Why Scotland should reject the Sterlingisation option and instead create its own currency

From the view of a Modern Monetary Theorist this makes very little sense. Therefore I would like to make the case as to why Scotland should reject the Sterlingisation option and instead create its own currency.

If Scotland were to become a monetary sovereign nation then it cannot go bankrupt in regards to its own currency. How can they when they are the monopoly supplier and own most of their debt? The debt and deficit are irrelevant to the issuer’s ability to service that debt, provided it is denominated in its own currency. For monetary sovereign countries we do not see many investors increasing yields to compensate that specific risk.

Take the example of Japan. Japan’s debt stands at one quadrillion Yen, yet because it owns most of the debt it has low interest rates, low yields, low inflation, increasing employment and healthy demand for bonds. The ability to control interest rates and the money supply is absolutely vital. It means we can better tackle debt interest payment and control inflation.

By giving up monetary sovereignty to the rUK post-independence we open ourselves to real bankruptcy and a liquidity crisis. That sort of scenario is what will push investors to increase yields, whilst others may be hesitant to purchase government bonds.

The Growth Commissions also recommends that Scotland follows the EU’s Growth and Stability Pact, which limits government deficits at 3% of GDP and debt at 50% of GDP. But there is no need to follow this rule, because it is in fact not enforced for non-Euro countries. It is a recommendation. Countries outside the Eurozone who break the pact face little to no backlash. The UK has broken the Growth and Stability Pact numerous times.

What if Scotland has a large trade deficit? If we have a trade deficit above 3% of GDP or supply is greater than demand then we need to have increased levels of government spending to make up for the shortfall. This is to make up for the outflow of our currency or to get consumers spending.

If we do not have the fiscal flexibility to spend, in order to balance the real economy, then consumers will begin to build up levels of private debt. Individuals cannot own their own debt the same way governments can. Increasing private debt leads to recessions.

If an independent Scotland does not have an independent central bank then it will struggle to join the EU, which is made clear in Chapter 17 of the Aquis Communinitaire. For new EU members it states “economic and monetary policy contains specific rules requiring the independence of central banks in Member States”. Sterlingisation also means we cannot use monetary levers for price stability, since we are not a monetary sovereign country. Scotland could ask the BoE to negotiate on our behalf. But the BoE is essentially owned by the UK Government. The UK is just leaving the EU. This lacks credibility ane makes joining the EU politically tricky.

But Scotland have its own central bank with a floating exchange rate, as suggested by Nobel Prize winning economist Joseph Stiglitz. The fluctuations within the UK economy can be damaging to Scotland, but floating our currency will reflect our productivity and domestic costs, whilst giving us the central bank we need.

The EU Mortgage Credit Directive is baked into UK law, and would presumably be carried into Scots Law. Scottish residents would have the right to have their mortgages converted into the new currency for an independent Scotland or some other forex risk protection would be applied.

The Growth Commission puts forward the question “Would a separate currency meet the on-going needs of Scottish residents and businesses for stability and continuity of their financial arrangements and command wide support?”

The answer is yes.

Various forms of tax, that need to be paid in a new currency, create demand as businesses and households must accumulate the new currency. You can also use a Job Guarantee programme to maximise idle resources and labour, increasing our productivity and the value of the economy.

What about foreign exchange reserves? This really depends on how large we want out reserves to be. If we want to copy the UK at around 5% of GDP then we could take our fair share of the UK’s foreign reserves (£11-14bn). That covers the £10bn cost. Unionists would struggle to complain; after all they do see Scotland as a mini-UK, right? The think tank Common Weal has also produced their own paper as to how Scotland can accumulate a larger foreign exchange reserve beyond 5% of GDP. I highly recommend political activists add it to their reading list.

If we wish to move away from the UK neoliberal paradigm, with increasing levels of private debt within a credit bubble, then certainly there is an even greater case for Scotland to be a monetary sovereign country.

Forex reserves are not a major problem. Scotland would be CONVERTING from sterling to Scot £. So individuals and firms would convert by buying/exchanging sterling balances for Scot £s. Scottish central bank would issue new currency and acquire sterling deposits, automatically creating a forex reserve. Also, new a Scottish central bank would presumably be entitled to its share of Bank of England reserves.

‘individuals and firms would convert by buying/converting sterling balances for Scots £s.’

If I prefer that my savings – a smallish number of pounds sterling – in the Santander Bank in Leith should remain in pounds sterling – just in case – would that be acceptable ?

I suspect that many Scots, like me, would prefer the devil we know, at least in the short run.

The critical feature isn’t savings. It is tax. Your taxation will require to be paid in the Scottish currency.

“One of the most important powers claimed by sovereign government is the authority to levy and collect taxes (and other payments made to government, including fees and fines). Tax obligations are levied in the national money of account: ….. In most developed nations, it is the government’s own currency that is accepted in the payment of taxes.” (Randall Wray, ‘Modern Money Theory’; Ch.2, p.48-9).

In an imprtant but simple maxim Wray argues ‘taxes drive money’.

‘The critical feature isn’t savings. It is tax’

According to the most recent figures I could find, in a Lloyds Bank analysis in 2015, the average level of savings in the UK is £145,000 – with a third being held in deposit accounts. (About a third of people have no savings.)

I wonder how many of these people would be as blase as you are the potential loss of a significant chunk of their savings ?

If you are going to cite something you should provide the full source, unless it is fairly obviously accessible. Are you implying that the average UK saving is £145,000 per person? and one-third have no savings (So two-thirds still have sufficient saving ON DEPOSIT for the equivalent of £145k for everyone). Yet at the same time the private sector is heavily in debt? I think you need to do some work and bring a clear and credible argument, that can be understood by readers; because I don’t understand this.

The point about tax being critical applies to all currency issuers, including the UK; it is tax that gives the sovereign power the security; sufficient guarantee to issue the currency. That is why it works to issue currency – tax. Money is created by sovereign power, and tax redeems it. It is the relationship between the two that establishes the power relationship. If you are paying tax in your domestic currency you will normally make your savings decisions keeping that in mind; that is why you are claiming people are currently saving in sterling; they pay taxes in sterling. They will certainly be earning negligible interest, so tax remains critical even for savers; but saving is not the critical feature of the currency.

Started 2 years ago, and gaining Yes Grassroots support across Scotland, all 129 MSPs kept regularly informed, and the First Minister of Scotland this may be of interest???

Posted today: “The longest journey starts with the first step. The Growth Commission Report (GCR) is a document to create discussion. For me, I see it not as words (lots of them) but as a Map – want to join me to think about it that way – as a Map.

We know where we are, the GCR says here is where we want to take you, this is the destination we have chosen for you, and this is the route we suggest is taken to get you there. Thought of that way, questions arise: 1) Is that the destination you would choose? 2) Even if it is are there other routes that are not yet shown on the map, ways of getting there that, given the choice, you would prefer to take?

