Take Back Control

Richard Taylor on a fantastic opportunity to take back control of our money from the commercial banks which could be key to indyref2. Positive Money is part of IdeaSpace in Glasgow this week.

Richard Taylor on a fantastic opportunity to take back control of our money from the commercial banks which could be key to indyref2. Positive Money is part of IdeaSpace in Glasgow this week.

Scotland is on the brink of a great economic opportunity, below our radar. If you care about inequality, fairness or living in a prospering economy then this opportunity is hidden in plain sight. It’s foundational to so much in our society, and to so much that is wrong.

It involves finance, monetary policy and Quantitative Easing – not topics that stir much passion. But once you grasp these ideas, you’ll see the economy in a whole new way.

Most of the money we use day to day is in the form of bank deposits. Cash transactions are declining, and physical notes and coins are a tiny part of our economy. Although the Bank of England ultimately controls the amount of cash in circulation it doesn’t have direct control of the total quantity of money in bank deposits — that’s almost all money. In 2014 the Bank of England confirmed what many, including Positive Money, had been arguing for some time. Most electronic bank-deposit money is created when banks make new loans. These loans are not savers’ money recycled, but brand new money that increases the total quantity in circulation and creates new spending power. This debt-based money comprises 97% of all money in circulation. So that is what our precious pound really is — circulating, privately-issued debt, rented from banks.

If the Government and Bank of England don’t issue money directly, they must have tight control of the quantity – right? Well, no. The mechanisms are very indirect. Hence the near exponential growth of money, and therefore of debt, just before the banking crisis, and now a sustained period where the money supply has flat-lined despite the desperate attempts of the Bank of England to get people borrowing again. This is our problem. With our debt based money system the way we are trying to stimulate a recovery is by creating more debt – not the smartest of moves.

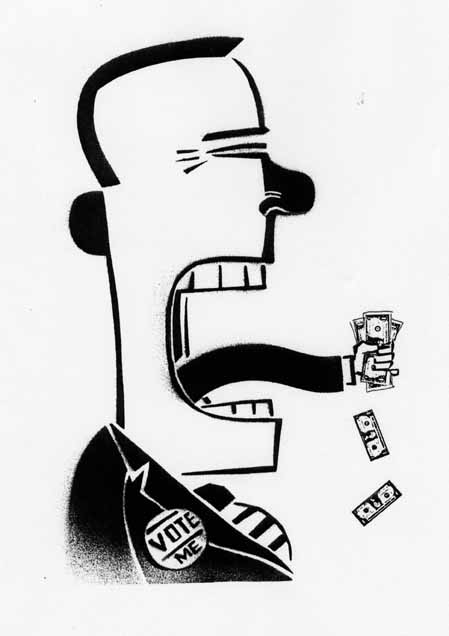

The commercial banks have two great powers. They control the amount of money in the economy. And then they say where that money should go. The banks have turned into machines for lending against property and other financial assets. This simply drives prices up, and starves the productive areas of the economy such as smaller enterprises that create the most employment.

The commercial banks have two great powers. They control the amount of money in the economy. And then they say where that money should go. The banks have turned into machines for lending against property and other financial assets. This simply drives prices up, and starves the productive areas of the economy such as smaller enterprises that create the most employment. Only the banks win, as we pay more of our income to them directly or indirectly. Nor is this fair — those on the lowest incomes pay the highest proportions.

I first got involved with the Positive Money campaign group a few years ago when searching for an explanation of the financial crisis that made sense. Positive Money has by far the clearest, well-thought-out and best-researched explanation of our money problems. They campaign for a banking and money system that actually works for all of us. We need to debate whether our money system should work this way at all. Positive Money believes that the creation of new money should be a public good that should be used to directly serve the public interest.

Recently there has been more Quantitative Easing to the tune of £70 Billion. This is on top of £375 Billion created immediately after the banking crisis. That’s more than £6,000 per person. The Bank of England creates new money and indirectly loans it to the Government, in the hope that this stimulates spending and persuades the banks to invest in the real economy. We certainly needed some of this after the crash but the positive impact now is slight. By the Bank of England’s own admission, this action increases inequality, making the rich richer as they are more likely to hold shares that benefit. At the same time it is depressing returns for pension funds.

And we now have the curious situation that the Government effectively owes a quarter of the national debt to itself.

