Scotland’s Currency Dilemma

In the aftermath of Humza Yousaf’s latest speech William Thomson of Scotonomics argues that “the economic framework underpinning Scottish independence is dangerously misguided and likely to lead to a worse economic situation than we experience as part of this dysfunctional Union.”

One of the reasons that people are drawn to heterodox economics is the scientific desire to be proved wrong. As the world’s most famous heterodox economist, John Maynard Keynes, quipped, “When the facts change, I change my mind – what do you do, sir?” Like other scientists, economists in heterodox schools of thought attest that being proved wrong leads us closer to the truth.

As 2024 opens up before us, I have a stronger than ever desire for the following statement to be proved incorrect: the economic framework underpinning Scottish independence is dangerously misguided and likely to lead to a worse economic situation than we experience as part of this dysfunctional Union. The statement, however, seems to be gaining strength, powered as it is by the current SNP’s orthodox economic view, revealing itself in economic contradictions that prove it is unravelling in front of our eyes.

Undoubtedly, the Scottish government is firmly rooted in an orthodox view of the economy. Their advisers, as orthodox economists, fundamentally struggle to change their narrative. This is perhaps one of the reasons why the orthodoxy remains so powerful. No deviation from the founding principles is ever considered, save the whole edifice will fall. In many ways, this obstinance is hardwired into the discipline. When you build your beliefs on axioms, ‘natural laws’ and assumptions which can not be tested in the real world, pivoting is a serious challenge. For an orthodox economist, it is much easier to move the goalposts than to change the rules of the game.

The advice from these neoclassical economists seems to be able to weather any storm. Real-world evidence constantly crashes against the hull of mainstream economics without the slightest chance of a course change. The 2008 financial crash should have sunk the orthodoxy or at least knocked it off course. But onwards, it steamed. As Karl Polanyi observed in his 1940s masterpiece The Great Transformation, the economic orthodoxy had bouncebackability, “its particle eclipse may have even strengthened its hold since it enabled its defenders to argue that the incomplete application of its principles was the reason for every and any difficulty laid to its charge”. Onwards and faster.

The reason for the 2008 collapse, shouted the mainstream, was imperfect knowledge, market failure, and, if you can believe this, too much financial regulation. Heterodox economists, led principally by the indomitable Professor Steve Keen, modelled the financial collapse based on Hyman Minsky’s simple real-world observation: stability leads to instability. This post-Keynesian view was supported by Marxist economists who pointed to the crisis as another example of the unsolvable internal contradictions of capitalism. But despite the obvious problems with this particular form of financialised capitalism, little has changed. Orthodox economists maintain their seats, whispering in the ears of governments across the globe. While the World burns.

In this sense, the Scottish government is simply a standard, run-of-the-mill European government. It sticks to orthodoxy. As JK Galbraith said, “It is far, far better and much safer to have a firm anchor in nonsense than to put out on the troubled seas of thought.” The nonsense continues to influence this administration, even though not since 2008 has the orthodoxy been so clearly on the back foot.

The orthodox stalwart the Phillips Curve is now an anachronistic tool to guide policy, insisting as it does that unemployment must rise to control inflation. Orthodox economist Snowbird and former US Treasury Secretary Larry Summers, from his beachside retreat in early 2023, agreed with the US Federal Reserve position and assured his Bloomberg audience that the Fed “explicitly recognise that there’s going to need to be increases in unemployment to contain inflation.” Inflation and the US unemployment rate are close to 3% and well under control.

Heterodox economist Isabella Weber was rounded on for suggesting that inflation was due to price gouging. Later that year, Isabella was proved correct. The Orthodox bastion, the OECD, admitted that “corporate profits contributed far more to inflation in Australia than wages”. Orthodox models say this is impossible! And yet, we are still led by their output.