One of the objects placed on the map – BUT placed on there sometime in the POSSIBLE future of Scotland, ONLY AFTER independence PLUS you may have to wait a an unknown number of years is this: A new Scottish Central Bank : would act as banker to the Scottish Government, holding deposits.

Two years ago, I suggested how a Scottish Central Bank could be demonstrated by Yes Grassroots – now – NOT after independence, NOT after independence plus however many years – but now.

2 years ago I took my first step on my journey, many amongst the Yes Grassroots have now joined in that journey – the next step is a promise I made at the Gathering that by the end of this year, a working practical example of an independent Scottish currency will be available – initially tied to the £sterling, (again a decision I took 2 years ago) – but maybe for this Map we need to think that we don’t export oil in the £, nor sell whisky to Japan and get paid in the £, nor export to the EU and get paid in the £.

Scotland is a journey, all who have lived here prove that. It is our time on that journey. Maybe you are happy to wait until later – or maybe now is the time to take the first step?”

ENDS: For further information:

https://www.facebook.com/TheScottishHand/

https://www.facebook.com/DoYesHaveTheBottle

In 2014 I thought a short period of currency union made sense, under the assumption that it would end at some point.

Now I have done more reading on the subject and understand things a bit better – particularly the point that a government’s finances are *not* the same as a households, a household cannot create new currency units – I see an independent currency as vital to prosperity and the flexibility to do what we need. And we should be planning for it from the get-go.

I would recommend that anyone who wishes to understand why Scotland should be a currency issuer, rather than a ‘currency user’ (Sterlingisation), and to understand the critical importance of Modern Monetary Theory (MMT), for a clearer understanding of money, currency, banking and taxes should read Randall Wray, ‘Modern Money Theory’ (2015).

Here are short excerpts from Wray’s general arguments (not specifically addressing Scotland, but Wray thoroughly reviews the characteristic, conventional approaches typically proposed by the Growth Commission Report), offered here simply to provide some context, albeit limited within this comment forum. It is best to read Wray yourself for a proper understanding:

“MMT argues that a sovereign government that issues its own ‘non-convertible’ currency cannot become insolvent in terms of its own currency. It cannot be forced into involuntary default on its obligations denominated in its own currency.”

“It is important to recognise the difference between a fully sovereign, nonconvertible currency and a nonsovereign, convertible currency. A government that operates with a nonsovereign currency, using a foreign currency or domestic currency convertible to foreign currency (or to precious metal at a fixed exchange rate), faces solvency risk. However, a government that spends using its own floating and nonconvertible currency cannot be forced into default.”

“Generally speaking, the nonconvertible, floating exchange rate currency system provides more policy space. Government can use fiscal and monetary policy to pursue the domestic agenda. Fixing the currency reduces policy space because government must consider its promise to convert. That can conflict with the domestic policy agenda. For example, it is usually (but not always) the case that the government must pursue policy to ensure a positive flow of foreign currency (or gold) to be accumulated as a reserve to maintain the peg. That usually means domestic unemployment to keep wages an imports down.”

“…. if a national government issues foreign currency-denominated IOUs, the interest rate it pays is ‘market determined’ in the sense that markets will take the base interest rate in the foreign currency and add a mark-up to take care of the risk of default on the foreign currency obligations. It is likely that the borrowing costs in foreign currency will turn out to be higher than what government would pay in its own currency to get foreign (and domestic) holders to accept the Government IOUs.”

Can Scotland issue its own currency now? What steps need to be in place before a functioning Scottish currency is going to work? Can we achieve these steps before independence or manage to complete them overnight into Independence Day? The answers to these questions are obvious and I am disappointed in the nonsense spouted on Bella that ignore these facts.

As the growth commission says we will need to use sterling for a transitional period until we can set in place the mechanisms and controls to create a stable Scottish currency, just as Ireland did all these years ago.

The nay saying and divisive comments do the cause of independence no good at all. The aim is independence and we cannot create all the functions of a separate state while we are ham-strung by the UK. Let’s gain our independence first and then work as quickly as we can to disentangle our infrastructure from that of the U.K.,it may take some years but the last thing we want is a crash and burn scenario where we try to run before we can walk.

Hi Dougie, there’s no nay saying, Cameron has put together an entirely coherent analysis of the situation from his own perspective as part of an ongoing debate about these issues as we’ve been invited to do by the First Minister.

If you haven’t already read it Commonweal’s take on the currency issue is here: http://www.allofusfirst.org/library/how-to-make-a-currency-a-practical-guide/

Hi Dougie, are you saying, in other words, “Shut up and eat your cereal”!

Not in the least. There is division and spurious argument throughout these posts. We must first secure our independence and we must do that on a program that includes a new Scottish currency. The road to a new currency is neither simple nor short, we will need to set up the mechanisms and have a transition period while we gain international confidence. Once that is achieved set sail on our own into a better future. How long will it take? Longer than the 3 years proposed by Common Weal but hopefully less than the 10 years bandied about.

There is not point going off half cock; with independence agreed we should work through the many steps required in setting up a new country but we must not blunder into something that we will regret later. If it takes a few years to settle and gain confidence so much the better. Prove we are not spendthrifts but apply as much as we can to build growth and infrastructure while not digging ourselves into a hole of debt.

The people from the RIC, Rise and others see a socialist paradise and are disappointed in the growth commission because it does not provide for one. The majority of Scots are neither Socialists nor Tories, they want a fair society where those that can support those in need but everything in balance. Those like me who can will always complain but probably not object to paying a bit more tax if we work toward a fairer society. Can we get rid of food banks?

Can we find work at a wage they can live on for everyone that wants it? Can we get away from the nonsense of bad employers being subsidised by the state to pay third world wages? Can we again get people to mend the roads, maintain the flower beds, open and run the libraries and all the other things that have been neglected under the mantra of “less tax for the rich and less pay for the poor”.

Decentralise and break up local authorities so that they really are local. Rearrange their tax raising powers with perhaps a land tax so that they raise all they spend. Kick out the multitudes in each local authority that sit in offices, draw huge salaries and can only say we have no money.

There you have extracted a rant from me.

Cameron Archibald, thank you for this lucidly expressed opinion and thanks to Mr Kerevan for his addendum.

Whether the concept of ‘sterlingisation’ is the best one for an independent Scotland or not is a matter of opinion. Other , reputable, economists as well as mr Cameron have rejected the concept, too.

What irritated me was the immediate condemnation of sterlingisation by various individuals, such as Richard Murphy and Ian McWhirter. Both of these have very good track records and their opinions are ones which I respect.

