went along with this change because, in the last analysis, they do not think it is possible to replace capitalism with socialism. “There is no alternative” – to use Thatcher’s phrase.

At least, Piketty reckons it is possible to go beyond capitalism, unlike Branco Milanovic who, in his latest book, Capitalism Alone that I reviewed recently, agrees with Thatcher and reckons capitalism is here to stay. “You have to go beyond capitalism,” says Piketty. In an interview, when asked “Why this word ‘beyond”, why not “To get out of capitalism”? Piketty replied: “I say “go beyond” to say go out, abolish, replace. But the term “exceed” me allows for a little more emphasis on the need to discuss the alternative system. After the Soviet failure, we can no longer promise the abolition of capitalism without debating long and precisely what we will put in place next. I’m trying to contribute.”

Piketty reckons the “propriétariste and meritocratic narrative” of the neo-liberal period is getting fragile. “There’s a growing understanding that so-called meritocracy has been captured by the rich, who get their kids into the top universities, buy political parties and hide their money from taxation.” That leaves a gap in the political market for redistributionist ideas.

But Piketty’s answers are just that: a redistribution of unequal wealth and income generated by the private ownership of capital, not replacing the ownership and control of the means of production and the exploitation of labour in production with a system of common ownership and control. Apparently, the big multi-nationals will continue, big pharma will continue; the fossil-fuel companies will continue; the military-industrial complex will continue. Regular and recurring crises in capitalist production and accumulation will continue. But, as these vested interests of capital are still not generating enough profitability to allow any significant increase in the taxation of extreme wealth and income that they control, what chances are there that the current ‘ideology’ of the ‘sacralisation of property’ can be overcome, without taking them over?

Capital in the 21st Century by Thomas Piketty

Published by Harvard University Press

ISBN: 978-0674979857

Micheal Rogers, a self-proclaimed Marxist economist, reports that Thomas Piketty was “feted, if criticised” at the 2015 meeting of the American Economic Association’s annual conference but he fails to report the full story. Many socialist commentators have contended that with a slew of data, Thomas Piketty confirmed what those on the left had long believed: that extreme inequality and the clustering of wealth are the natural outcomes of capitalism. [See: https://newrepublic.com/article/154186/bernie-sanders-democratic-socialist-failure-envision-world-without-capitalism ]. But, income inequality in the US has not risen in the last 60 years and the US Census Bureau data (along with Kitov & Kitov 2012) [See: https://www.academia.edu/4383266/The_Dynamics_of_Personal_Income_Distribution_and_Inequality_in_the_United_States ] prove it. Since 1960 the Bureau’s Gini coefficient (one of many important measures that almost all economists use to track inequality) of income for “All US Persons” (individuals) has remained almost totally flat. [See: Table PINC-01 Selected Characteristics in the March Supplement which is published each year by the US Census Bureau as part of its Annual Demographic Surrey or visit https://politicalcalculations.blogspot.com/search?q=gini#.XR4aendFwuU ]. Thus there has been virtually no increase in US income inequality for individuals for six decades. [See: https://voxeu.org/article/human-capital-and-income-inequality ]. Also, most collectivist writers do not know that Prof. Piketty in 2015 quietly recanted much (most?) of what he wrote in “Capital in the 21st Century”. [See: “About Capital in the 21st Century” American Economic Review 2015, 105(5): 48-53 or go to http://dx.doi.org/10.1257/aer.p20151060 ].

I’m not an economist like you so I cannot quote fancy authorities. But this is nonsense. The ordinary reportage of the newspapers and my own first hand experience of America and of the post war generations shows that those born in the 1960s and later have fared less well than their parents despite having had more resources in terms of easier educational opportunities than their parents had. Those later generations have barely treaded water economically whilst there has been an explosion of wealth amongst the Trumps and other capitalists becoming super wealthy. And neither has the lot of those at the very bottom improved. The homeless population has soared, and the poorest amongst the black population are no better off.

MBC:

If you insist that what I wrote is “nonsense” then please tell which of my many links is incorrect. In addition, your beliefs are based upon ordinary “newspapers” which are, at best, unreliable plus your own personal experience which is only anecdotal. Please remember that Prof. Piketty retracted much of what he wrote.

My personal experience may be anecdotal to you but it is lived first hand experience to me.

Dear MBC:

Under the rules of logic, a person may not extrapolate individual experience (anecdotal evidence) into a valid general rule.

Best,

Richard Burcik

Piketty’s argument seems to be tha capital and in particular private capital (which tends to be concentrated in the hands of few people – I think he gives data to back this up) has represented a larger and larger portion of national wealth since the second world war almost reaching by 2010 the same extremes as pre ww1. He also points out some of the mechanisms that cause this (population growth slow down, economic growth slow down, with savings staying constant or growing) and from which we can surmise that the trend will continue in many countries. Income inequality doesn’t really come into it since by now the value of capital in many of the countries studied is 4 to 7 times more than the total national income.