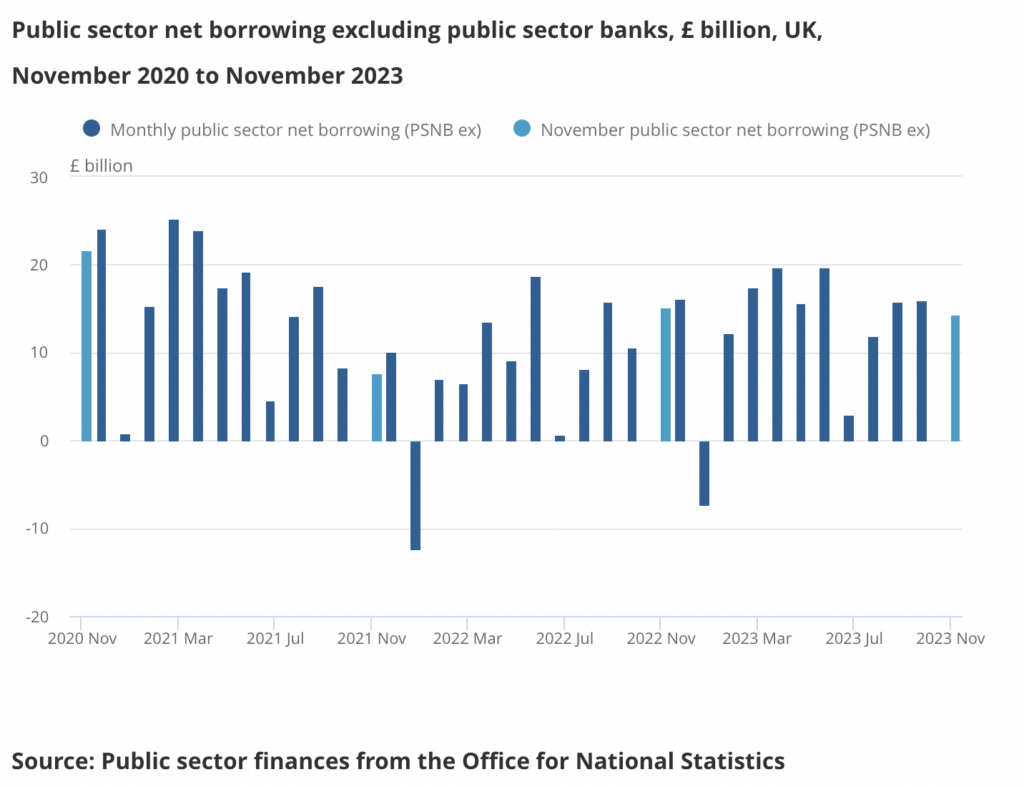

Finally, and I really could have written up a much longer list, there is mounting evidence that the GOAT of monetarist tools, Interest Rates, are more of a fiscal stimulus than a monetary handbrake, just like MMT founder Warrne Mosler has been saying for decades. Last year, over £140 billion was paid out in interest to the already-wealthy bondholders in the UK, supercharging wealth inequality. This leisure class shot-in-the-arm likely helped the UK avoid the recession that raising interest rates is supposed to create.

Using the evidence above, I hope I have made a case that it must be time for the Scottish government to listen to opinions and ideas outside the neoliberal economic mainstream. That ‘firm anchor in nonsense’ for all of our benefit must be loosened.

Returning to the inconsistencies in SNP economic policy, the charge sheet is even longer.

As stated by our FM in his major economic speech yesterday, the Scottish government has “very limited borrowing powers for capital investment”. Yet his administration settled on a new Fiscal Framework that left Holyrood with fewer prudential powers than a Scottish Local Authority. The turkey that voted for Christmas twice, according to a common weal report.

The 2022 National Strategy for Economic Transformation maintains that Scotland – with the current set of powers – can “significantly increase GDP growth”. How can this be feasible while we simultaneously lack the current capacity to create a Ministry for Industrial Policy?