However, both are politically and economically aware to a far greater extent than the majority of the population, including people like me who read blogs like this. The issue of the currency was one which had a great effect of the 2014 outcome and, it is the kind of people who were swithering and the people who were frightened by Project Fear (its raison d’etre) who have to be taken through the details of the debate. It is THEY who have to be persuaded to vote YES (or stay with YES), not Messrs Murphy and McWhirter. Changing attitudes takes time because fairly deep seated views have to be confronted within the person. These are personal and ego driven (and I do not mean that in a dismissive pejorative sense) because our egos are where much of our identity, self-respect, are located and we do not change these things easily, often for very good survival reasons. However, attitudes can be changed and are changed.

Until now on this site (and others) we have had a number of articulate and principled arguments opposing sterlingisation. What we need now are people who are going to provide explanations of why the Growth Commission has adopted the recommendation it has made. We need these to be set out by people whose commitment to independence is well known and believed.

To change attitudes the persuader has to start from where the persuadee IS and present arguments which might set up enough cognitive dissonance that the persuadee can shift, fairly comfortably to a position closer to that which the persuader would like. If the persuader pitches too far from the persuadee’s position, the persuadee will usually just reject it. If the persuader is someone whom the persuadee trusts then the argument is more likely to be listened to. It might be rejected initially, but, it has had a hearing and the persuadee has some idea at an intellectual level what is being suggested, but, emotionally, is unable to commit – at present!

On that model, the target audience – the swithering and the somewhat afraid (again no pejorative implication – most wartime heroes admit frankly how scared they were) – are at a position that is closer to wanting sterling than not. They KNOW what a pound sterling is, it has been part of their life since they were born, they have a measure of confidence in it, it is something seemingly stable in a changing world. I am not portraying them as ill-informed, indeed, to a fair extent I am describing myself. Many of them have been overseas and have used Euros, Dollars, Swiss Francs, etc. They know about other currencies and have used them, but, they live in the UK and the pound sterling is part of that.

Therefore, strategically, perhaps the Growth Commission is right to set out its recommendation as it is. Over the course of the discourse, if this is well conducted by people who are respected and, more importantly, who show respect for the listener, then the listener might well be prepared to embark on a shift.

The instant dismissal approach not only closes down the debate on the currency, it also closes down any examination of everything else that is in the report. Already, sections of the unionist media are dismissing the entire report on the basis of dismissive comments about sterlingisation, by supporters of independence.

Truly well put Alisdair.

Taking the people with you on the journey to where we want to be is an absolute key.

Project Fear played heavily in delivering the no vote.

The Growth Commission Report therefore I think tries to minimise the opportunity for the No Campaign to disparage in people’s minds the notion that independence is a a wild jump into the a radical unknown.

Sterlingisation is therefore not the end of the journey but rather only a stage of it, and maybe a very pragmatic one at that.

No one, least of all the GC is saying that an Independent Scotland cannot have its own free floating central bank supported currency.

Quite frankly, as an independence supporter for very many years I’d rather have an independent Scotland with a currency initially linked to the pound Sterling, than no independence at all.

Not that you’d think that from some of comments being made.

Idealism now, the full Bhuna, nothing less, and who cares if we scare the horses.

Interesting – though the Sustainable Growth Commission doesn’t envisage EU entry. I’d agree we’d need a central bank and a record of successful currency management to make an application. Though the basked of successful economies used in the report includes several that are not EU members.

On MMT – it is intriguing in that is seems to offer an explanation of the magical world of modern money – created at the click of a mouse. But it also seems too easy…

If MMT is true, how does an economy like Zimbabwe end up in crisis? It prints its own money (lots of it), it doesn’t have full employment or a fully-developed economy, yet it has hyper-inflation and poverty. What went wrong when it decided to just print more money?

Zimbabwe? Read Randall Wray: Ch.9 on hyperinflation (Yes, the Weimar disaster is there too); p.261-2 on Zimbabwe. There is a link between hyperinflation, budget deficits and the money supply; but it isn’t the Monetarist explanation.

There is no quick fix to understand this (for reasons you surmise), save reading carefully; it is counter-intuitive.

I’ve had a read of a couple of articles on his website. He seems to hinge his argument on governments being prudent. Zimbabwe wasn’t, and production and exports fell – the country had to import food and to spend its foreign currency reserves to do so, which meant it couldn’t import raw materials further reducing production.

But all that suggests that there comes a point where other people don’t want your money if you let the printing presses run for too long?

Your judgement is inadequately founded (“seems to…”?). Why not just read the case? It really isn’t what you “seem to” think, or wish to conclude. The argument deserves proper attention. The issue is important.

You have not understood the argument as it relates to Zimbabwe, because you haven’t read it. I could reproduce the whole argument here, but I can’t read it for you; and it can’t be done here for every question that everybody asks. They aren’t new questions and the answers are available. A little effort is, however required on the part of the reader; that is not too much to ask – and it is an important matter about the future of the country.

The whole point of this exercise is that the public should understand a complex but important argument about currency (not least, for them) and a ‘conventional wisdom’ that is parroted on the media about monetary policy and currency, assumed to be correct (because it seems quite obvious), but is quite simply wrong, isn’t obvious, and has serious consequences for everyone both now, and in the past.

The failure of monetary policy that led to the 2007-8 Crash was the product of the conventional wisdom of Neoliberal monetary ideas, by economists and bankers who didn’t see it coming. It was the ranks of the MMT economists who provided the few economists who did forecast the Crash; because their theory is far more robust, and better desrcribes economic reality. This failure can only finally be addressed and fixed if the public engage with the issue and are prepared to understand a novel approach in economics (only relatively; elements of MMT were first stated in 1913) as monetary theory goes through a paradigm change.

Zimbabwe destroyed its productive capacity in a short period of time. Spending outwith the productive capacity of the nation will create inflation.

Your statement, in monetary terms in impenetrable. As an explanation in this economic context, I am not sure what it is supposed to mean; if anything. If it is supposed to be a criticism of Wray I suggest you actually read what Wray wrote about Zimbabwe, rather than just assume you already know.

This is becoming a good example of the nature of the problem: Neoliberalism relies on a certain simple plausibility to confuse the public; who are then too lazy (or think it is too obvious) to take the time to learn, and then be able to correct the error.

I may however, have misunderstood your meaning? If I misunderstood, I retract, with apologies for the misunderstanding; I found it difficult to follow.

A few thoughts?

1) The Growth and Stability Pact has been exceeded by many Euro nations. But not when applying for membership of the EU – Indy Scotland. Scotland has a deficit of 9% approx which needs to be 3%. This would require years of hyper austerity. No?

2) A condition of joining the EU is automatic monetary union. Scotland would have to adopt the Euro.

3) Scotland, as part of the union has seats (influence disproportionate to other areas of the UK/ currency area) and dispensation on the board on the independent Bank of England. Given that 65% of Scottish trade is in the Sterling zone how will floating a currency with problems such as maintaining convergence 1) business cycle 2) exchange rates for imports as well as exports 3) divergence leading to inflation and price fluctuation across the trading zone (England is 10 times bigger etc) be affected? My guess…

4) When Scotland floats it’s new currency, without being China or very authoritarian, how will it avoid imposing Capital controls on banks, businesses and people to prevent capital flight + the loss of all investment for a decade or so?