THE TRUTH CONCERNING ALLEGED RISING INEQUALITY IN THE USA

Background

It is a fact that inequalities exist in America but they are almost always solidly rooted in immutable psychological traits such as IQ, industriousness, honesty, creativity, courage, etc. [See: AEI Monograph (1998) “Income Inequality and IQ” ]. Take IQ. According to the National Longitudinal Survey of Youth by age 28 to 36, the top 10% in cognitive ability have a median earned an income of 4.8 times the median for the bottom 10%. Indeed, “The Bell Curve” (1994) in part one, “The Emergence of a Cognitive Elite”, found that IQ is one of the best single predictors of job productivity. Most recently, researchers have found that DNA plays a role in social stratification. These investigators concluded that “Human DNA polymorphisms vary across geographic regions, with the most commonly observed variation reflecting distant ancestry differences.” [See: Nature: Human Behaviour October 21, 2019 “Genetic Correlations of Social Stratifications in Great Britain” Abdellaoui et al or https://www.nature.com/articles/s41562-019-0757-5 ].

For proof that all psychological traits are firmly riveted in nature and not in nurture one need only read Prof. Robert Plomin’s new book, “Blueprint: How DNA Makes Us Who We Are”, (Nov. 2018) which is the most recent scholarly work on the psychology of human genetics. In “Blueprint” Plomin, one of the very top experts in the field of behavioral genetics asserts that “A century of genetic research shows that DNA differences inherited from our parents are the consistent life-long sources of our psychological individuality — the “Blueprint” that makes us who we are.” Prof. Plomin also reports that “… genetics explain more of our psychological differences — not just mental health and school achievement but all psychological traits, from personality to intellectual abilities. Nature, not nurture is what makes us who we are.” [Note: The Dec. 14, 2018 issue of Scientific American contains a very brief essay by Prof. Plomin titled “In the Nature-Nurture War, Nature Wins.” and in it, Plomin admits that “Environmental influences are important… too, but they are largely unsystematic, unstable and idiosyncratic — in a word, RANDOM.” (Emphasis added) Plomin continues “These findings call for a radical rethink about parenting, education and the events that shape our lives. It also provides a novel perspective on equal opportunity, social mobility and the structure of society.”]

In spite of this contrary scientific evidence that inequality is not rooted in economic factors, countless left-leaning economists, law professors, and political scientists insist, without foundation, that capitalism is the source for much of our nation’s inequality. One needs only to read Prof. Joseph Stiglitz’s “The Price of Inequality” (2013) or Prof. Thomas Piketty’s tome, “Capital in the 21st Century” (2014) or Prof. Thomas Shapiro’s “Toxic Inequality” (2017) and their calls for redistribution to understand that their driving motivation is a search for almost totally equal economic outcomes. They undertake this crusade in spite of the fact that even Lord Keynes believed that efforts to fight inequality hinder economic growth. [See: Foundation for Economic Education Aug. 11, 2018]. Even the IMF got it wrong. In a 2015 report titled “Causes and Consequences of Inequality,” this organization errantly asserted that “Widening inequality is the defining challenge of our time. In advanced economies, the gap between rich and poor is at its highest level in decades.” Interestingly, this barrage of unsupported claims prompted an author like Edward Conrad to produce a book, “The Upside of Inequality” in which he mistakenly states that capitalism is a cause of inequality but asserts that the overall impact is positive in that growth (rising GDP) has markedly improved everyone’s standard of living.

But the unifying and driving force exhibited by all of these millenarian collectivists is a desire to eliminate economic inequality of outcomes. This deep-seated human drive for equality likely stems from our ancestral days living as small hunter-gatherer bands that wandered the several continents (except Antarctica) for over 100,000 years. Sharing the “wealth” was a possible adaptation that probably helped to ensure the survival of the group. Individualism likely played a subservient role to the collectivism of each clan. Of course, these people all lived on the edge of starvation at a level of servile poverty that is almost unimaginable today. [See: https://en.wikipedia.org/wiki/Hunter-gatherer ].

Then about ten millennia ago humans mastered the science of agriculture which resulted in a more stable food supply and as a consequence population levels of our lineage began to rise. But, our farming forebears still lived in a condition of almost total abject poverty. [See: http://j-bradford-delong.net/TCEH/1998_Draft/World_GDP/Estimating_World_GDP.html ].