At every opportunity, the administration bemoans Westminster’s economic control of Scotland, yet for perhaps a decade after independence, it will retain the Bank of England and the UK Treasury as paymasters.

Our economic future is being positioned towards EU membership, while our decision to use Westminster’s pound stymies this process. We need a separate currency and central bank to move to EU membership. If EU membership is the aim and is regarded as ever so important, then surely we should have our own currency on day one of independence?

After decades of under-investment, Scotland will need substantial government deficits to create a prosperous Scotland. But by signing up voluntarily (this is the very definition of economic madness) to the EU’s Stability and Growth Pact, we ensure we cannot create those deficits even when we have our own currency.

Without our own currency, we must borrow foreign currency and pay that back with interest. Somehow, this process is expected to lead to investment in social infrastructure of the type that creates no financial return on investment.

We are told to believe in our long-term consistent plan for a post-independent Scottish economy. At the same time, our FM can make a lengthy speech on the economy and fail to mention a Just Transition, a circular economy, a well-being economy, or Community Wealth Building.

And finally, the Scottish government seek to lead on climate change while placing continued fossil fuel extraction at the heart of our economy. Humza Yousuf’s speech yesterday placed fossil fuels front and centre in a way not seen since the 2013 Scottish government white paper on independence. This seemed ignorant at the time. 2013 tied with 2003 as the fourth warmest year globally since records began. 2023 was the warmest year on record. Inconsistency is one thing; ecocide is another thing altogether.

These contradictions are brought into sharper focus with every Scottish government economic paper and speech.

Possessing a scientific approach to the economic discipline as I do, I am open to the chance or the charge that I am wrong. Speaking as I know I can, all I ask on behalf of many independent-minded economists and commentators is a forum or an opportunity to question this orthodoxy in detail and explain that there is an alternative.

To this end, in 2024, Scotonomics is resourcing up for the challenge. You can see our provisional plan for this year. On the 21st of March, we will host an event at Holyrood entitled Economics of The Real World with four leading heterodox economists. Later that evening, our public events will move our erudite panel down the road to the Leith Dockers Club. 2024 is a year of action.

We have two objectives. The first is to continue to put forward a thoughtful heterodox economic narrative to demystify the economy. Our second objective is more specific. To be able to engage openly and meaningfully with this administration.

We could do with your support. Subscribe to our mailing list here or find out more details of our events in 2024.

Links:

the OECD, admitted that:

https://australiainstitute.org.au/post/oecd-report-shows-corporate-profits-contributed-far-more-to-inflation-in-australia-than-wages/

Commonweal:

https://commonweal.scot/policies/turkey/

our provisional plan for this year:

https://scotonomics.scot/about-us/

Subscribe to our mailing list:

https://scot.us21.list-manage.com/subscribe?u=8096c91f80236191e96978298&id=f7cc011dce

find out more details of our events in 2024:

https://scotonomics.scot/live-events/

I am glad to hear about the Holyrood event/s. I am powerfully struck by the seeming incapacity or unwillingness of the SNP/SG and its leadership to listen to the range of intelligent and sensible voices proposing a range of creative, innovative and bold alternative policies that make sense for the current conditions and requirements of the present time.

If the FM has to be kidnapped, tied to a chair, and forced to attend a few of these presentations (and complete a test afterwards), this absolutely has to happen.

Thanks, Mary. We will start with gentle persuasion first and see where that gets us.

‘After decades of under-investment’

In which areas has this under-investment been most problematic ?

‘Scotland will need substantial government deficits to create a prosperous Scotland’

How will such deficits be funded ?

I have to ask, is the first question a serious one? The overall social infrastructure across the UK has been in decline drastically and dramatically since the 1970s. And there is currently no plans to improve it. Post indy £20 billion (across a decade) will be like flicking a pea at a charging climate rhino.