5) How will Scotland afford to save the necessary reserves without massive austerity?

6) Scotland is not a low cost mass manufacturing country (like all developed countries). Most manufacturing and exports e.g. Energy tech, Renewables, High end services etc. require a high value currency to maximize the high cost for return. How will having a new low value currency affect these nascent industries (See Denmark is pegged to the Euro for this very reason)?

7) If Scotland is independent, with a low value ‘new’ currency, what will stop rUK England/ Wales imposing tarrifs on low cost goods/ exports from Scotland in order to protect the working poor and economies of the North/ South wales etc?

8) If Scotland has a low value currency without back up from a wider OCA (optimum Currency Area), how will the government prevent speculator buying up the country, as happens with China in Africa? Will this not make Scotland and Scotland’s assets – land, Universities etc open to such possibilities (as happens elsewhere)?

9) ‘But legislation is already in place to deal with these difficulties, such as the EU Mortgage Credit Directive.’

‘The EU Mortgage Credit Directive is baked into UK law, and would presumably be carried into Scots Law. Scottish residents would have the right to have their mortgages converted into the new currency for an independent Scotland or some other forex risk protection would be applied.’

Please explain to me why anyone would take the risk? And what would prevent capital flight?

Interested….

Gary to answer your first point, I really recommend watching this video by prof Stephanie Kelton…

https://youtu.be/d57M6ATPZIE

These are all perfectly legitimate questions and it is not practical to cover everything comprehensively here. Mr Egner rightly suggests Stephanie Kelton as a source for some of the issues; Randall Wray and Bill Mitchell are others; but that is general, and some of your points are specific.

I see the Growth Commission Report as the beginning of a major process of review; in which everything must be examined under thorough critical analysis. I think this is so big we should all acknowledge this matter will take time for everyone to understand and work their way through. As a general statement some of your questions are difficult to answer, not because of MMT, but because of Brexit. We do not know sufficient about Brexit, the position of the UK, the implications for any deal to resolve the Northern Ireland problem (and the trade consequences for Scotland that will flow from this), so I am not sure that they can be answered properly, simply as framed, and without any assumptions about Brexit. I suspect the EMU may also change. In the end Scotland may be in or out of the EU: I am pro-EU, but I have little doubt that the UK can drag us out, whether Scotland is independent or not; not certain, but likely.

Some of your questions seem to me may assume different policies (4 and 5); the reserve issue is not as pressing if the currency floats rather than pegged. And with 6 and 8, I was not quite sure if you were treating Scotland as a developed or developing country. On the OCA, and for a thorough demolition of the Growth Commission Report currency proposal I recommend that you read the Australian MMT economist Bill Mitchell, ‘Oh, Scotland – Don’t you Dare! Part 2’ on this link: http://bilbo.economicoutlook.net/blog/?p=39506#more-39506

I hope these thoughts are helpful. Generally, I believe this will take time; but it is all worthwhile.

That is a good deconstruction of the Growth Commission’s sterling proposal (and the euro also fails two, possibly three, of the three tests for an optimal currency zone).

‘This gives Scotland’s monetary sovereignty to the Bank of England, which is effectively controlled by Westminster’

Am undecided abt this issue but we’re not ‘giving’ anything away. Monetary sovereignty resides with BoE already and would probably stay that way for a period until a £Scot is created. Bonus being we become an Indy country in the process. Ok, not 100% independent but which country is?

Turning Scotland into a currency user (with a ‘peg’) is dangerous; it exposes the country to ‘solvency risk’ that simply does not arise for a currency issuer.

1. This is a very good debate thread and exactly what the GR is there to stimulate.

2. You can’t logically argue the GR is there to open discussion then say it is wrong to disagree with parts of it in case opponents of Indy seize on this as “division”. They will do that anyway.

3. Yes people are used to sterling. But sterling/ Bank of England monetary policy was hardly beneficial to ordinary folk. For the last 50 yrs of the 20th century the Bank imposed high interest rates to curb City of London inflation while Scotland and English Noth need low interest rates to manage industrial chang. Result: unemployment. Lately, post Brexit vote, pound has dropped like a stone.

4. No one needs be forced to give up sterling savings. But you will need Scot£s to pay taxes, buy stuff in shops etc. So there is a need to acquire Scot£s fro Scot central bank. This is NOT Zimbabwe case where Mugabe printed UNLIMITED notes, creating hyperinflation. Scot central bank only issues currency in return for hard reserves.

5. Final point: GR says key UK bank regs in entirety. But UK bank regulation is inadequate. Scotland needs better control over private banks from day one. This is weakest part of GR.

‘No one needs to be forced to give up sterling savings’

Thus, prior to the introduction of a Scots £, savers in Scotland, with savings – in sterling – in banks. will presumably be offered the opportunity to choose between their savings remaining in sterling or being changed to the new Scots £.

Can George Kerevan tell me which open economy – comparable in size and modernity to Scotland – has successfully operated such a scheme ?

It’s probably worthy of a future discussion about Wynne Godley’s work on sectoral accounting. MMT is very thorough on this..

http://bilbo.economicoutlook.net/blog/?p=32396

Assuming a neutral balance of trade (export balancing import revenue), as you say, an attempt to reduce govt deficit (running a govt surplus), will rely on private debt fuelled growth.

The problem here is that levels of private debt are already at an all-time high and the propensity to borrow would be pretty low. The private sector needs to de-lever so we would potentially be in a stalemate.

The sectoral approach tells us that the government deficit is really controlled by the spending/saving habits of the private sector. The state requires the capability to ‘prime the pump’ when private sector demand is low but it can’t necessarily do that if it is constrained as the USER of the currency.

Can anyone explain why Modern Monetary Theory (MMT) has suddenly become the go-to economic theory of the Indy left? As I understand it it is a new-ish fad among a small group of left-leaning economists. To say it is controversial would be an understatement, many economists think it is utterly bogus, a fantasy, others believe it to be “the truth”. Not being a macroeconomist I can’t judge but I certainly wouldn’t want to bet my pension on some completely untested theory, nor I suspect would most people in Scotland. But that is apparently what we are all being asked to do. The question is not whether MMT could work or not, but why has this become the only discourse available to the Indy left?

MMT is not actually that new. The leading MMT economists came to the front, becuase they were the only economists who forecast the crash. One of their greatest influences was the great American economist Hyman Minsky (he died in 1994). The history of Classical economics has within it quasi-MMT ideas; but actually the first clear statement of basic MMT ideas was made in 1913, by Alfred Mitchell-Innes, a British diplomat.