This state of affairs continued uninterrupted for almost 10,000 years until the advent of capitalism (individualism) in central England about 1765. [Note: Highly regarded economic historian, Prof. Deirdre McCloskey, places this critical conversion in the northern Netherlands roughly 100 years earlier but the result is the same.] With the development of capitalism the Industrial Revolution began, GDP surged ahead and human-kinds overall levels of economic well-being soared, increasing according to some estimates by up to 5,000% at the turn of the 21st century. [See: https://www.bankofengland.co.uk/KnowledgeBank/how-has-growth-changed-over-time ]. In all of history, things had never gotten better for everyone any faster. [See: https://en.wikipedia.org/wiki/Great_Divergence.%5D The following graph shows this remarkable upward trend in life expectancy, GDP per capita, energy capture, democratic governance, and war-making capacity along with a remarkable decline in extreme poverty.

Moreover, in a 2001 essay titled “The Law of Accelerating Returns”, Ray Kurzweil opined that the rate of technological change is exponential. [See: https://www.kurzweilai.net/the-law-of-accelerating-returns ]. Thus the sharp upward trend in these measures of well-being has continued and even accelerated since 2000 and it is not unreasonable to believe that the shift of ever-improving living standards and the rest will stretch further into the future. [See: https://fattailedandhappy.com/rise-of-asia-global-growth-since-2000/ ].

Regrettably, ever since Jean Jacques Rousseau wrote his famous essay, “Discourse on the Origin and Basis of Inequality Among Men” in 1754 some (many?) collectivist scribes have sought to return our species to its hunter-gatherer roots when everyone was equally hungry and always desperately poor. [See: https://en.wikipedia.org/wiki/Jean-Jacques_Rousseau ].

As evidence of this ill-advised tendency, every day I read an almost endless array of pro-socialist and anti-capitalist articles in a variety of newspapers, magazines, and web sites and almost all of these focus on alleged rising levels of inequality. A single recent example should suffice. In a June 6, 2019 article in the NY Times, titled “The World is a Mess. We Need Fully Automated Luxury Communism”, Aaron Bastini insisted that “We live in a world of low growth, low productivity and low wages, of climate breakdown and collapse of democratic policies. A world where billions, … live in poverty. A world defined by inequality.” Next, I ask myself — How could so many bright well-informed authors be so apparently unaware of the actual realities concerning the facts regarding the imagined phenomenon of increasing income and wealth inequality in the US? [See: https://www.amazon.com/product-reviews/0691143617/ref=acr_dpx_hist_3??ie=UTF8&filterByStar=three_star&showViewpoints=0 ].

These unfounded claims of growing income inequality and the exaggerated concentration of wealth in the US due to capitalism are easily rebutted.

Many left-leaning economists are at heart closet “levelers” who favor more equal economic outcomes and these same people therefor support almost any move towards socialism. They thus espouse every misleading set of statistics that they can find in an effort to attain their goal. This is often called “data mining” and it is not useful. In his 1954 book, “How to Lie With Statistics” author Darrell Huff coined the word “statisticulation” by which he meant “statistical manipulation” which also describes very well the work of these many current day egalitarians.

For example, some socialist commentators have contended that with a slew of data, Thomas Piketty confirmed what those on the left had long believed: that extreme inequality and the clustering of wealth are the natural outcomes of capitalism. [See: https://newrepublic.com/article/154186/bernie-sanders-democratic-socialist-failure-envision-world-without-capitalism ]. But, income inequality in the US has not risen in the last 60 years and the US Census Bureau data (along with Kitov & Kitov 2012) [See: https://www.academia.edu/4383266/The_Dynamics_of_Personal_Income_Distribution_and_Inequality_in_the_United_States ] prove it. Since 1960 the Bureau’s Gini coefficient (one of many important measures that almost all economists use to track inequality) of income for “All US Persons” (individuals) has remained almost totally flat. [See: Table PINC-01 Selected Characteristics in the March Supplement which is published each year by the US Census Bureau as part of its Annual Demographic Surrey or visit https://politicalcalculations.blogspot.com/search?q=gini#.XR4aendFwuU ]. Thus there has been virtually no increase in US income inequality for individuals for six decades. [See: https://voxeu.org/article/human-capital-and-income-inequality ]. Also, most collectivist writers do not know that Prof. Piketty in 2015 quietly recanted much (most?) of what he wrote in “Capital in the 21st Century”. [See: “About Capital in the 21st Century” American Economic Review 2015, 105(5): 48-53 or go to http://dx.doi.org/10.1257/aer.p20151060 ].

