The Scotonomics Festival of Economics 2024

The Scotonomics project brings a Festival of Economics 2024 in Leith and Dundee ‘a real-world look at our economy’.

An increasing number of Scots, especially young people, have clearly given up on the tired mainstream economic model. We see it in the actions of climate protesters. It is reflected in the low turnout of elections. It is the cause of a drift away from established media.

Not only do our young people see that the media, politicians, commentators and business leaders can not give them the answers that want, they do not even see their questions being asked:

- Why have energy companies and banks seen historic profits during a cost of living crisis?

- Why do homeowners pay only 18% of their income on their homes and private renters pay 32%?

- Why do young people need to raise nine times their average earnings to afford a home when, in the mid-1990s, it was only four times?

- Why do they see community spaces being replaced by products and services only consumed by the wealthiest in society?

The mainstream economic framework never seeks to answer these questions.

When the dominant economic narrative is called to task, it falls upon the most simplistic of models like the Phillips Curve, the Laffer Curve and the Environmental Kuznets Curve. In a world of complex dynamic systems, neoclassical economists love a reassuring, nice, simple linear curve. To avoid debate, they cite natural economic laws and uncontestable facts, which are nothing of the sort.

The neoclassical framework is built around only one variable: efficiency in allocating resources. Not the effectiveness or justice of this allocation. To see the fallibility of this premise, one needs only to consider the climate crisis. What is efficient is rarely effective or just.

This tired and oversimplified narrative does not resonate with the younger generation. They experience the world as a complex, dynamic system. Most folks cry out for a framework that makes sense to them and reflects their daily issues, and it is evident that most Scots have given the mainstream economic framework ample time to reflect their world. And time and time again, that framework has failed.

It did not see the 2008 financial crisis because the mainstream models didn’t include money. Or inflation of the real estate market.

These neoclassical models predict that 3 degrees of global warming will only reduce global GDP by 2.1% – something akin to a nasty recession – and that 4 degrees is “optimal”. They find this optimal level after applying a neoclassical tool, the cost-benefit analysis. Applying a cost-benefit analysis to our ecosystem is like trying to use a hammer to tune a piano.

After COVID, these models still missed the bloody obvious.

European Central Bank economists in early 2022 said: “Recent projections….have substantially underestimated the surge in inflation, largely due to exceptional developments such as unprecedented energy price dynamics and supply bottlenecks.” This is where a little knowledge is dangerous.

Everyone reading this article would have said that inflation would rise when people started chasing a falling number of goods. We know that inflation is guaranteed when electricity is priced in relation to commodities on global markets. “Unexpected?” only if you blocked out all the evidence.

More devastating even than missing the biggest recession in almost 100 years or the inflation following COVID, the neoclassical model delivered austerity in the 2010s. And it will do so again if we do not fight against it.

It is the economic justification for austerity that should become the death knell for the mainstream approach to our economy, and it warrants a short investigation.

A 2022 Glasgow University study found that “Over 300,000 ‘excess’ deaths in Great Britain are attributed to UK Government austerity policies” Further afield in post-Soviet Union Russia, in the late 80s and 90s, 10 million male deaths have been attributed to austerity.

According to economist Clara Matti, austerity was created in the UK, and more often than not, she concludes, austerity leads to an authoritative right-wing rule.

Austerity has a Made in Britain stamp all across it.

It was also a creation of mainstream economists, and these neoclassical economists revitalised it in the 2010s.

Back then, the IMF suggested that public spending had a very low multiplier effect, which meant that you could cut public spending because it had a very small overall impact on economic stability and growth.

A paper from Italy suggested that fiscal contractions, in the short term, would lead to higher growth in the future.

A now infamous study by Reinhart and Rogoff from Harvard University claimed that government debt levels at over 90% of GDP tended to turn growth negative! It was a six-page article with only four references, all other Reinhart and Rogoff papers.

All three of these papers were used as evidence for Austerity. George Osborne, in particular, lapped these up.