Like everything else, Neoliberalism turns everything upside-down. Neoliberalism was a pushy upstart that elbowed Keynesianism aside from the 1970s. It was a disaster waiting to happen – and the disaster duly came: the Crash. Keynesianism replaced the orthodoxy, following on the Depression. We are simply going through a similar phase. Neoliberalism is stumbling on, having solved precisely nothing from the Crash (because too many current/recent politicians have been Neoliberals, and too many Neoliberal economists have tenure). MMT’s time has come.

You make a good point about the relative recency of ‘neoliberalism/Thatcherism/Friedmanism/Hayekianism’. These have been presented by think tanks like the Adam Smith Institute as having the status of a natural law akin to the laws of physics and so ‘show’ that ‘markets’ are kin to the space-time continuum. They are implying that ‘market economics’ is the theory of gravity of economics – THAT IS HOW THINGS ARE. This has been made hegemonic by continuous repitition in the economics departments of universities, in the majority of our media, by politicians of the major parties in the democratic countries, by those who have ‘done well’ – mainly rentiers.

We need to repeat again and again that it is a human construct like any other economic theory and rests mainly on repeated assertion rather than by being based on some objectively derived ‘facts’. It needs to be demystified.

We need to promote again the successes which Keynesianism achieved and we need to present things like ‘Modern Monetary Theory’ in ways which are more accessible to the general public, in the way that ‘market economics’ has done for its proponents.

Given the nature of the Financial Crash 2007-8 and everything that has followed, to the banking system, and with austerity; it is to me completely extraordinary that people would rather continue to ‘bet the house’ on an economic school that bust the system, and ignore those (not providing untested theory – MMT is built, first as a description – note, the description – of what actually happens in a monetary/banking system; Neoliberalism doesn’t), and who pointed to the failure of Neoliberalism (and forecast its disastrous implications).

Literally, astonishing. The economic Emperor has no clothes; quite obviously.

Inidentally, there is nothing particularly ‘left’ about MMT, save as part of the ‘spin’ associated with Neoliberalism, which relies on key tropes to put off the gullible: ‘household budgets’, ‘tax and spend’, and ‘Leftist’. The essential elements of MMT are descriptive; they could be used by anyone; oh, except Neoliberalism, becuase it doesn’t describe anything; it prescribes everything.

This seems to be their strategy John. I noticed straight away, for example in the Times, those strongly in favour a sovereign currency were pigeon-holed as being on the left. They should tell that to some of the very right-winged Italians who would love a return to the Lira!

To John S Warren

You ask me to cite a source; Google; ‘Lloyd’s Bank Report August 2015 How much savings do people in Britain have ?’

You say you do not understand the point I am making. I will persevere, after all I am in Leith.

In discussions about a possible new Scottish currency, especially one that floats, the question of money already saved by Scots in sterling accounts has come up routinely. Specifically, the fear that the new currency would lose value and those savers would lose out financially. It is reasonable to assume that such savers were well represented among the majority voting NO in 2014.

(Personally, I think it is near the top of reasons why the SNP has shown so little interest in a new Scots currency.)

The Lloyds Bank report was quoted because it suggests there are huge numbers of people in the UK, including Scotland, with very significant sums of savings.

If savers thought that a new Scottish pound would float down, there would be a near certainty of

currency flight. This would weaken the new currency and the wider Scottish economy.

George Kerevan has suggested on this thread that Scots savers would not need to adopt the new currency. I am sceptical as to how that might work out in practice.

I have now found the report. It includes pension savings. Pension savings will include investments in a number of currencies. My answer remains the same.

The point about tax being critical applies to all currency issuers, including the UK. Sterling has fallen by around 15% against the critical reserve currencies since Brexit. You haven’t been writing, wringing your hands (at least as far as I know); about the disaster for savings and pensions, for Sterling users. They make their choice, and they live in the UK, where currency and taxes are paid in sterling.

It is tax that gives the sovereign power the security and sufficient guarantee to issue the currency. That is why it works to issue currency – tax. Money is created by sovereign power, and tax redeems it. It is the relationship between the two that establishes the power relationship. If you are paying tax in your domestic currency you will normally make your savings decisions keeping that in mind; that is why you are claiming people are currently saving in sterling; they pay taxes in sterling. They will certainly be earning negligible interest on sterling deposit savings, so tax remains critical even for savers (they stick with it, don’t blink and carry on, even when sterling has fallen 15%). These are facts – not hypotheses.

Even allowing for pension savings, prosperous Scots have huge amounts of savings in sterling.

In the event of the creation of a new, floating Scots pound, what would happen to these savings would be of great political an economic importance. So much so that it is clear that the SNP will not touch the floating Scots pound policy with a bargepole.

With regard to devaluation, it can be a useful macro-economic tool. It was for the UK in 1931, 1949, 1967 and 1992.

However, what you are proposing is a change of a different order; leaving a currency union which has (on the whole) worked well for over three centuries. Scots would immediately and directly be aware of a change in the value of their savings since they would, understandably, still think in terms of sterling.

With regard to MMT, a decade into a vast economic crisis, I doubt if one person in a thousand has even heard of it. Good luck trying to persuade people.

I suspect that you will suffer the same fate as those promoting social credit in the 1930s. They were determined and were convinced of their righteousness.

With apologies to the people in the Canadian prairie provinces, they failed to convince anybody.

Well, you have just gone back to regurgitating the same case with which you started (with another unsourced reference to “huge savings” – but don’t bother, I have spent enough time on this already). Opinions are precisely that; opinions. I am a little surprised and disappointed to see that you are quite so complacent about how well the system has actually worked. It hasn’t worked well for a great many people, and they matter too. I am happy to let readers judge the relative merits of our case.

Nevertheless, you make one error that I can’t let pass. You assume everyone knows as little about MMT as you do. In fact it is not as obscure as you think; at least currently within the ‘system’.

I suggest you read the Bank of England, Quarterly Bulletin 2014 Q1: ‘The Money creation in the modern economy’. This, effectively is an acknowledgement of basic elements of MMT on money creation. MMT describes how the system actually works, and that really matters.

I do not doubt that there is much to do, especially with regard to the understanding of MMT in general public; but fortunately, it is not down to me! It would be in the Scottish public’s own interestto spend time on understanding it; after all, it is their money.

You state that I am regurgitating the same case. I would phrase it differently; I am asking the same question. How do those who favour a new, floating Scots currency persuade Scots with sterling savings that their interests will not be harmed ?

George Kerevan, to give him his due, has accepted that there is a problem here. He has said that people would be allowed to keep their savings in sterling. Personally, I doubt that would be feasible.

Once this particular detail has been dealt with, we can then – if necessary – go on to discuss the ‘system.’

I have said from the moment currency was raised, that currency was the single most challenging issue. It is something that has to be worked through slowly and thoroughly. Sterling has problems for savers now; a 15% fall, perhaps with much more to come post-Brexit. There is no certainty now; and nobody can promise otherwise. The problem is not quite as stark as you paint it (a hopeless Scotland: a ‘golden age’ Brexit-UK? I think not). Quite simply, in the context of independence I believe a currency peg to sterling would be a serious mistake. That is my core argument.