The second one is central to the issues I have identified in my article. If Scotland uses a foreign currency it has to borrow in a foreign currency or tax to fund infrastructure. The money has to ‘be earned’ it has to come from somewhere before it is spent. If Scotland issues its own currency spending comes from newly created fiat money. The spending takes place first. Scotland spends and then accounts for that spending by taxing away some of that currency or issuing new government debt (neither of these two fund or pay for anything). The investment is social and must be done by public money which doesn’t need to make any profit. The funding comes from a government willing and (with its own currency) able to spend more than it removes from the economy. This deficit spending, assuming it is not playing too big a role in the overall inflationary pressure, funds investment spending to ensure full employment. This is exactly how all infrastructure spending is done in currency issuing governments that run a trade deficit (apart from the full employment bit unfortunately). The options for Scotland are stark. Borrow a foreign currency which demands not only a return but a profit. Or use your own which needs neither.

William Thomson

‘the overall social infrastructure in the UK has been in decline drastically and dramatically since the 1970s.’

This simply is not so. Go into any hospital and you will find a mass of technology unavailable 50 years ago. The railway system is far better. The roads can, and do, carry vastly more traffic than before. The problem with schools is not the infrastructure but the curriculum.

I agree that there is a large backlog in repair and maintenance which needs to be attended to.

‘issuing new government debt’

What if – as Liz Truss and countless governments have found out – nobody is willing to buy this debt ?

What you have outlined is a political programme. Bearing in mind that no political party at present shows any interest in promoting such a programme, how do you envisage it coming about ?

Florian, I think it’s much more useful to compare infrastructure in Scotland and across the UK with continental Europe and northern Europe. On almost any scale infrastructure is superior in other comparable nations. And even without a comparison it is drastically in need of improvement.

No one needs to buy government debt. No one didn’t buy new govt debt when Truss was in charge. Debt doesn’t fund anything. If bonds are offered and no one buys them (which incidentally never happens as bonds pay a higher rate of interest than currency sat in reserve balance accounts – as long as banks have balances at the central bank – which they need to do – there will be a buyer for bonds) But so what if no one wanted to own an asset. Then the bonds are withdrawn. The main function of bonds is to allow CB to hit an interest rate target. There are other ways it can do that. They don’t fund anything. They simply account for spending. It’s only a particular view of monetary operations that say this bond + taxes = spending. There’s no practical reason why this has to be the case. I know no one does this at the moment but that is because the orthodoxy is in charge. A close approximation at the moment is Japan where BoJ buys all government debt. This is the same process as not selling bonds in the first place.

The longest journey starts with the first step. To turn your question around. How did we fund WWII and COVID? And how will we ‘pay’ for the huge amount of climate infrastructure? The answer is govt spending and encouraging people to defer spending, high taxation of certain products etc. This is all structurally sound and is no more (in fact it is much more academically sound) ‘out there’ than the moneterist doctrine that came to prominance in late 70s. All we need is political parties who want to create a well-being economy. The politics needs to change. The economics is there to support it.

‘It’s much more useful to compare infrastructure . . . with Continental Europe.’

Fair enough, but it was you who made the comparison with the 1970s.

‘How did we fund World War II’

With a mixture of very high taxation and borrowing. (We also got a massive amount of stuff free from the USA.) We did not use MMT. We managed to pay it back fairly easily – in comparison with WW1 – because we allowed high inflation to cut its value. And because post 1945 we benefited from the US-led period of Western prosperity. Even then, we had to endure a vast amount of austerity; rationing went on till 1954 and things like bread were rationed only after the war.

I do not understand the second paragraph. Until you can explain it better, the politics won’t get started.

The UK was off the gold standard and all government expenditure then – as of now – was newly created govt spending. Taxes and bonds were used to control and limit inflation. Then as of now. This is a description of monetary operations. It is no more doing MMT than a place does gravity. I totally accept that this is not the mainstream understanding of how govt financing works and is at the heart of why I believe that the Scottish government needs to engage with economists outside of the mainstream. It is unfortunate that you don’t see the functioning of governmenr as such. However it is potentially catastrophic for the prosperity of Scotland that the Scottish government is not abreast of as wide as possible a view of how government finances work. SCOTONOMICS has events in March in Dundee and Edinburgh and I would love to see you there Florian *almost* as much as I hope to see elected representatives.

