The Seven Deadly Sins of Marketisation in British Higher Education

Over 45,000 workers in British Higher Education (HE) are in the middle of an eight-day strike over pay, pay inequality, casualisation, and pensions. At the root of most of these grievances is the transformation of UK HE into a market, particularly since 2011. This article outlines the most destructive aspects of marketisation.

1. Commodification

Every market involves a producer trading a commodity — a good or service — to a consumer. In a marketised university, academics are framed as providing a commodified service to students. This grossly distorts the true nature of education, which is never, and can never be, a one-way way “supply” of a “service”. Education is a complex, collective enterprise, requiring as deep a commitment from students as from lecturers; indeed, higher education is premised on the idea of guided independent study. Its commodification leads to the idea that it offers “poor value for money” because “contact time” is limited, when in reality higher education requires students to have ample time to read, reflect and write about ideas, to develop their own minds. Yet increasingly, academics are judged on crude, factory-like metrics, such as “value added”, implying that it is only our “supply” of “teaching” that “adds value” to the student. This exemplifies the broader problem of markets, which always construct producer and consumer interests as diametrically opposed. Students, explicitly framed by government policy as consumers, come to evaluate every interaction in monetary terms, and increasingly come to see their lecturers as a hindrance to their progress — as putting hurdles in their way or denying them the grades they need to get work — rather than as their guides. This increasingly poisons a relationship that should be one of care, trust and mentorship.

2. Competition

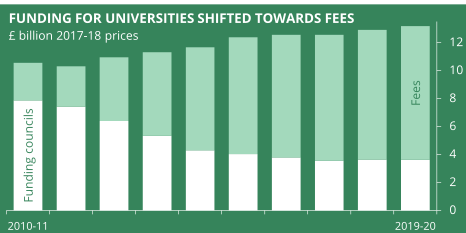

The Conservative-LibDem government established UK HE as a competitive marketplace through their 2011 reforms. In the past, the British government had allocated teaching grants to universities, capping student numbers to contain overall costs. New Labour governments introduced fees (£1,000, then £3,000) to top up these grants, improving the overall “unit of resource” (income per student). However, the Con-LD government mostly scrapped teaching grants, shifting the financial burden to students. The fee cap was lifted to £9,000 (now £9,250) and the cap on student numbers was abolished. Universities were expected to compete on price, with “better” institutions empowered to attract more students than before, at the expense of “worse” ones, which would have to cut their prices to survive. Competition would supposedly force universities to drive up quality.

Contrary to government intentions, however, universities chose not to compete on price: almost all of them charged the full £9,000. This was partly because setting any lower “price” would imply a low-quality “product”, potentially deterring “customers”, and partly because, with the slashing of teaching grants, universities needed the full amount available from fees. However, some empire-building university managers also sought to exploit the new freedom to expand, and for that they would need the highest possible incomes.

These changes led to a massive transformation in university income and its structure. From 2008–18, HE institutions’ (HEIs) income increased by 63% to £38.2bn. The sector is now awash with cash. However, the proportion from grants has fallen sharply while income from fees has risen by a staggering 202%. Around 80% of universities’ income now comes from “private” sources, through the market. Whereas once universities were funded as a public good, now students must borrow to undertake the private consumption of a university education.

Rather than competing on price, universities resolved to compete on “quality”. To persuade “customers” that their university is the best place to spend their £9k, managers have done two things. First, they have “invested” in flashy buildings to woo students on open days. Second, they have reoriented university life around climbing the league tables supposed to influence “consumer choice”, with endless bureaucratic initiatives designed to improve (i.e. game) various assessment metrics. The model was how universities had gamed the Research Excellence Framework (REF) — the regular rating of universities’ research performance, which determines the allocation of “quality-related” government research funding — for many years, with endless “dry runs” designed to massage scores upwards. This was now repeated with “Key Information Sets” provided to “consumers”, the National Student Survey, and the Teaching Excellence Framework (TEF). University life has become less about actually improving research and education and more about how to improve the external measurements of these things, which are typically arbitrary and barely connected to the underlying activity.