The Growth Commission Report made its recommendation; and I profoundly disagree with it. The fact that Scotland should rather be a currency issuer (of a non-convertible floating currency), ensures it would not carry solvency risk.

Savings are important, but they are not the most critical issue in the currency choice, in my opinion, however strongly you feel about it. There are very strong reasons for people to have their savings in a Scottish currency; to pay their taxes. Indeed it is doubtful if most people with savings will not find this a compelling and decisive argument. Tax is, in the end more critical for most people. Some of the ‘savings’ issue (and much of it is in pensions), will require to be subject to sensible negotiation and resolution before independence. There will no doubt also be choices for savers to be made (at some point); this is inevitable, but that is scarcely a radical change to the general dynamics of financial decisions in the modern world. Change is now the norm.

It will be a new currency, and therefore some people holding on to sterling deposits in spite of the tax risks, and low interest rates; may initially be apprehensive. The ‘problems’ are too easily exaggerated. Scotland has considerable international trading strengths (less propensity to import, and positive trade balances in many international markets, plus large Green energy resources for new European markets, in addition to non-Green oil); and the assumption you imply, that Scotland’s currency (and people) will be excessively subject to being “harmed”, smacks a little of the “you would say that wouldn’t you?” kind. It is a speculative claim, and no doubt it will be made. At the same time, I do not believe any of this is easy for savers. Choices will require to be made by them. It is not, however insurmountable, or too difficult to contemplate; “flight” is too easily exaggerated – like the high-flyers who are always about to leave somewhere, for tax reasons; but only rarely actually do so.

A float does not necessarily entail devaluation; it finds its level (there are positive dynamics, not just negative), and it means we do not require to lead economic policy with solvency-risk driven unemployment, because of an attack on a peg. A currency float provides public policy space – for growth, and stability; a smoothing of the choppy ‘boom-bust’ British cycle that incontrovertibly is our history, and has never fitted the Scottish business cycle satisfactorily since the war (one reason for our low growth).

At the same time, given the current challenging predicament with Brexit for the UK, there are now no certainties at all, for anyone – including rUK, which is already over-reliant on financial services, and burdened by the treaties and obligations it has chosen to build up ‘independently’ over a long period internationally, perhaps with too much alacrity for its current prospects. But rUK will be the continuing state; another choice. Furthermore, reliance on British currency stability going forward, of the kind often assumed to pertain (and historically somewhat over-egged), has gone. Brexit has changed ‘the game’. We had all better focus our minds; because we need to, whatever you believe about Brexit, the Union or independence. There are no easy options now – for anyone, anywhere.

I think it overdue that you now made your case – fully. Then the readers can compare notes (if there are any left to read it on this thread).

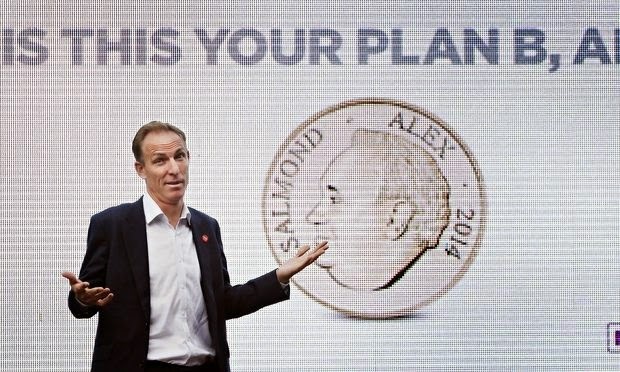

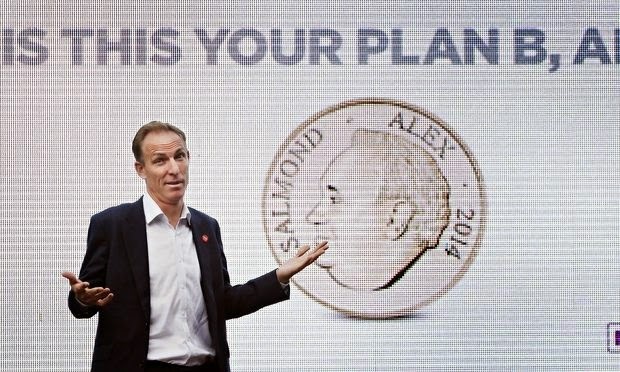

I turned on to see some of the conference report on the BBC. There we were, George Kerevan with the BBC’s fat man sowing discord. Almost a “What’s your plan B” moment neither would give the guy supporting the growth report half a sentence to say anything. Those that want an immediate floating Scottish currency want to print money to work miracles; the BBC want discord and alas discord was there in plenty.

I think we can give up now. We will either never have another independence referendum or we will sink under the weight of sections of our own side wanting every detail their way; just like Jim Sillars in the last referendum. It suits the unionists to foment argument and division and while we do their squabbling for them the voters switch off and move on. The point of independence is to gain the power to make decisions in the light of the circumstances as they are at the time not to prophesy now and make promises that are unsustainable.

A good article and explanation of the issue. However, it’s steeped in economics jargon (as is the thread of comments afterwards), and I suspect that most voters either wouldn’t follow the arguments, or would switch off after about the third paragraph.

If we are to persuade voters that £Scot IS the best option (with 51% still preferring £)*, someone is going to have to come up with a simple, clear soundbite without economics jargon that explains this in a way that voters will grasp easily and quickly.

*http://whatscotlandthinks.org/questions/were-scotland-to-become-independent-what-currency-would-you-most-like-to-see-an#table

MMT is a worthwhile theory to explore. But it is only a theory and has more holes in it than Swiss cheese in reality.

1) MMT claims that you can have a ‘Fiat currency’ – a currency with no fixed value or fixed exchange rate, issued by the government (actually its the central bank – issues of democracy, and currency manipulation around elections – hence most Central Banks in dems are independent) other than the debit/ tax burden of the nation. The more public debt + the higher the tax burden, the more a country can print/ issue money to balance things and more money is in the economy (so the govt issues more bonds etc) Win win. Deficits/ govt debt are good.

2) The fundamental problem (there are many) is that the ‘real economy’ and ‘real wealth’ is not value free outwith its own national parameters and depends on exchange rates and currency value if trade is to occur and ‘real wealth’ created (you can’t build a bridge without being able to afford the steel + you can’t make cash selling high tech or Irn Bru abroad etc unless the exchange is reasonable). The notion that a small country like Scotland can have a self contained value system of price and exchange is absurd (maybe USA/ china can at a push due to massive internal economies – within limits?), if it is to import and export.

3) this unfortunately means a downward spiral – more debt + more tax = needed for greater real wealth in the economy (growth). Private credit offsets govt debt. Say good bye to low/ competitive corporation tax and jobs as every company ups sticks and moves to Newcastle or Rotterdam.