What has been skewing upwards is the US Census Bureau’s Gini coefficient for “US Households” (and “US Families”). [Note: In 2009 Prof. Robert Gordon found that “The rise in American inequality has been exaggerated both in magnitude and timing.” See: https://www.nber.org/papers/w15351 thereby confirming the assertion that Alan Reynolds made at the Western Economics Association’s July 2007 meeting that “… inequality in income, wages, consumption, and wealth among the US population as a whole does not appear to have increased significantly since 1988.” See: https://www.cato.org/publications/policy-analysis/has-us-income-inequality-really-increased ]. But nearly 100% of any increases have been caused by sociological (and not economic) factors (i.e. alterations in the size, make-up, and constitution of both US households and families.) For context, any divergence of these two data sets from the stable status of the statistics for “All US Persons” (individuals) began about 1970. [See: https://politicalcalculations.blogspot.com/search?q=gini#.XTMahXdFwuU ]. But as Stanford economist, Thomas Sowell, put it in his book, “Economic Facts and Fallacies” (2008), “Income comparisons using household statistics are far less reliable indicators of standards of living than individual income data because households vary in size while an individual always means one person.” Later Prof. Sowell continued “Household income data can, therefore, be very misleading, whether comparing income differences as of a given time or following changes in income over the years.”

Perhaps a single specific example of this household trend will help to dismiss the lefts baseless trope regarding rising income inequality in the US. If a young woman in the 1950s became pregnant out of wedlock she almost always married the father thereby forming one new household (and one new family) with one caregiver and one breadwinner. Twenty years later mounting numbers of young women began bearing children without any serious intention of matrimony (today this figure in the US stands at 39.8%) [See: https://www.cdc.gov/nchs/fastats/unmarried-childbearing.htm ] and this results in the formation of two new families (and two new households) one with a caregiver but no breadwinner and another with only a breadwinner. Both of these freshly formed households (or families) are each poorer than the combined single household (or family). Obviously, this emerging cultural (not economic) change began shifting the income inequality for households (and families) upward.

There are many other sociological (but not economic) trends that have resulted in similar skewing of the household (and family) data. These include (but are not limited to) elevated levels of divorce which split one household (and family) into two needier units; increasing numbers of elderly women who outlive their spouses; rising instances of assortative mating (i.e. In the 1950s a doctor often married his nurse but today she marries another doctor or lawyer which results in a very high two-income household and family. Indeed, according to Greenwood et.al. (2014), the US Gini coefficient in 2005 would have fallen from the observed 0.43 to 0.34 if all US mating had been random. And the authors of this research thus concluded that “… assortative mating is important for income inequality.”) [See: https://www.nber.org/papers/w19829?utm_campaign=ntw&utm_medium=email&utm_source=ntw ] [Note: For a contrary point of view see: https://www.nber.org/papers/w20271.pdf ]; and numerous other sociological kinetics which markedly raises the Gini coefficients for both families and households but not for individuals.

In their 2016 book, “Unequal Gains”, Profs. Lindert and Williamson begin by dismissing in a footnote the US Census Bureau’s data as “faulty official numbers” but later admit that the racial and gender inequality gaps have been converging since 1970 along with a declining gap in the North-South levels of inequality. But these two authors are unable to reconcile why these American “countercurrents” are moving in the opposite direction of their “new” measure of inequality which is the “tax unit” research of Piketty & Saez (2001). [See: https://www.nber.org/papers/w8467 ]. Lindert and Williamson revealed their true colors in “Unequal Gains'” last paragraph. “If there were any fulcrum at which historical insight might be applied to move inequality, it would be political. As we have said, no nation has used up all its political opportunities for leveling income without harming economic growth.” Even worse, these two liberal economists asserted that “The South was the richest of the colonies, and even its slaves had higher living standards than did the poorest in England.”

Most collectivist economists (including LIndert & Williamson) always examine inequality using only pre-tax data and before taking into consideration any government transfer payments which each highly distort the real situation in America. The following graph depicts the true status: [See: https://www.cato.org/blog/different-look-after-tax-income-inequality ]. This certainly is no picture of rising income inequality in the US.

For context, one should also note the following: According to the IRS data from 1992 to 2014 over 70% of “tax units” (a very close proxy for families) were among the top 400 individual US taxpayers for only a single year while only 3% were among this top tier for ten years or more. [See: https://taxfoundation.org/turnover-among-richest-americans/ ]. Thus, most US taxpayers had ultra-high incomes only one time in their careers. Also, in 2017 a US household needed $421,926 to be in the top 1%. [ See: https://www.epi.org/multimedia/unequal-states-of-america/#/United%20States ]. This is a very handsome sum but far less than many would imagine.In 2019, Auten & Splinter reported that “Top income share estimates based on only individual tax returns, such as Piketty & Saez (2003) are biased by tax-base changes, major social changes, and missing income sources.” These authors continued “Our results suggest that the income shares are lower than the tax-based estimates and since the early 1960s increasing government transfers and tax progressivity have resulted in little change in after-tax income shares.” [See: “Income Inequality in the United States: Using Tax Data to Measure Long-Term Trends” Or see: Davidsplinter.com/autensplinter-tax_data_and_inequality.pdf ]. The Economist, noted regarding this research, that “Just as ideas about inequality have completed their march from the Academy to the frontlines of politics, researchers have begun to look again. And some are wondering whether inequality has risen as much as claimed — or, by some measures, at all.” The results of this research paper have also been reported by Vox, PBS, The Hill, and the WSJ.Then in Oct. of 2019 Elwell et al reported that “… when we more fully account for taxes and transfers and use the proper sharing unit and unit of analysis … we show that while over this period (1959 – 2016) the rich got substantially richer, so did poor and middle-class Americans.” [See: Income Growth and its Distribution From Eisenhower to Obama: The Growing Importance of In =Kind Transfers (1959 – 2016) AEI Economics Working Paper 2019-21.]