Austerity was clearly led by political dogma. But it is worth remembering that the Treasury, the Bank of England and the Office for Budgetary Responsibility all supported austerity. The reason was they all relied on and were advised by the same economists and the same economic theory.

These three papers were all that was needed to justify the harshest contraction of government spending across Europe in almost 40 years. No more research was conducted, no other opinions were sourced, and no tests or trials were implemented.

All three of those bits of evidence were proved to be fanciful.

The initial multiplier effect of between 0.3 and 0.5 from the IMF was recalculated “to substantially exceed 1.”

The research from the Bocconi School in Italy was heavily criticised for data mining and data omissions. As Economist Steve Keen often says about neoclassical research, “The assumptions tend to equal the conclusions” Or, if you catch him after a few drinks, he reframes this as “Bullshit in, bullshit out.”

The Reinhart and Rogoff study was both comic and tragic. Even the OECD and the IMF shifted uncomfortably when they saw the neoclassical assumptions underpinning the model. But that wasn’t the bad bit. The authors had accidentally deleted cells in their spreadsheet. When they were included, it flipped the finding on its head, suggesting, in fact, a correlation between an increase in government spending and an increase in long-term growth. A long read in the New Yorker provides a shocking paper trail.

So what does this all tell us about the mainstream economic framework that drives policy in all of our major governments and institutions, including Holyrood?

It finds an economic framework that was too easily persuaded to introduce and recommend austerity, a policy that caused catastrophic harm and is again rearing its dangerous head.

It represses workers’ wages for fear of inflation while staying silent on huge historic profits for extractive sectors, such as banking and energy, derived from increased prices. Inflation caused by profits isn’t an input into the models, so they don’t try and control it. When you see nuggets like this, you start to see who is operating the pulleys and levers behind the curtain. It is the already wealthy.

The Wizards reduce spending on essential services like health and mental care while funnelling interest payments to those who are wealthy enough to hold government debt. Did you know, and can you even comprehend, that over £150 billion in interest payments have been made by the Bank of England since Jan 2023?

And finally, it is a model that says that growth is still the only answer to end our current plight. But this time, it needs only to be sustainable or green to solve all our problems.

The Scotonomics festival in Dundee and our events in Leith support an alternative narrative.

There is a real-world alternative that has a well-developed narrative. One of the leading proponents, Economist John Harvey, says, “Events must be interpreted, and we do this within a particular social context. We share beliefs about what causes outcomes, and this mental model is a major determinant of what we interpret as relevant.”

For too long, this mental model has been shaped by an economic framework incapable of dealing with a world that already overshoots its carrying capacity. It is a 19th-century framework used to address 20th-century problems. It has no place in this century. It fails to explain the issues of the day, and by chasing perpetual growth, it directly contributes to our poly crisis. Despite what Thatcher and every other UK PM who followed her has said, there is an alternative.

The Scotonomics Festival of Economics tries to shift the social context as we consider the poly crisis engulfing Scotland, the United Kingdom, Europe and the rest of the world. We need a real-world perspective.