4) ‘Real wealth’ requires a value vis a vis the ‘real wealth’ of elsewhere.

5) Essentially it is an attempt ( and an admirable one – if counter intuitive.) to solve the problem of money supply and inflation. But it really doesn’t. Printing money is printing money.

I suggest readers actually read MMT (Randall Wray, Bill Mitchell, Stephanie Kelton etc., etc) and not this quite frankly bad interpretation of it. MMT does not claim to solve all the problems; it promises to stop making the catastrophic blunders of Neoliberal economics – the conventional wisdom that bust the system in 2007-8, and still hasn’t fixed it. And MMT economists forecast the disaster. The reason for this is simple: Neoliberal economics is seriously flawed, and supported by politicians and apparatchiks seduced by it.

MMT is fundamentally descriptive of the monetary and banking system – it explains how it actually works. It is not about ‘printing money’. This kind of ‘stuff’ (it is not analysis at all), is just ‘spin’.

With all due respect I have read my fair share. I suggest you also read some of the criticisms (criticism is not ‘therefore’ ‘necessary’ support for Neo-liberal orthodoxy) of it also rather than indulging in Emperors new clothes. Just because Neoliberal econ is flawed does not mean MMT is any adequate solution.

If you read the post you will see I mentioned MMT in relation to Scotland as a small independent country subject to the greater forces outwith (this is not possible without risking hyper inflation and currency collapse – good luck when the asymetric shock comes in). I also stated that the USA could ‘theoretically’ manage MMT due to the size of its economy and therefore not subject to such externals. Size matters. Scotland is not the USA or China. Scotland is dependent on prices and value elsewhere – 65% of trade is with Sterling. Therefore the value of currency vis a vis the ‘real economy’ can’t simply be left to debt, deficit and Tax take. The ‘real economy’ upon which ‘real prosperity is measured – e.g. food in the shops will be asymetrically affected by the value of currency of Scotland’s main trading partners – market prices still matter. MMT also makes the assumption (in theory) that debt is always denominated in a nations own currency – it isn’t. Scotland (being small and hyper interdependent with England and other traders/ banking systems) therefore under MMT could not borrow in foreign currency – the Scottish economy therefore HAS to be self sustaining with regards it’s currency – but it isn’t… the real economy requires both public and private borrowing in other currencies. A country with a truly floating exchange rate and levels of foreign debt are asking for disaster.

‘MMT is fundamentally descriptive of the monetary and banking system – it explains how it actually works. It is not about ‘printing money’.’

The problem is that MMT is ‘neat’ theory rather than a practicable solution to Scotland’s currency problem.

Well, at least we have an acknowledgement from you that Neoliberal economics is “flawed”. It was like drawing teeth, but you have just showen that you were (are?) prepared to let people stew in that flawed system. It has been a disaster, and that is just a fact. All you are offering is more rhetorical alarm and ‘spin’, about the well-founded alternative. Why should anyone believe your creaking defence of the failed any more? Isn’t it time that you started to reconsider the basis of your belief? It is overdue.

When you say MMT is a “neat” theory, this just means you do not know how to dispose of it. Your arguments are series of red-herrings or simply inaccurately describe MMT’s intent. MMT is descriptive. It is not ‘leftist’, or the other follies used to discredit it. It doesn’t wash. MMT explains how money, currency and banking actually work. It then proposes solutions that reflect the circumstances. It doesn’t matter whether you believe in independence or not; MMT provides a framework to provide a viable solution. Both a ‘peg’ and borrowing in a foreign currency carry insolvency risk; that is incontrovertible. The Growth Commission have failed to make a good case for taking that risk; if you have a better case – prove it; don’t lecture, you are representing this flawed theory of Neoliberal economics. The time when Neoliberalism can take itself (and everyone else) for granted has gone. So you have to justify your case, not simply deflect attention from your endemic problem. Justify it.

Ok, so instead of actually addressing the valid issues I pointed out what so ever, you instead project completely unfounded motives and notions on to me. Ad homs and dismissal by stealth. Perhaps my analysis touched a nerve?

I have not and do not, in any way support the ‘Neoliberal’ economic orthodoxy (whatever manifestation that may be in your mind). I equally distrust MMT for very similar reasons (govt debt and private credit are not completely separate – what led to a banking crisis of private debt, also can happen in public debt – see South Sea Bubble, Dutch Tulips, 1929 etc – all in part caused by public debt – yes the country under MMT cannot ‘theoretically’ go bust if it simply issues more money – but not going bankrupt is not the same as generating real wealth – Food, Housing, etc…all subject to imports, market prices both internal and external and thus the exchange rate) and the reasons stated above (among others). I am not so arrogant to assume a set dogmatic position…and to do so in such a blinkered ideological fashion it is pretence of knowledge.

It may be hard for you to grasp the logic, but just because I don’t like hamburgers does not mean to say I therefore like vegetables.

Perhaps you should read more widely instead of indulging in such binary false equivalents which is exactly the methods and rationale employed by a century of Communist regimes to justify their systems ignoring the logical inconsistencies that led to every single command economy failing.

And MMT calling itself ‘just a theory’ of how money works while deflecting from any wider practicable issues in the messy ‘real world’ is the intellectual pomposity.

Well that really is rich. First you implicitly supported the conventional wisdom in your first comment; then conceded the conventional wisdom was ‘flawed’, and then go on effectively to defend its operation, as if its flaws do not matter. You do not support MMT, so I have no idea where you are; a sort of economic eclectic, ‘I’ll just use anything that looks handy to defend my case’.

You then start thrashing around with false equivalences, and spurious analogies, to try to drag in 1929. Ironically, it was precisely the New Deal economics and Keynesianism to fix 1929 that was overthrown by the upstart Neoliberal economics that produced this mess we are now in – a mess that was inevitable when Keynesianism was dumped (as Hyman Minsky argued). We can talk about 1929 if you like, but I doubt if you find that will end well.

The richest of all is this; “MMT calling itself ‘just a theory’ of how money works while deflecting from any wider practicable issues in the messy ‘real world’ is the intellectual pomposity”. Neoliberalism wouldn’t recognise ‘the real world’ if it fell over it. The problem with the conventional wisdom is that it is 99%+ Microeconomics. Macroeconomics has effectively been dumped. The biggest problem with the economics you defend is that the theory is not based on the real world; it is based on theoretical abstractions, an illusory equilibria, and simple-minded ‘models’ – that keep on collapsing; spectacularly, becuase they are nothing to do with reality.

If Scotland goes down your route on currency, that you do not believe in, but at the same time do; then we will have to built up large reserves, and use unemployment to defend a peg. Why? If you – or the Neoliberals – actually believed in what they preach, a float would settle the matter. It is not a calamity waiting to happen. But if you, as a non-Neoliberal Neoliberal, or whatever you are; have a better solution, then prove it. Stop posturing.