Turning the alleged accumulation of wealth due to capitalism. This misleading claim made by many collectivists also lacks important framing. Augustus Caesar was worth an estimated $4.6 trillion but economic historians name Mansa Musa I (1280 – 1337) of the Mali Empire in sub-Saharan Africa as the richest man of all time. Jakob Fugger (1459 – 1525), a German merchant, amassed a fortune worth an estimated $400 billion in today’s dollars more than 250 years before the onset of capitalism. Today the world’s richest man is Jeff Bezos with a net worth of about $125 billion. He is followed by Bernard Arnault with just under $108 billion and Bill Gates at slightly more than $107 billion. [See: https://www.msn.com/en-us/money/markets/arnault-overtakes-gates-to-become-worlds-second-richest-person/ar-AAEqfUQ?ocid=spartandhp ]. Basil II, Alan the Red, Nicholas II, William the Conqueror, and Muammar al-Qaddafi, along with all of the “Robber Barons” of the late 19th and early 20th centuries were also far wealthier than Mr. Bezos in US dollars adjusted for inflation. [See: https://en.wikipedia.org/wiki/List_of_wealthiest_historic_figures ]. As an aside and for further context, several large family fortunes have been divided by inheritance. The combined Walton family fortune today stands at $191 billion, the Mars estate has a total worth of $127 billion and the Koch family wealth is now $125 billion. [See: The Jewish Journal reporting from Bloomberg Aug. 11, 2019].

In the May 15, 2014 edition of Foreign Affairs magazine in an article titled “The Inequality Illusion” economists Wojciech Kopczuk and Allison Schrager reported that “… there is limited evidence that wealth inequality has actually worsened in the US in the last 30 years.” A year later Zucman & Saez in a scholarly paper, (“Wealth Inequality in the US Since 1913”) found that wealth inequality was not rising quickly below the top 0.1%. [See: https://berkeley.edu/~saez/saez-zucmanNBER14wealth.pdf ]. According to Harvard professor and economist, Martin Feldstein, this increase in the wealth statistics among the top 0.1% was due almost entirely to the 0.01%’s conversion from reporting their taxes as “C” corporations to “sub-S” corporations after the 1986 tax act. [See: https://object.cato.org/sites/cato.org/files/pubs/pdf/anti-piketty.pdf ]. Thus, there has been little or no concentration of wealth in the US since 1970.

For some unexplained reason, many socialists confine their analysis of inequality to measures of income (annual earnings) and wealth (accumulated economic assets less debt) thereby ignoring many other important benchmarks (mortality, morbidity, literacy, consumption, gender, race, etc.) and one might assume that these other unmentioned norms may not support their collectivist claims of inequality that is skewing out of control. [See: https://mortality.org/ ]. The simple truth is that these other metrics are both: getting better fast and converging while not diverging as many on the left would have us believe. [See: https://www.un.org/esa/desa/papers/2005/wp2_2005.pdf ].

The Organization for Economic Co-operation and Development (OECD) has firmly asserted that “Economic growth is the most powerful instrument for reducing poverty and improving the quality of life in developing countries.” [See: http://www.oecd.org/derec/unitedkingdom/40700982.pd ]. Of course, many collectivists want to halt the expansion of human economic well-being asserting that things are good enough today. [See: https://www.amazon.com/Lets-Get-Rid-growth-Globalization/dp/1484036557/ref=sr_1_28_sspa?keywords=capitalism&qid=1564929398&s=books&sr=1-28-spons&psc=1 ].Thus, any effort that might slow economic growth via socialism would be a virtual “death sentence” for our planet’s needy. Interestingly, Michael O’Sullivan in his new book “The Leveling” insists that while globalization has ended the next major trend will be a worldwide equalizing of wealth, income, consumption, etc.

In further support of the OECD’s assertion Prof. Raghuram Rajan, an economist at the University of Chicago and former chief economist for the IMF, in his latest book, “The Third Pillar” (2019) reports that “We are surrounded by plenty. Humanity has never been richer as technologies of production have improved steadily over the last two hundred fifty years. It is not just developed countries that have grown wealthier; billions across the developing world have moved from stressful poverty to a comfortable middle-class existence in the span of a generation. Income is more evenly spread across the world than at any other time in our lives. For the first time in history, we have it in our power to eradicate hunger and starvation everywhere.” This is capitalism’s real historical economic record.

