The Price is Wrong: Why Capitalism Won’t Save The Planet

Brett Christophers, Verso Publishing

Prodigious and detailed, Brett Christopher, the English-born Professor of economic geography at Uppsala University, has a knack for focusing on the stories that tell us all we need to know about capitalism’s failures.

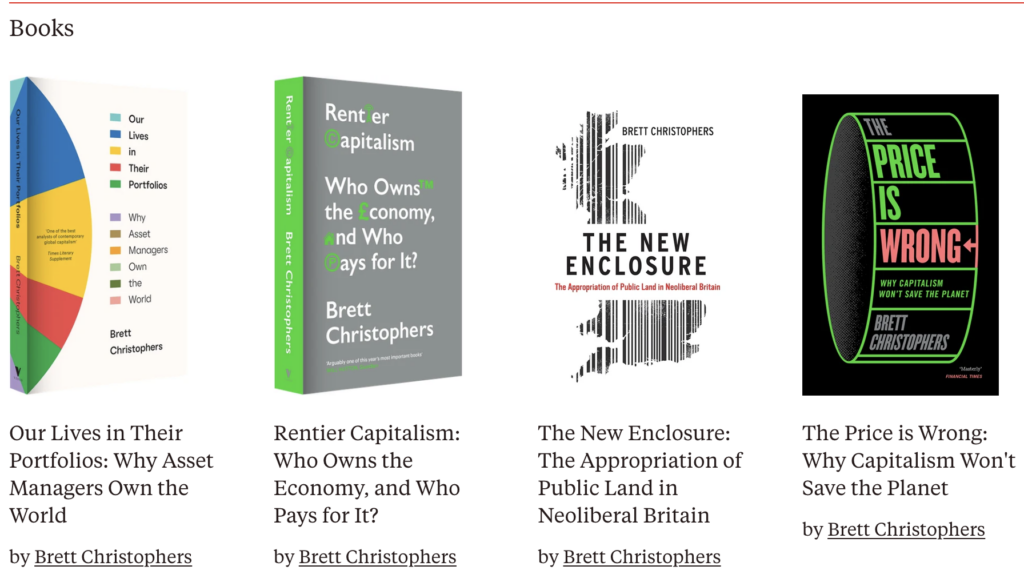

Brett Christophers’ 2019 book, The New Enclosure, details how neoliberal Britain undertook a ‘new enclosure’ of public land after Thatcher came to power. Rentier Capitalism was initially planned to look at the USA. However, after some detailed research, Christophers found that ‘living off others’ work’ or Rentier Capitalism as he terms it, was, in fact, the defining feature of the UK economy. In Our Lives In Their Portfolios, Christophers has the UK as an ‘outliner’ in his detailed analysis of who owns our essential infrastructure.

In The Price Is Wrong: Why Capitalism Won’t Save The Planet, Christophers again finds the UK a fertile landscape for his criticism of capitalism.

He suggests that to understand the business of renewables, specifically solar and wind, one should look at the UK to see where the world is heading. In many ways, that is a depressing thought.

The UK regularly tops international charts for electricity prices for homes and industry. In 2023, 861,000 households in Scotland (34% of all households) were estimated to be in fuel poverty. Our electricity grid struggles to cope with the supply. Bottlenecks are common. For example, Christopher writes, “In 2020, nearly 20% of wind power generated in Scotland was discarded.” So, if the UK points the way, it looks like more bad news for the rest of the world’s customers.

Despite the UK being one of the leading generators of renewable energy in Europe – including nuclear (which is considered low carbon and renewable by some), the UK, since late 2022, generally generates around 51% of its electricity from low carbon sources – the UK is way behind its target of reaching NetZero by 2050 (Scotland 2045).

The global NetZero target relies heavily on electrifying everything and ensuring renewable supply. “It is hard to overstate the importance of that,” according to Christophers. However, in March 2024, the Climate Change Committee said that Scotland’s 2030 climate goals were no longer credible. In July, it said the UK “was off-track as a whole for its 2050 net zero ambitions.” If the UK is the future, then that future looks depressing.