3. Bureaucratisation

For free-market ideologues, deregulation and privatisation are supposed to increase efficiency. In truth, neoliberal marketisation typically goes hand-in-hand with intensifying bureaucracy — and this is certainly true in UK HE. This is partly due to the intensified regulation of HE as a market. In the “regulatory state” model of contemporary neoliberal governance, the central state withdraws from directly providing goods and services, and intervening to secure desired policy outcomes, to setting broad regulations and goals designed to “steer” diverse public, private and hybrid actors towards desirable ends. This is often presented as “light touch regulation” — a term used with respect to the TEF, for example. But, in reality, this model merely shifts the location of bureaucracy, from the central state to the entities being regulated. Universities must now interpret the broad regulatory goals set out by the state and ensure adherence to these, spawning a vast internal bureaucracy designed purely to respond to these reporting and compliance requirements.

But managers’ market-driven quest to climb the league tables also spawns endless bureaucratic initiatives designed to drive up particular metrics and “improve the ‘student experience’”. There has been colossal managerial bloat since 2011, with a massive expansion in upper- and mid-level management positions designed to manage this activity — what Benjamin Ginsberg calls “deanlets” in his book The Fall of the Faculty. My university, for example, now spends £2.1m per year on “key management personnel”. These individuals generate more bureaucratic busy-work for faculty, eating into the time in which they should be doing teaching and research. To respond to this additional workload, departments have hired more and more administrators. Accordingly, the majority of universities now employ more administrators than academics. This is not to denigrate the work of administrative colleagues, who also work terrifically hard, with many doing important jobs that enable good teaching and research. But the reality is that managerialist and administrative bloat now blights universities and is a key driver of the workloads crushing academic staff, who now work, on average, two extra unpaid days per week.

4. Managers behaving like capitalists

Another key driver of crushing workloads is the attempt by university managers to accrue large recurrent “surpluses” (the difference between income and expenditure), largely through working staff harder and harder — also known as the intensification of labour. Universities are not (yet) capitalist enterprises: they do not make a “profit” that they distribute to their owners. But they certainly do try to accrue “surpluses” which can be “reinvested” in future development or expansion.

For empire-building managers at “top” universities, which enjoy strong brand recognition, the 2011 reforms provided an alluring opportunity for growth at the expense of “weaker” institutions. Many have engaged in breathtaking expansion plans, including overseas campuses (39 now, from 136 HEIs), and domestic building projects, with the most ambitious being UCL’s £1.25bn plans, including a new campus in Stratford in East London. However, because there is a finite supply of students, the “best” institutions can only expand at the expense of “middling” ones, which compels the latter to struggle for market share, too, at the expense of still “weaker” ones — the whole system working like a gigantic vacuum cleaner, sucking up students. The fear of competition — and the potential hollowing-out of one’s income and, thereby, financial death — means that no university can stand still: like sharks, they must keep moving forwards in order to survive. They must try to grab more market share, more income, and deliver the surpluses needed for further expansion or merely to maintain one’s market position through .

The difficulty is that it is very hard to increase marginal income in the UK HE market, because fees are capped for a large majority of “customers” (UK/ EU students). One can accept more students, but that means more bodies on campus, more books to buy, more labs to build, more staff needed to teach them, more support staff needed, etc — and these services are very hard to deliver “at scale”, i.e. they do not get much cheaper the more one provides them “in bulk”. Universities try to get around this by recruiting overseas students (uncapped fees), shifting campuses overseas (uncapped fees and lower costs), and moving into distance learning (no additional “bodies” on campus), but this has limits.