Moreover, the editors of The Economist magazine on May 23, 2019, opined that “Capitalism is improving workers’ lot farther than it has in years … (and) … the zeitgeist has lost touch with the data.” They added that the bleak picture painted by the left “… is at odds with reality.” In other words, many news outlets are apparently not reporting the economic truth about capitalism.

Indeed, Prof. Richard Baldwin, president of the Centre for Economic Policy Research (CEPR) in London, in his 2016 book, “The Great Convergence” notes that “From 1820 to 1990 the share of world income going to today’s wealthy nations soared from 20% to 70% and that share has recently been plummeting. Today, their share is now back to where it was in 1914.” According to Dr. Baldwin “This new trend … is surely the dominant economic fact of the last two or three decades.” This leads one to inquire — Why does this critical new trend go virtually unreported?

Summary

One should compare all of these facts with socialism’s record of rendering almost everyone to be only equally poor. Thus, liberals imagined emphasis on rising inequality in the USA due in-part to capitalism represents one of the world’s biggest economic hoaxes.

Outstanding. This article is outstanding, this site is outstanding. I tweeted to as many as I think might read and thoughtfully consider this.

I must be in a minority (again), I did read ‘Capitol in the 21st Century’. I’m not an economist, and didn’t ‘get’ all (?any) of thethe economic formulae.

I did understand that the richer you are, the greater the proportion of your money that you can invest. He gave the example of the American University burseries, who unlike most wealthy individuals, publish a lot of their data. Harvard, with a bursary of $30Bn, can employ better advisors, take more risks with some of their money, & do have higher rates of return on their money (than poorer colleges)

Consistent with M. Piketty’s premise, I believe that the most important factor in life’s outcome is the accident of your birth. I believe in equality of opportunity, meaning as a minimum, that all children get the best education that their talents can cope with, perhaps even despite their parents. That will not make us equal, but will help, over several generations.

I love this idea that capitalism can be ‘replaced’, like a lightbulb is replaced, say….

Capitalism is the place you go to get a cup of coffee and a pastry in the morning. As such, I’m not sure it can be ‘replaced’…. it might, on the other hand, self-implode…

I mean, is that how history works? Did somebody come along and say, “Let’s replace Feudalism with Capitalism”, or “Let’s replace slave based societies with Feudalism”? I don’t think so… I think it’s a bit of a conceit that you can propose to “replace” a system from the top down… I’m afraid I don’t believe that any more, if I ever did.

Marx never took into account that black hole at the center of all of existence – and not just human existence – which is called chance or luck…Marx didn’t know the dinosaurs used to rule the Earth until our planet was hit by a meteorite and wiped them out, an act of chance without which we wouldn’t be here…. given that existential fact, how can anybody believe History is following a script, and, besides, with one a happy ending?

What we do know, because people in Britain have done it in the past, is that by concentrating on very concrete policies we can transform people’s lives. The NHS, the universal pension, free education, these are all things that even just one hundred years ago were considered to be “impossible” or “unaffordable” “pipe dreams”.

So I think dreaming big has never been more important – universal income, the constitutional right to decent housing, reversing inequality and radically redistributing wealth – these are all things which can be achieved….

I don’t know why you bothered it is just a rehash of David Harvey’s history of neoliberalism from years ago and tells us nothing new.

Reclaiming the state by Bill Mitchell and Thomas Fazi and Why Minsky matters by Randall Wray actually explains what can be done about it. Instead of just rehashing the same problem.

Eurozone Dystopia: Groupthink and Denial on a Grand Scale by Mitchell is the best book out there regarding what has happened since the Treaty of Rome.The

Piketty inequality data is good and that is about it and no surprise his book is heavily influenced by the neoclassical frame and falls foul of the usual errors.

So what is the usual errors?

Piketty was part of CORE. CORE promised to be the biggest shake-up since Paul Samuelson’s Economics became the standard bearer for introductory texts in 1948 ,

If course it wasn’t it was the usual nonsense. Inequality data good as for the answers Piketty puts forward they can easily be ignored.

http://bilbo.economicoutlook.net/blog/?p=36855

Captive state by George Monbiot is also very good. Excellent infact.

If you haven’t read the follow up you have been living under a rock.

https://www.plutobooks.com/9780745337326/reclaiming-the-state/

The fall out from that is this book which is going to be taught in universities and sold out in weeks after the launch. The best macroeconomics text book bar none.

https://www.macmillanihe.com/page/detail/Macroeconomics/?K=9781137610669

People who are 20 years behind the actual debates that have been going on in the economics corridor of power ( which I have been part of on the BBC.) Do not seem to realise whoever wins between Stephanie Kelton and Paul Krugman will decide economics for the next generation.