Christophers addresses the central issue of why we aren’t making the predicted massive gains in solar and wind, especially after the early 2010s, when the price of generating electricity from solar and wind fell below that of fossil fuels. This ‘price signal’ was supposed to be the tipping point. However, renewable capacity has stuttered outside of China. Christophers’ answer comes from an institutional economic analysis. The price per kilowatt hour (KWh) metric is not useful in this market. The Price is Wrong.

So governments, policymakers, and mainstream economists thought all that had to happen was for it to be comparably cheaper to generate renewable energy than dirty electricity, and all would be well. But like so many simple ‘iron laws’ of neoclassical economics, you find the devil once you get into the details.

Market failure

The type of market support we provide to generators is also at fault. In short, we don’t provide enough. Without stability from government support or high prices from consumers, many renewable projects are not ‘bankable.’

In what can be seen as a major shot across the bows of the current SNP administration, Christophers highlights that “The renewables business is not a wonderful business. Profits in that business are typically quite low. They’re typically quite volatile. And so the idea that this is an industry where there are great riches to be found has been proven, sadly in a way, comprehensively untrue.”

One story from the book highlights how difficult it is for the market to profit from renewables. One study calculated that the annual cost of this renewables curtailment [paying generators not to generate] to UK customers reached over £500 million in 2021 alone. So even when Capital isn’t working, it is still being paid. Despite this level of support – in contrast to the Labour politicians marching disabled people off to work – the volatility and low returns turn off only the most determined green investor. As we know, the number of those is sadly lacking.

The solution that inevitably arrives (considering the “Why Capitalism Won’t Save The Planet” part of the title) is for the state to take control and ownership of the transformation. In an interview I did with Christophers this week, he said, “For me, [public ownership] is [the answer]. I think the UK is the standout case, not just in electricity but in water too, for public ownership of these assets. In almost every conceivable regard, privatization has been a bit of a disaster.”

By 2050, the electricity demand will likely be around 60,000 TWh, all of which must come from renewables if we are to achieve NetZero. Christophers writes, “This would require colossal investment…the figures are nothing short of mind-boggling: a twentyfold increase in solar capacity and an elevenfold increase in wind capacity.”

The greening of our electricity system is a monumental undertaking that promises to deliver low returns (unless consumers foot the bill). It is something wholly inappropriate for the market to tackle. The only way to get close to these numbers is if governments renationalise and transform the market for generation and transmission. This wasn’t supposed to be how it would end up.

It turns out that price was the wrong signal for the renewables market. But greater than that, the belief that capitalism—the very system driving the urgent shift to renewable electricity—will be the death of us all.

Brett Christopher’s book is available here. Brett will be appearing at the Economics of The Real World event in Leith on the 20th of March and as part of the Scotonomics Festival of Economics in Dundee on the 21st and 22nd of March. Tickets, including online tickets for Dundee, are available here. Readers can use a 20% discount code “BELLA20” on in-person tickets in Leith and Dundee.

Presumably neoliberal Thatcherism made some exceptions to its general preference for rentier capitalism? After all, the Conservatives had to learn the lesson from Winston Churchill’s time in charge of the Treasury after WW1 (in The Value of Everything, economist Mariana Mazzucato says something about Churchill c1925 was concerned about rentier profits of finance at expense of industry, like old landlord times, and his decisions degraded British industry so much it handed a decisive advantage to rearming Nazi Germany, possibly the most egregious de facto British treason of 20thC. Arms must be made and sold, torture equipment flogged to apartheid South Africa, oil must be seized and extracted etc). These policies seem to have continued without a break.

I highly recommend reading the book!

This piece clearly bursts the bubble that all we have to do is “go all out renewable” and everything’s will be fine. So, here we go again – where do we find the money?

Of course, the answer is we print it if the Government of the day, Westminster or dare we hope an Independent Scotland. Actually get round to supporting MMT in its different forms.

I cannot be there in Dundee but will be there online. I hope that Ivan McKee, MSP, contributes because my own MSP, Emma Harper, has engaged with him on the subject.