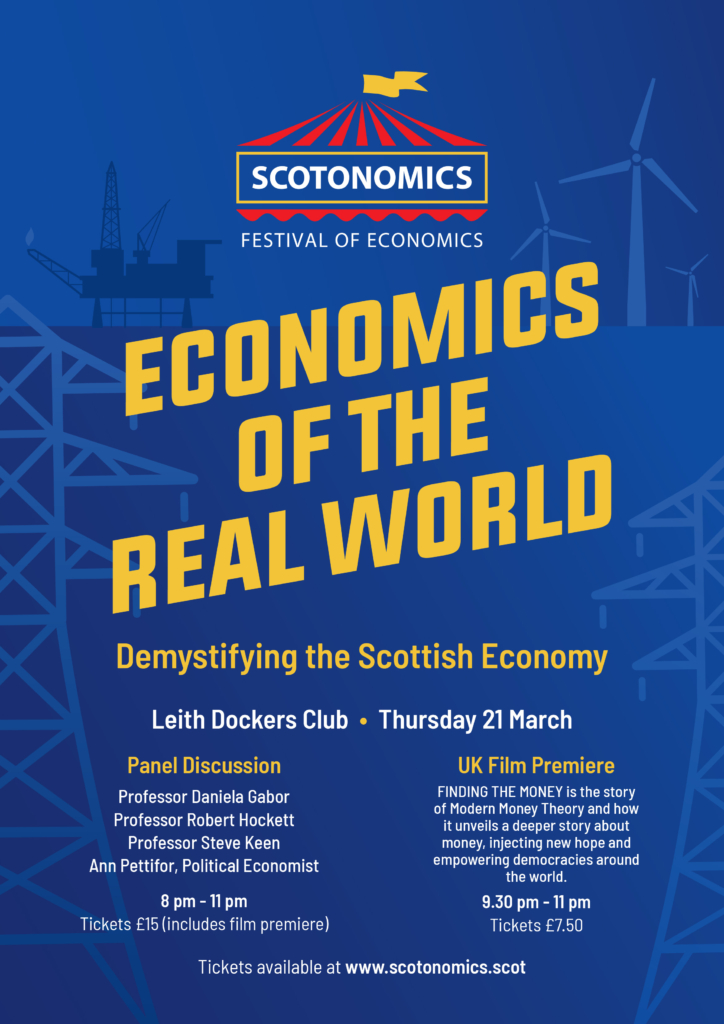

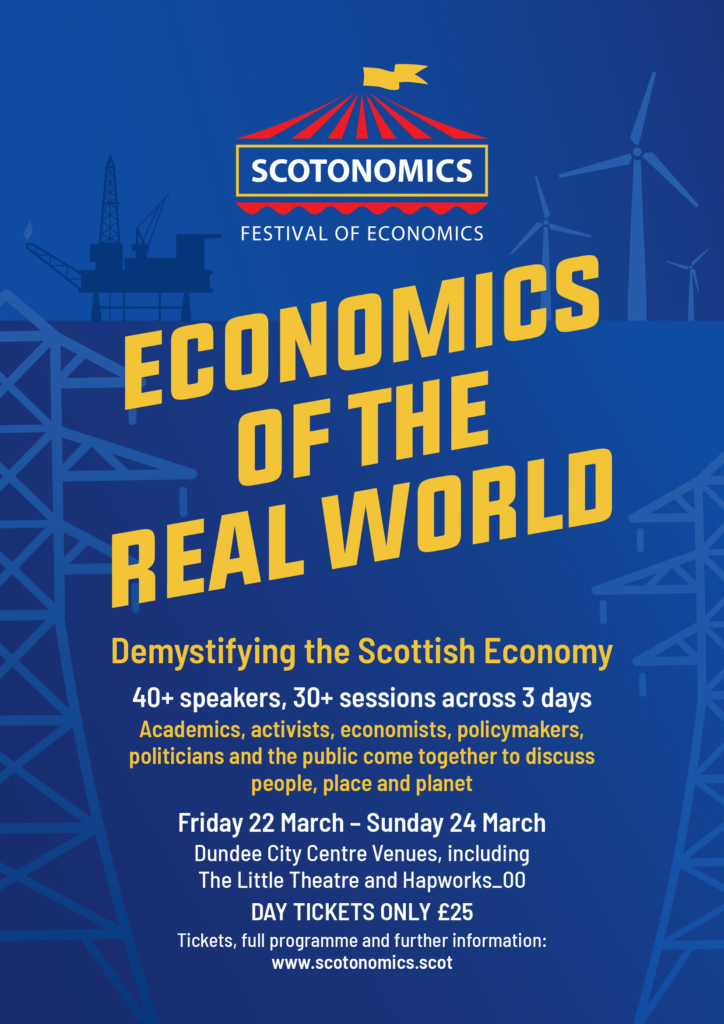

Academics, activists, economists, policymakers, politicians and the public come together to discuss people, place and planet at the festival in Dundee from 22nd to 24th March and at our events in Leith on the 21st March. Tickets for the festival are £25 per day and only £70 for the three days. You can see the full list of speakers here.