Positive Money advocates that this new money should go more directly into the economy in a way that could actually work in a fairer way.

Why is this so important for Scotland? If we have a second independence referendum, then an independent Scottish currency is sure to be centre stage. This is a fantastic opportunity to take back control of our money from the commercial banks. As Henry Ford famously said, “It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning”. With more widespread appreciation of our current system perhaps we can have that belated revolution and embrace the benefits of a reformed monetary and banking system. We can do so much better than just replicating the broken UK system we currently have.

***

IdeaSpace is an exhibition of Scotland’s most innovative and exciting social, economic, cultural and environmental thinking. Over 40 participating organisations and campaigns will have stalls and hold a total of 17 fringe meetings over 3 days on a wide range of the most important issues facing Scotland just now.

I think we need a second post as to how it could be structured, some flesh Is it any different from the now abandoned policy of France where the State took shares and management influence in all domestic bank and Banque de France was a full service bank leading the way.

It follows quite obviously from that model, the only Banks in France were French and this would go against EU rules? One market?

Need some meat on the bones.

I am not against the concept and the rationale. One State in USA has a State Bank, I think

Quick google shows that Not just France has state banks , and this is separate of course from the European Central bank , which like all central banks are privately owned.

OF course just last week St Corby talked of such a Scottish Development bank , which is what both France and Germany use as a mechanism to circumvent the “state ownership” rules of theirs.

Where this could and should be created is through councils and a new Scottish NSandI , where instead of private banks they are essentially state and people banks. Using councils they can therefore be self funding to a part , and this is important given the future collapse of social and care services predicted , see care needs warnings and increase in aged population surveys.

The biggest thing that caused the Financial crisis was AMERICAN sub prime loans , and secondly where global banking meant that banks sold that debt off across the world – so essentially the banks were the cause , and the recipient of tax payer funded bailouts as well as profiteering with lower savings rates , but with a secondary input from govts keen to deregulate banking for increasing profits ensuring it happened in the first place , ie unchecked casino banking.

But since then just how much change has there been in the Uk baking industry , very little , and as Scotland has no banking legislation powers , or indeed financial levers and even a separate currency to manipulate , well theses are things outwith its control – currently. Therefore it needs a better option on the table than the poor effort offered in 2014.

If the govts continue control housing (all levels of govt) , thus the biggest single debt most people will ever have , then they are deliberate partners in the problem , that is unless it enables councils to be the lenders , thus social banking along the lines of mutuals and building societies of old. Curerntly Holyrood s not interested in social change of this kind , it is keen on LDP for housing and profit driven for the few , including and most importantly the cause of the financial crisis itself – the banks.

So the answer to banking is regulation , social banking , and of course reducing the biggest debt we will ever have – housing.

If mortgages continue at up to 6x income , when Holyrood reports say no more than 3x main income earner , then we are looking at yet another crisis , this is known as sub prime and approaching the same multiple as in America pre 08. Tokenism like First time buyer loans is paid for by taxpayers , and is not the solution , other than at election time.

Reduce Mortgages to 10 years , 80 percent value maximum is also a good start. But not for banks.

But can it be done , yes , but will it be done , no.

House price increase is in the interest of Govts , showing an artificial wealth , and of course is particularly interesting to pensioners whom dont want to see their home devalued – to where it was when they bought it….. when wages were considerably more than todays. Ironically these pensioner homes will perhaps be used to pay for their care , like some sort of Govt/Council piggy bank.

It is time to rethink banking , and starting with housing is where it should be investigated.

10 or 15 year mortgages may mean halving the current outgoing term for households , and that means cheaper housing funds national growth not wealth for the few , or increased personal pensions , even earlier retirement . Considering the 1 trillion deficit of private pension funds today this should also be considered in the calculations , as pension funds can be the very originators of investment into cheaper housing. Note at least two major pension funds have taken investments into such endeavours , including L and G.

Land reform , Housing reform , Banking reform = only one of those is reserved to Westminster.

You miss out a very simple but pivotal point. The High Street Banking systems and the Casino banking systems should have been totally separated years ago thereby facilitating the second to be treated like any capitalist venture whereby the shareholders pay for managerial failings.

By keeping the two businesses together the problem has not gone away and in fact has worsened.

Scotland, with a clean sheet could set up shop outside that pernicious and poisoned Ponzi scheme.