Therefore, to squeeze out a recurrent “surplus”, one must work to suppress the costs side. Since building costs must increase, this largely means reducing “staff costs”, i.e. pay and pensions. From 2008–18, staff costs as a proportion of overall expenditure has fallen from 57% to 54%. In the same period, staff’s real-terms pay has fallen by 20.8%, while the USS pension scheme (which covers pre-1992 universities) has been cut three times, costing an average lecturer £240k across their retirement. Gendered and raced pay inequalities are at the very least functional for reducing staff costs; certainly, the imperative to drive down pay does not create an amenable environment for leveling up. At my university, the gender pay gap is 13.9% while BAME colleagues are paid 21.9% less than white personnel; the gap between BAME women and white men is 31%. This is pretty typical of UK HE as a whole.

Another way to drive down staff costs is to employ staff on “atypical” terms, e.g. temporary, hourly paid, or even “zero hours” contracts. This practice is now rife in UK HE. Of course, some “atypical” employment is entirely legitimate: the PhD student who needs a few hours of teaching per week to train and gain experience; the non-academic professional who delivers a practical session for students; someone filling in for someone on maternity or research leave, and so on. But with 53% of teaching and research staff now on irregular contracts, it is obvious that UK universities now rely heavily on precariously employed staff to deliver their core functions on a recurrent basis. Life for these colleagues is often miserable. They must rapidly skill-up to teach a new module, work very long hours for very little pay, then face the unemployment at the end of the contract. They are often juggling several jobs at different institutions, grappling with the institutional requirements of both, commuting long distances, and barely making the minimum wage. Even highly prestigious institutions, like Oxford and the LSE, make extensive use of this sort of labour to deliver teaching to undergraduates in particular.

A final way to squeeze out surplus is to intensify labour processes so that workers must deliver more value per hour worked, and/or just force them to work longer hours. This has been done at many universities through expanding student numbers faster than staff numbers: for example, at my university, from 2007/8 to 2017/18 the student body grew by 66% but staff numbers only rose 33%. That figure includes research staff who don’t teach, but even factoring them in, that means the ratio of students-per-staff has increased from 9.8 to 12.1, or 13.1 in 2018/19. And this conceals uneven growth within institutions: in my own department, the staff-student-ratio is now 1:21.4. Put simply, we have many more students each to teach and are compelled to “do more with less”. Staff are also pushed to work harder on income-generation through grant applications and commercialisation of research.

The net result, at my university, is that the amount of income generated per employee has increased by 40% in the last decade. In the sector as a whole, HESA data show that it has increased by 35% .

Given that it is hard to increase “academic productivity” (except through increased class sizes), increased surplus extraction largely means longer working hours. On average, academics work 51 hours per week, with 29% working over 55 hours per week. Assuming a normal working week of 35 hours, that’s 16 hours per week extra, unpaid labour, or 832 hours over a 52-week year, i.e. 119 extra days per year. Universities literally run on the basis of this unpaid labour; they would swiftly collapse if it was withdrawn.

It is unsurprising in this context of managerialism and surplus extraction that bullying is rampant, as staff are harried to do more and more with less and less, and anyone speaking out against this regime is ruthlessly slapped down. At my institution, 44% of staff reported witnessing bullying and harassment last year. Combined with high workloads, this behaviour is destroying the physical and mental health of HE workers. Nationwide, from 2009–15, staff referrals to psychiatric counselling services increased by 77%, while referrals to occupational health services rose by 64%. QMUL did not disclose local data. 43% of university staff exhibit symptoms of at least a mild mental disorder — twice the rate of the general population. Rates of stress are higher than for police or medics.

5. Degradation

As well as degrading the people who work in HE, marketisation degrades the “product” itself: higher education. Markets construct producer and consumer interests as opposed: the producer always has an interest in supplying their product as cheaply as possible but for the highest price possible, while the consumer always wants maximum quality for a minimum price. In such a situation, left to their own devices, producers always have a motive to adulterate their product: to put water in wine, to put chalk in baby milk powder, or whatever, to reduce their production costs.