There’s no doubt that government measures to reduce public expenditure have created the difficult economic conditions they were meant to cure.

This is a non sequitur.

The cuts in public expenditure aka ‘austerity’ were intended to ‘cure’ the problem the very wealthy had because the hoi polloi had too much power and had lots to say for themselves. They were getting higher wages and better working conditions. And, the latter reduced profits and dividends for the very wealthy.

Of course, the less wealthy also benefitted, although to a lesser extent and only a relatively small percentage of them, compared to the mass of the population, but under the ‘greed is good’ mantra, the put aside any communitarian feelings they might have had, because they were feart that they might lose what they have.

So, the divide and rule concept worked again for the very wealthy.

Now the not so wealthy see their children and grandchildren struggling to get the same standard of living as they have had and this places them in the horns of a dilemma. It is to them that the Labour Party is directing its efforts. ‘Ruthless’ Starmer has got rid of all that Corbynite redistributive baggage, so the not so wealthy can vote for them knowing that Labour will protect them at the expense of the poor – which will become a growing proportion of the population.

Here’s an alternative narrative to the old Victorian melodrama of the robber barons.

Capitalism suffered a systemic crisis in 2007-08, the worst global economic meltdown since the Great Depression. In Europe, this meltdown mainly took the form of a debt crisis, which began with a deficit in Greece in late 2009 and the 2008–2011 Icelandic financial crisis (the largest economic collapse suffered by any country in history). This debt crisis led to massive bank failure, to alleviate which governments had to borrow heavily to keep the system afloat. That borrowing came with conditions. European governments were obliged by their creditors to massively reduce their public spending, both as a security on the loans in the first place and in order to divert resources to service the subsequent debt.

Hence austerity. It’s a product of the systemic failure of capitalism rather than a conspiracy by some evil plutocratic elite.

“…..were obliged by their creditors ……”

And who are these ‘creditors’ and why do they not want public spending? Could it be that they want public monies to be paid as interest (rent), before using it for the common good?

Are the ‘creditors’ subject to different laws from the rest of us?

Primarily pension funds and insurance companies, who don’t ‘want’ anything in the way that a robber baron might. The behaviour of such economic entities isn’t voluntary; it’s governed deterministically, by their own internal logic. And they ‘crash’ precisely because they function independently of anyone’s volition. Smith’s ‘invisible hand’ is just a metaphor.

Your time line is a bit out.

There was a run on Northern Rock bank in UK in late 2007.

You have failed to mention the real estate crash in USA (Freddie Max & Fanny Mae) due to how debts were being spliced and diced and banking crash in USA which had a massive effect on confidence in worldwide banking system.

But you get the idea, John.

I would also add Lehman Brothers and Bernie Madoff – not only was the banking behaviour dodgy but in some circumstances illegal. Regardless of where and how it occurred it was driven by personal and corporate financial greed.

To quote the old adage:

if you owe the bank £1000 you are in trouble,

If you owe the bank a million pounds the banks in trouble,

If the bank owes a billion pounds the country is in trouble.

It was the poor suckers in general public that picked up the tab short term and suffered financially in longer term.

Many economists in 2010 argued that economic austerity was counterproductive especially as interest rates were predicted to be rock bottom for several years. It is therefore not hindsight to say that austerity was the wrong policy to implement.

No; the behaviour of the banks wasn’t and isn’t driven by moral vice, but by the inherent logic of the capitalist mode of production. It’s not a matter of ‘right’ and ‘wrong’ but of science. That same logic then locked the global economy into a cycle of austerity, which supposed ‘cure’ has just perpetuated and deepened the crisis.

I can see the all-too-human need to blame someone for such natural disasters, but you might as well blame bad harvests on witches as blame economic crises on robber barons.

The crisis is a structural rather than moral one. What we’re experiencing is the immanent deconstruction of capitalism and its ideological expression in ‘modernity’ and the evolution of that civilisation into something else.