I think the Banks were kept separate until Clinton ditched the Glass-Steagall legislation. In UK we had the “Big Bang” and financialisation of the economy and “masters of the universe” making money out of making money. Someone called such activity “social useless”. I hope an independent Scotland will be different.

Yes but, we did not have to do that. Why did we?

Next question.

I am one of those eevilll CityBanksters, and I have only minor issues with your rant, but let me make absolutely clear when and where the crash of 2008 was baked-in as am unexpected consequence of political liberalism (and bye-the-bye Scotland has more idiodtas/any measure than any place else worldwide.

In 1992, in early February, just after Bill Clinton was sworn-in as President, he and Barney Frank, D-5Mass, got together to shake hands on a long-planned ‘Good Thing’.

The Good Thing was that EVERYBODY in America should own a home. Creditworrthy? HA! Have a job, even? HA!

Clinton’s & Fife’s Big idea was passed by Congress (along with enabling legislation to change mortgage rules.)

From that point, Bankers took it to hand.

ejc

CityBankster

yes, it was part of a quid pro quo, for the repeal of the Seagull something act to be linked to unfettered lending to allow disadvantaged US minorities to get on the property ladder.

The problem, like Iceland, was that the whole system went bananas as unfettered lending looked for schmuks to offload bonuses on?

Then another rocket scientist decided that these should be commoditised?

I looked at the last pages of D Bank, 5 or 6 years ago and found them not a lot different from today’s.

Do they not yet know their net debt? RBS is the same.

What a way to run a railway.

Hi, er, Bugger,

this Thursday at 4.30, Richard Taylor (Positive Money), author of this piece, and Ronnie Morrison will be giving a talk and expanding on this. If you can’t make it, we’ll report it and broadcast it.

Sorry, my Lear Jet is out on a short term contract in USA with Donald Trump; paid up front and all male staff

I clicked on the Likes thumb to find out who had done so, and then realised I had voted for myself.

Bugger!

The financial system, the political system, the whole state apparatus has been designed by the rich and powerful, (going back to warlords, kings, the aristocracy, the capitalists) for their benefit. As well as another post as suggested above (perhaps a resume of some of the articles on Positive Money) we need some ideas about how we could break the power of the establishment in an independent Scotland and gain these other freedoms.

How about us all taking our money out of RBS and puting it in another back of our choice, let RBS stew in its own juice.

PS I am 80 years years young so sometime think stupid thoughts, but I would hate a bank to do anything like that to me or mine.

mike, did a marmoset dine on my comment?

ejc

I got that

Ronnie Morrison and Andy Anderson wrote the book ‘Moving On’ which puts some meat on the bones. Positive Money’s book Modernising Money (Jackson, Dyson) focuses on changing the existing monetary system in the UK and provides a quite a bit of detail.

Ironically post brexit, there will be no Maastricht treaty preventing the policies in Modernsing Money being implemented. The main resistance would comes from the city of course.

Broadbield, I don’t want to be harsh, but you are full of prunes. The financial system was created to facilitate trade, and governments and nobles detested banks. They still do. And with reason. Everybody has to get along, but nobody likes it.

ecj

CityBankster

“Broadbield, I don’t want to be harsh, but you are full of prunes.” Plums, actually. We had rather a large crop this year. Money was created to facilitate trade, finance was created to make powerful men (usually men) rich and more powerful. Don’t you remember when usury was banned? The systems of the state (and society) have always been designed by the strong, the rich etc, never by the ordinary citizen.

This is a great article. Commentators should know there are alternatives to the present system. One brand is “Change the Regulations” the other brand is REFORM the system, by changing the law that allows debt to be a negotiable asset. [Return debt to its place as a contract between lender and borrower.]

It doesn’t matter what your politics are, the monetary system where money is created as debt is world wide and fails all of us. Regulation change may help, but which regulations are made stronger with teeth will depend on which sort of politics are favoured, and the system is still the same, where debt creates the money so debt is the tail that wags the dog.

Positive Money ask for a Money Commission to explore the various reforms that can be applied – quite easily – if there is enough realization of the need and enough will to do so. Create money differently.

Just buy gold and bugger off to Lithuania or sumfin like tha.

You don’t think they have inequality and poverty in Lithuania? Get real. Or do a bit of the research such as the author of the piece has done.