The same applies in the HE market, where the quality of higher education is being progressively degraded. Recall that universities have resolved to compete on “quality”. One of the key ways in which “teaching quality” is “measured” in the HE market is through reported levels of “student satisfaction” in the National Student Survey (NSS) and “value added” (the difference between students’ entry grades and their final degree qualification). These metrics feed into many league tables and are therefore critical to securing the “competitiveness” of HEIs.

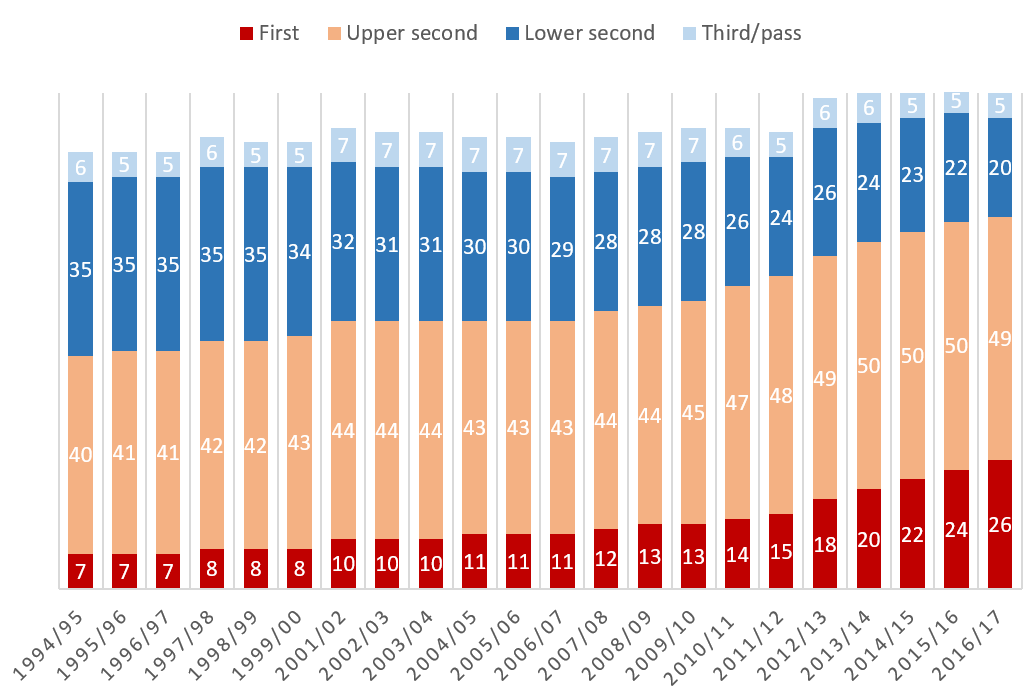

The trouble is that NSS responses are tightly correlated with students’ expected grades: as “consumers”, they are more likely to be “satisfied” if they “got what they paid for”, i.e. a degree that will qualify them for decent future employment, i.e. an Upper-Second class (“2i”) degree or better. This creates a strong incentive to make it easier to attain such grades. Similarly, “value added” is very difficult to shift, because student attainment rests heavily on things outside of lecturers’ control, e.g. prior education, social class and material barriers to engagement (e.g. poverty, the need to work “part time” during one’s studies, etc), and students’ own abilities and effort. The only easy way to increase “value added” is to dilute grading standards, so higher marks are routinely awarded.

Accordingly, universities have revised their marking criteria and their classification processes, leading to a massive explosion in the proportion of Upper-Second and First-class degrees being awarded since 2011. It is obvious that, at a time when staff-time per student is actually falling, as is the amount of time students themselves commit to their studies, this cannot be accounted for in any other way. The market regulator, the so-called “Office for Students”, itself recognises this grade inflation, but describes it as “unexplained” — because, as a key instrument of marketisation, it cannot name the true source of the problem.