The light touch regulation that was implemented on banks from 1980’s onwards has enabled the corporate and individual greed to take hold which led to the banking crisis in 2008. You could argue that fallout from this banking crisis has led to a loss of trust in capitalism across western societies.

I would contend that for capitalism to work effectively it has to work for all and this needs effective regulation to protect it from the corporate and individual human greed we all have within us.

To assign the banking crisis soley to a system is a cop out as it is politically driven decisions by individuals o groups of individuals that have enabled this system to be put in place.

Your argument is the moral equivalent of the ‘computer says no’ type of reply.

For capitalism will work effectively and realise the abolition of scarcity it has made possible only when it evolves (as it naturally will) into socialism.

Men don’t create ‘the system’; ‘the system’ creates man. ‘The system’ is indeed driven by the political decisions of individuals and groups of individuals, but those decisions are made collectively rather than individually, unconsciously rather than deliberately; it’s the outcome or aggregate of myriad economic and political micro-decisions rather than any purposive agency, the product of the general will rather than any particular will. No one’s in control of the historical process; no one’s ‘ morally responsible’. History is beyond ‘good’ and ‘evil’.

Everyone and every decision an individual makes has a moral dimension no matter how much we wish to deny this reality. Whistleblowers understand this and do not go along with corporate consensus for the greater good often at great personal expense.

Your response explains why:

the Post Office acted like it did to its Postmasters. Do you think that anyone in PO management should face prosecution?

Why no bankers were ever brought to trial for their actions in 2008 crash.

It is the excuse that those in power give to avoid responsibility for their actions.

Indeed: ever action we make has a moral dimension insofar as others will approve or disapprove of it according to the measure of ‘right’ and ‘wrong’ to which they subscribe.

A corporate consensus is an expression of the particular will of that corporation; ‘the greater good’ is an expression of the general/consensus/aggregate will of society in total. Individuals, of course, may or may not approve or disapprove of either or both according to their own private conscience.

Individual PO managers should face prosecution if it can be shown that the they engaged in criminal activity; that is, activity that’s specifically defined, prohibited, and punishable under criminal law.

According to Financial Times research and Channel 4’s FactCheck, as of 2017, 28 leading bankers and traders had been charged with crimes relating to their role in the 2008-11 financial crisis; to date, five had been convicted and 15 cases were still to be decided. This does not include does traders and other bank staff jailed, fined or deported for their role in interest rate rigging. In the US, where by far most of the criminal activity took place, 402 individuals to date faced criminal charges and 324 people were convicted, of whom 222 were sentenced to jail time. The narrative, that no one was held personally accountable for the financial sector’s catastrophic failures, is a populist myth.

Wrong – nearly every action we undertake has a moral dimension because it will impact upon another human being. It is not whether the other person approves or disapproves it is how it impacts upon them.

In short always treat others in a manner that you would wish to be treated yourself. It is that fundamental and simple. If you do not try to adhere to this way of living you are a selfish shit. There are plenty of examples of selfish shits for us all to see and it is not edifying.

In addition it is now becoming increasingly apparent that we cannot act without impacting on the animal kingdom and nature.

Lastly- yes other countries did hold bankers etc to account (eg Iceland) but the UK was not among them.

You may try to excuse corporate bad behaviour and irresponsibility but many of us can see it for what it is – greed and groupthink which ignores the greater good or the negative impact it has on innocent individuals. It is a philosophy of moral irresponsibility that exemplifies how the various national scandals such as Hillsborough, contaminated blood, Grenfell, PO happen and are never dealt with to the satisfaction of wronged citizens or justice.

Just a test post before reading the article.

Inflation is largely driven by corporate greed at the moment.

No; all inflation is driven by real demand for goods and services, reduction in available supplies (such as occur during energy crises and wars), and/or changes in inflation expectations, which may be self-fulfilling (e.g. as a result of hoarding).

Again, it’s a structural rather than a moral problem.

Numbers man,

You need to de-colonise your mind from the thoughts of that western, white, racist bone idle drunkard Karl Marx.

He was wrong in the C19th and he’s wrong now.