Next year this book by Stephanie will be the game changer. Kevin Hague will have to take down his blog or be sued.

https://stephaniekelton.com

Infact, if you watch Stephanie’s videos on You tube you will know more about economics that those parading around as professors in Scottish universities.

Kevin Hague’s blog is filled to the Brim with errors, lies and deceit and he calls himself the GERS expert it is hilarious. When Stephanie’s book comes out next year he is in big, big trouble.

His errors are the fact he thinks we all live in a gold standard, fixed exchange rate world. Fails to recognise the difference between the £ and the Euro. No idea how banks work.

However, his biggest mistake is summarised in this debate

http://bilbo.economicoutlook.net/blog/?p=3921

Kevin Hague and the way he thinks things work are completely destroyed by this economic paper by Prof Scott Fullwiler – interest rates and fiscal sustainability

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1722986

I told Kevin he was 25 years behind the debate and tied him in knots on Twitter. His response was to ban me and then threatened to sue anyone who hosted my findings on the internet.

I can’t wait until next year then everyone will see what a farce his blog is.

I’m going to say something that I find very uncomfortable but has been plaguing me for some time. I am glad that people are now beginning to ask: why do we need billionaires? We don’t. Really wealthy people are consumers not creators whose consumption does not help the economy to grow even if they are consuming at the ostentatious levels that they do. Picketty successfully challenged Marx’s view that ‘labour’ was the basis of wealth and argued that it was actually knowledge that had driven growth, new technologies, new science. I agree.

But if labour is no longer the basis of wealth, and new technologies in robotics and AI threaten most manual jobs, do we need so many poor unemployed people either? The world is already overpopulated. The economy we have could easily tick along as well if not better on half the world’s population. Even a quarter. In the Middle Ages well before the industrial machine age (when labour was important to the economy) the great plague in 1368 is estimated to have removed about 1/3 of the population of most European countries without having had any impact on the wider economic growth of Europe. The Renaissance still happened. The Enlightenment followed and the Industrial Revolution. Though the plague claimed victims in all classes, it is estimated that the poor were the most reduced because of pre-existing malnutrition. If anything the reduction in numbers actually helped economic growth, especially if we accept Picketty’s view that it is not labour but knowledge which had driven the economy. Because what happened was that life immediately got better for the survivors. Apprentices were fast tracked into deceased masters shoes instead of the enforced stasis of long periods of economic servility as ‘training’. Serfdom disappeared as an institution because agricultural workers were in short supply and could demand higher wages and better conditions. Society became less hierarchical at the lower levels. Poorer land was abandoned and better land was redistributed amongst the survivors as owners were forced to sell or part with some of their land. There was a net redistribution of resources. The overall effect was a shake-up and this was reflected in universities too, and amongst those who dealt in knowledge or furthered knowledge. So if the Middle Ages in pre-industrial times could not only survive, but actually benefit from a reduction in a third of its population, without damaging the underlying strength of its economy, how much more could we survive and benefit from a much smaller global population? So, granted, we don’t need billionaires, but we don’t need the unemployed poor either, and that thought really makes me shudder. The only comfort I take from any of this is that birth control is beginning to halt the world’s population. Hopefully we can voluntarily shrink our numbers without a catastrophe reducing the world’s population.

I chuckle at the “refutation” of gaping income and wealth inequality in the USA, where I’ve lived all my life. Life has gotten steadily harder over the decades; cities where I used to live have driven out many who used to live there as prices skyrocket…you don’t have to read an economics textbook to know the score. Books have their place, of course, especially when they aren’t produced to further quibbles between self-impressed “experts,” but the book that has the final say is the one whose pages we are living through today. For some strange reason, that book bears out the daily desperation of millions of people just trying to get by, while scum like Jeff Bezos and the rest of his parasitic crew try to buy elections.

The book we will write will erase capitalism and with it, the rule of the zero people who destroy real value–life itself–in exchange for abstractions of it in bank accounts and reports to corporate investors.

Mr. Raphael:

I hope that you understand that your post is entirely anecdotal and therefore contains almost zero probative value.

Best,

Richard Burcik

Corbynomics and the Current Budget Balance and the Tories stole it. Bangs head off desk walks into kitchen swearing at oneself.

Why the left and right spending plans will never work. Without understanding the government accounts. Neoclassical trained Piketty is no different.

The numbers come from the Public Sector Finance report from the UK’s Office of National Statistics. For the financial year 2014/15 the current budget deficit stood at £48,876mn. So that is the amount you have to generate from somewhere to get it to zero.

However before we do that it is useful to understand how you get that figure. What actually is the current budget deficit?