It is not exaggerated to say that this will eventually produce a crisis in our civilisation. Thanks to marketisation we are now sending young people out into the world who are formally better-credentialled than ever, but who actually know less, are less educated, less skilled, and worse trained in the virtues of citizenship than graduates of, say, 20 years ago. The HE sector has become complicit in a gigantic lie to the contrary, a lie that every academic feels in their heart each time they are forced to write a reference for a graduate whom they regard as mediocre but whose transcript clearly states got a First. Students are graduating with an average debt of £57,000 in exchange for this. Many of them will never earn enough to repay this colossal debt, thanks in part to the massive oversupply of graduate labour relative to the actual needs of the market. According to the ONS, a staggering 47% of recent graduates, and 37.2% of all graduates, are working in non-graduate jobs. This is a direct result of marketisation which, by segmenting the interests of different “producers” and “consumers”, constantly results in irrational shortages and surpluses. For many of the “consumers” passing through our higher education system, what Andrew McGettigan called The Great University Gamble will turn out to be the great university con trick.

6. Financialisation

On top of efforts to squeeze surpluses out of students and staff, universities are increasingly financing their expansion (or simply shiny new buildings) by resort to private capital markets, i.e. through private borrowing. This generates imperatives for further market-conforming behaviour.

The turn to capital markets happened very quickly after 2011. During 2015 alone, universities issued $1.39bn in private bonds, typically at around 3% interest over a long time period: 50 or even 100 years. From 2013–18, university bond issues totalled £4.4bn. Oxford has borrowed £750m over 100 years at 2.5%; Cardiff, £300m at 3.1% over 50 years; Cambridge, £300m at an inflation-linked rate and £300m at 2.35% over 60 years; even Portsmouth has raised £100m through issuing bonds.

Raising private finance depends on assuring investors that the institution is financially sound and their money will be returned with the stated rate of return. To keep the ratings agencies sweet (yes, Standard and Poor, Moodys, et al. now rate universities, just as they rate governments), universities must show financial probity. That involves two things: first, they must demonstrate that revenue (i.e. students) will continue to flow to the institution, which requires a solid competitive positioning in the market place. Portsmouth’s investment prospectus, for example, makes direct reference to its league table position to reassure bond-purchasers. This reinforces the managerialist turn to gaming the league tables and degrading higher education, as described above. Secondly, universities must show a determination to suppress costs, to show that they can generate the required surplus to repay the bond when it matures. That entails bearing down on staff pay and especially “pensions liabilities”, which are always a concern for private investors. The desire to shrink these liabilities was a key factor behind employers’ attempt last year to cut USS pensions a third time 2011, which drove staff out on strike en masse.