‘Taxes and bonds were used to control and limit inflation.’

I do not dispute that. Were they not, also, used to pay for materiel needed to fight and win the war ? Just as my taxes today help pay for the

NHS ?

I have read, and understood, a good number of contemporary economists; Paul Krugman, Barry Eichengreen, Tyler Cowen, Joseph Stiglitz, Milton Freedman, and Dani Rodrik, for example.

MMT does not appear to have anyone as capable as these individuals to ‘spread the word,’ Until this happens, MMT will remain marginalized.

No taxes and bonds/borrowing do not pay for anything in the UK. Taxes are deleted (in the old days paper money returned to the government was literally burned) and bonds swap one form of money (reserve balance accounts) for bonds (interest bearing accounts). They all account for spending as it is assumed that public money is less efficient/effective than private money. This is the view of the types of economists you have listed. The heterodox is blessed with some amazing economists. It always has been.

I do not understand what you have written. I take consolation in knowing that the Nobel Prize winning economist, Paul Krugman, said he found it hard to understand MMT.

Until you get somebody able to explain MMT to the public – as Keynes and Friedman did with their ideas – you will continue to be ignored.

It’s called The Deficit Myth. Written by Stephanie Kelton. Kelton has worked in government. She describes the workings of MMT in terms understandable by those with a secondary education and a reading age of 16.

The book has sold extensively across the world and was available for free to Amazon Prime subscribers.

Is that popular enough for you?

Or if you don’t want to read one of the most popular economics books of the last decade, here are several central banks and central bankers themselves describing how they create and destroy money, just as described by Mosley, Kelton et al.

Worth Reading Murphy’s blog if you actually want to read “popular” texts on economics

https://www.taxresearch.org.uk/Blog/2024/01/06/central-bankers-on-the-ability-of-banks-to-create-money-out-of-thin-air/

Thank you.

I am aware of this book.

One of the things that put me off buying it was the following comment about Stephanie Kelton;

‘The problem is that I don’t understand her argument at all.’ Paul Krugman; New York TImes 25 February 2019.

Economics is not a science. And one of the poorest predictors of recent economic outcomes has been orthodox economics theory. It missed 2008-09 and provided little of consequence to help governments ameliorate the outcomes of recent inflation. Indeed, orthodox economics continues to demand the imposition of unemployment of drive down “inflationary” pressures when it is clear that much of the real pressure is from profit-gouging.

MMT explained those events.

Time to move beyond hero worship and perhaps do some learning of your own.

It is many years since Jim Cuthbert outlined the massive problem of Full Fiscal Autonomy for Scotland in the Union. The retention of the £ after independence retains many of the same difficulties and is a recipe for financial disaster.

The lessons of the Weimar Republic and Argentina are tte dangers of debt in a foreign currency.

It is important that a new Scotland becomes a currency issuer as soon as feasible post independence. The example of Slovakia shows how quickly that can be done.

John Hughes 16 January 2024 9.oo pm

‘Time to move beyond hero worship.’ That is a silly comment.

I agree that economics is not a science. That said, MMT has not been tried. To me, that is its most significant feature. Since it promises so much, why has no country tried it ? There are lots of countries beset by chronic economic failure; Argentina, Pakistan, Nigeria. Why do none of them give it a go ?

The failures of orthodox economics do not, in themselves, make a case for MMT.

Keynes’ basic ideas can be outlined easily. I have read them outlined in many newspaper articles. I have yet to come across any similar exposition of MMT.

‘Time to . . . do some learning of your own.’

I want to learn but have to say – regretfully – that the article above has not been of much help.