It is defined as:

Net Current Expenditure + Interest Paid + Depreciation – Current Receipts

so using the figures from 2014/15 (In £ mns) you get:

634,317 + 47,222 + 37,306 – 669,969

To get the current budget deficit to zero you have to conduct extra investment spending – which then gets taxed away at the tax take

percentage (which is 1 – the saving percentage) creating the extra tax receipts to cover the current budget deficit. Effectively you move the

deficit from the current budget to the capital budget.

Anyone watching the Marr – Javid interview on Sunday morning could see the myths if you knew what to look out for.

There are a couple of things to note from this calculation.

The first is that the depreciation figure is a transfer from the capital budget and adds to the current deficit. The more investment you do, the bigger the

depreciation figure gets which then means you have to do ever more investment spending every year to cover the growing current deficit.

The second is the interest paid figure which similarly adds to the current deficit. The more investment spending you do at interest the

bigger this figure gets. The higher interest rate you pay the bigger this figure gets. And the bigger the figure gets, the more investment

spending you have to do in subsequent years to clear the current deficit.

You can already see that there are two unfortunate positive feedback loops inherent within the calculations.

Net investment spending (Gross spending less depreciation) for 2014/15 was £30,328mn. If you express receipts as a percentage of total

expenditure you find the tax take is 89.4%. So for every £100 spent, £89.40 came back as tax and £10.60 was held as private sector household and business “savings.”

The tax take percentage varies as the tax side auto stabilisers allow people to save. In the post crash era where people are generally saving

it has been as low as 82%.

So to clear the current budget deficit at a conservative tax take of 80% you’d need to make £61,095mn of extra investment spending (i.e. the

capital net spend needs to be three times what it currently is). That will vary up and down depending upon the actions of the automatic

stabilisers. In 2009/2010 you would have needed £107,684mn of investment spending.

There is of course lots of talk within Corbynomics of closing tax gaps, changing rates and the like. All of that is largely distributional. If you take tax off one person, they can’t then spend it with somebody else and you potentially deprive somebody of an income. Only where you defer or offset saving behaviour, somehow, is there an impact on the total tax take percentage. Really you’re relying on the old balanced budget multiplier to work its magic – which isn’t that effective in an open net importing economy like the UK.

There is, of course, no need to balance any budget, and doing so violates ‘Lerner’s Law’. The wisdom in Lerner’s statement is already apparent given the brouhaha

over People’s QE. All that is down to the complexity of trying to present a simple overdraft or guarantee in flowery language. The mainstream have misinterpreted it and are now engaged in a campaign of misinformation. The lack of simplicity makes that difficult to counter.

Besides the complexity issues, balancing the current budget has clear issues.

1. You are limited to fixed capital formation and capital transfers. So you can build universities and hospitals, but you can’t staff them.

2. Eventually you run out of stuff to build. This leads to the old Labour problem of building roads to nowhere just to keep ‘investment’

going. See Eurocentral between Glasgow and Edinburgh as a perfect example and every small industrial complex on the outskirts of every town and city.

3. You neglect items because of the current budget restriction. The only effective investment a government can make is in its people. But

that is all current spend and is therefore difficult to do.

4. You have to raise taxes to make the books balance. Nobody likes tax rises. Raising taxes is far more unpopular than explaining that budget

balances are not really significant. It seems strange to take a political hit on taxation when you don’t need to. That’s because they act as if we are still on the gold standard.

5. Fixed capital investment targets a small section of the country’s supply chain. Only a small section of the population is engaged in building things. The UK is 80% service based and people are trained for services. So you are quickly going to run into supply side capacity constraints, and potentially start to limit other capital development in the private economy.

6. The action of the auto-stabilisers pulls the current budget out of balance as a matter of design. If the economy contracts social security payments go up and tax take declines. You then have to do more investment spending to counter that. Yes there is more slack at that point, but is it the right sort of slack. Is the supply fungible enough? No…

7. The more investment, the more depreciation and interest paid. That leads to a positive feedback spiral between the current budget deficit and the level of required investment (and is another reason why Gilt Issues are harmful)

Overall it seems a strange political choice, when you can easily get away from adjusting taxes and allow yourself more freedom to improve

direct services (the National Education Service for example) with a functional finance approach. Simply explain that government is creating money so banks don’t have to lend it. Government is stepping in so that ordinary people can save more and borrow less while at the same time ensuring everybody the private sector doesn’t wish to hire has a job and an income. Surely the only people that would object to that are bankers and their economist lackeys.

Japan now on daily basis exposes our leaders as deceitful liars. Propaganda machines that Orwell would have been in awe at.

The BoJ provide this diagram to describe the way government transactions are facilitated in Japan.

http://bilbo.economicoutlook.net/blog/?p=43607

In short, no gold standard, fixed exchange rate self imposed constraints that no longer apply to their monetary system. Shouldn’t apply to ours.