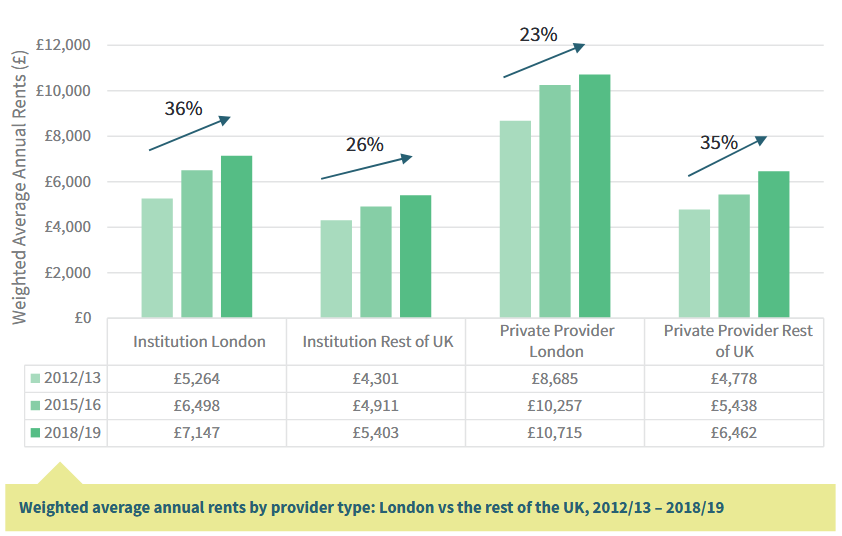

Financialisation also has other pernicious consequences, not least the forced “sweating” of “assets” procured with borrowed funds. To ensure they make the required “surplus” to repay private loans with interest, universities must pack their shiny new buildings to the rafters. On many campuses, that means overcrowded seminar rooms and lecture halls. It also means extracting money from students in the form of very high rents in student halls. Although university rents are still below private sector averages, they have risen at a faster rate: 31.3% from 2012–19. The annual rent for a room in halls in London is now a staggering £8,875. The maximum student maintenance loan for London-based students is £11,354. That leaves just £2,479 to live on, or £47.67 per week. Small wonder that students are forced to work incredibly long hours for pay each week, just to make ends meet, meaning that the poorest, in particular, cannot engage properly with their studies.

Of course, it is not only universities that are cashing in on the lucrative student property market: private investors have also done so in droves. And some of these certainly prioritise profit over safety, as the recent fire in a student hall in Bolton demonstrated.

7. Instability

The final deadly sin is the sheer instability and unsustainable nature of this way of organising higher education. By their very nature, markets have winners and losers. As some institutions have expanded, others have struggled just to maintain numbers (including through lowering entry standards — another sign of degradation), but some have simply shrunk, as students take places now opened up elsewhere. The 2011 reforms explicitly envisaged universities going bust and they are now required to have “student protection plans” so that students can complete their degrees elsewhere should they fold. The OfS has recently confirmed that it would never intervene to prevent this from happening.

Thanks to financialisation, HE debt has tripled from £4.1bn in 2010 to £12bn in 2018. A full quarter of HEIs were in deficit last year, with several reportedly on the verge of bankruptcy. Many academics will be tempted to think that only “bad” universities will be affected: it could never happen to the place where they work. But this is to buy into the neoliberal ideology that spurred marketisation in the first place. As Darwin knew, competition favours not the “best” but the “fittest”, i.e. those best able to adapt to a changing environment. An institution like the Open University, for example, has done fine work for decades in opening access to higher education for millions of working-class people, but that did not spare it from financial crisis as support for part-time degrees collapsed after 2011. The School of Oriental and African Studies houses high-quality research and teaching, including of many rare and endangered languages, but that does not protect it from students going elsewhere, leading to financial losses entailing radical cuts to provision. UCL may boldly stride into the brave new world of marketisation with its £1.25bn expansion plans, but this swiftly plunged the institution into a “barely financially sustainable” situation with just “42 days of expenditure in the bank”, leading to demands that staff “tighten their belts”. Precisely because they are “stronger” institutions, more attractive to private investors, the “better” universities are the most heavily leveraged. The destructive and irrational behaviours driven by marketisation are affecting us all.

The current strikes also speak to the unsustainable nature of UK HE’s “business model”, which is based on the hyper-exploitation of skilled professionals. For many years, academics accepted relatively low pay (relative to their skill level) and long hours in exchange for relative autonomy at work and a dignified retirement. That social contract has been torn up under a decade of marketisation. The supply of “good will” (i.e. underpaid and unpaid labour) that has kept universities running for a long time is now close to zero. Even if the employers win in this dispute, it will be a Phyrric victory, or a Carthaginian one — creating a desert and calling it peace. Unless vice-chancellors change course, workplace relations will be poisoned for a generation and universities will become increasingly dysfunctional.

The truth is that many vice-chancellors and senior managers know all of this. By and large, they are not stupid, nor are they necessarily wicked. Confronted with these critiques, they will admit many of them. Indeed, some now performatively rehearse the critique of their own managerialist initiatives at the exact same time as they announce them: “as an academic, I have real concerns about this thing I am going to make you do; however, we live in a neoliberal society and so…” This symbolises their own sense of powerlessness when confronted by the impersonal forces of the market: in their judgement, the best they can do is trim the university’s sails to the howling winds of competition, and try to ride out the storm. “Realism” demands nothing else. And even if a few of them think differently, competition poses them as enemies: rather than banding together as senior academics to warn the public of the coming disaster and demand change, they plot ways to exploit each other’s weaknesses, each hoping that the others will fall before they do. And they recoil in terror of any threat to changes in market governance — resisting, for example, any cut in student fees, for fear that the state will not make up the resultant shortfall.

Redemption?

In the Christian faith, the seven deadly sins can be redeemed through confession and penance. But there is no one coming to redeem us from the seven deadly sins of marketisation. We can only redeem ourselves. And the only way to escape the commodification, managerialism, degradation and financialisation of our universities is to abolish the market itself.

There must be a great potential for sharing in Higher Education: digital commons of open educational resources, free and open software, open data standards and services and so forth that would drive down costs (and potentially drive up quality) through a form of idea-communism. The textbook racket in the USA, not sure if that has been imported wholesale to UK higher education, is ripe for an alternative model to rise in competition. Likewise reducing wasteful or even harmful (say, to animals) duplicated research.

However, one the best forms of marketing is missing from this list: the move towards open online (often free or at least freemium) courses that may also serve as a global entry point to Higher Education for those unable to access it, as a testbed for prototyping courses to be developed for undergraduates at the home institution, as public-service contributions to democratic deliberations, and tie-ins to institutions with a responsibility for public understanding (like museums).

If I may add an infuriating case study:

Part of the deal in charging 9k was that all unis must demonstrate that they are engaging in sufficient Outreach to ‘underprivileged’ youth. This results in every uni having a team of people who’s whole job is to entice kids who can’t afford the cost of tuition into insurmountable debt; and they know it. They all know perfectly well the best way to get these people into HE is lower fees or more bursaries, but whenever they suggest this to their overpaid boss they are told there isn’t the money. I imagine they feature prominently in those colleagues needing therapy.

The results driven environment they endure also directs their outreach toward kids in the later years of school; well after they pick their subjects for Standard Grade or GCSEs. Again, everyone involved is fully aware they need to target their efforts at around 9-11 year olds (especially to get and keep girls in STEM – big focus there. They can get a little Athena Swan certificate! Which would help recruitment. Literally the only reason the bosses seem to care). But they have targets to hit, and they need to justify spending money going to science festivals so…16-18 year olds it is.

Oh, and while the prospectus claims they want more bright young STEM graduates, my uni is also tossing whether to close the physics or engineering departments in the mid-long term future. Physics isn’t getting enough student applications in for the last two years (so they are being fined. by the university. I don’t know how either.) while engineering is much more expensive to run. What we all know is that the Buisness School is safe. Whether the rest of us are safe from the Buisness School remains to be seen.

I’m not planning a job in academia.

I wouldn’t be surprised if the whole UK HE sector implodes in 5-10 years without drastic action.

The fact that this strike is going on only registered with me when I saw a group of pickets outside Strathclyde Uni last Wednesday. Afterwards, I forgot about it until I read this article.

Lee Jones makes a number of very good points about the way university administrators run their institutions for their own ends.

However, the big issue is the size of the Higher education sector in the UK. A political decision was made to encourage roughly 50% of school pupils to go on to Higher Education. The implications of this were not thought through. Twenty years down the line, the decision looks ill-advised.

A survey was done recently of people born in 1970 and 1990 who went on to Higher education. By the age of 26, the first group had a premium in earning over non-graduates of 19%. For those born in 1990, the premium at 26 was only 11%. For those born in 2000, a further reduction of the premium seems certain.

During the election campaign, there have been extravagant promises of increased public spending. (Widely disparaged by the IFS.) I have not heard any politician mentioning Higher education as being likely beneficiaries. It looks likely that this sector will, by a process of political neglect, be allowed to shrink to a significantly smaller size.