‘If Scotland goes down your route on currency, that you do not believe in, but at the same time do; then we will have to built up large reserves, and use unemployment to defend a peg. ‘

My route? pray tell? Please stop projecting. I admit to being baffled by the problem of currency and what is the best solution mainly because all seem problematic.

And simply spitting about the iniquities of ‘Neoliberalism’ does not therefore make MMT correct.

Seeing the criticisms of A does not justify B – B also can be criticised = logic.

But I think you know this, hence the reason you are deflecting from answering the valid criticisms laid out because you can’t so would rather dismiss and deflect.

And I am not alone in my criticism of MMT – even closet supporters like Krugman have doubts as do many others (non right wingers).

Your attitude is ‘shut up, don’t be critical,I know better and if you do question you therefore support Neoliberism?’

It’s this intolerance of criticism, arrogance and conceit, the patting of the electorate on the head, ‘it’ll all work out, you just rest your pretty head’ that turned so many people away from the Indy movement.

If an independent Scotland adopts the pound sterling as its currency, then the nominally independent Scottish Government would be a mere currency user – a user of another nation’s currency – which means that it would be subject to solvency risk. In order to remain solvent, there would be occasions when the Scottish Government would have to implement fiscal austerity and increase the unemployment rate in order to protect its solvency. Such a Scottish Government would be independent in name only. It would not be able to guarantee full employment via a Job Guarantee that pays a fair minimum wage to anyone who wants a job. It would have limited fiscal policy flexibility.

If an independent Scotland issues its own currency, allows that currency to float in foreign exchange markets, and uses a Job Guarantee as an automatic stabilizer to maintain full employment with stable prices at all times, then the government would be genuinely independent. It would be able to keep unemployment at 1 or 2 percent at all times (this would comprise wait unemployment and frictional unemployment). The government would have no solvency risk. The constraints on the government’s spending would be real resource availability and inflation risk.

It is much much better to allow the currency to float and keep unemployment constant at 1 or 2 percent than to be a mere currency user that must allow the unemployment rate to float in order to maintain the government’s solvency. Unemployment inflicts devastating ills on society. Unemployment is economically wasteful and it is cruel. Exchange rate movements, on the other hand, need not be a problem. Australia, for example, has had a floating currency since 1983. Since 1983 Australia’s exchange rate with regard to the USD has varied significantly in both directions without inflicting significant economic or social damage on Australians.

Unemployment = a massive problem

Currency depreciation = a much more manageable problem than unemployment, or not necessarily a problem at all

You have to accept that by advocating that an independent Scotland be a mere currency issuer you are assuming that unemployment is a smaller economic and social problem than currency depreciation. The facts are not on your side when you make this assumption.

My last sentence above should read:

You have to accept that by advocating that an independent Scotland be a mere currency USER….

I invite you to read your contribution to this thread with just a little objectivity.

“MMT is a worthwhile theory to explore. But it is only a theory and has more holes in it than Swiss cheese in reality.”

That is how you started out. You ended with:

“5) Essentially [MMT] is an attempt ( and an admirable one – if counter intuitive.) to solve the problem of money supply and inflation. But it really doesn’t. Printing money is printing money.”

Brazen condescension, the air of the expert, acccompanied cockily by gratuitous “criticism, arrogance and conceit” was your operational method; this was the way you started: and not the least indication that far from being certain, you are in fact “baffled”. Read it again.

I have expended considerable time rebutting your limp arguments, and now you have the audacity to come up with: “I admit to being baffled by the problem of currency and what is the best solution mainly because all seem problematic.” You could have started with this, rather than with conceit and arrogance; and then engaged in an open way with criticisms of something you do not understand. I would respnd in kind. But you didn’t. I met your sallies in precisely the same way you delivered them. Obviously you are “baffled”, and I understand that. But you have a very funny way of trying to fix it.

‘I have expended considerable time rebutting your limp arguments’

No you really really haven’t.

It was like pulling teeth to discover you do not subscribe to Neoliberalism. You do not subscribe to MMT. You have not said what is your understanding of the working of the currency, money and banking system. It can’t be nothing because you clearly have opinions how the system works, and what doesn’t work.

Indeed, how could you challenge MMT or Neoliberalism if you simply have no idea whatsoever how the monetary system works? How could you tell what works and what doesn’t if you start from no understanding at all? I have no idea why you believe your opinion on the subject is; (which remains completely hidden, in spite of enquiry) after four attempts by you (all we know is that you are baffled): but you seem to think an appeal to “logic” (note the quotation marks); which consists in “seeing the criticisms of A does not justify B” is making an important point. It isn’t. The problem is, how can you “see” the criticisms of A or B (or any letter between A and Z) if you do not have some existing understanding of the monetary system already?

Frankly, I suspect that you are indeed, at least unconsciously, committed to Neoliberalism; but I don’t know; but this coy footling around, as if you have some important point to make (but its a secret) has finally run out of time; because candidly, you have simply wasted mine.

I hope this video of a discussion on currency from a meeting Orkney may prove of interest, it is one of the items (of many) on this subject (and wider) to be found in the links I provided earlier, here: https://www.youtube.com/watch?v=E_rWwJS-E6I

Extract: florian albert 13 mins ago

“You state that I am regurgitating the same case. I would phrase it differently; I am asking the same question. How do those who favour a new, floating Scots currency persuade Scots with sterling savings that their interests will not be harmed ?

George Kerevan, to give him his due, has accepted that there is a problem here. He has said that people would be allowed to keep their savings in sterling. Personally, I doubt that would be feasible.”

One item in the video link I gave above makes reference to the Isle of Man (population just slightly larger than East Kilbride) … which might interest you in terms of the questions you raise – and the answers that have been established there.

Perhaps we should start to think about private debt as well as currency? For those who are in debt, which could well be most voters today, the currency of that debt matters little, it is still debt. I accept that the well off middle class etc will tend to have savings and also tend to vote more, which possibly explains the perceived political need to focus on currency risk which might arguably impact the middle classes more. However average British household debt is rising and in 2017 was £13,000, and this even before mortgages are counted. Depressed incomes and rising prices is creating ever more private debt. More and more people are in debt to utilities and councils. Rent arrears are also increasing. Debt has been rising in the younger age groups, e.g. 25-39 years being the main indebted group. After paying bills a great many people have just a few pounds left to manage on. Personal debt has been rising by up to 10/11% a year.

It might therefore make some sense for any SNP/Yes campaign to focus on dealing with the large and growing parts of our society who are in debt, and to ensure independence provides rapid solutions to help remedy this. To this group the currency of their debt is arguably immaterial, what is more important is the debt trap itself and how people can get out of it.

To John S Warren

You write, ‘I think it is overdue that you now make your case – fully.’

I have never suggested that I was attempting to make any case. I was drawing attention to what I view as a fatal weakness in the case some people, including you, are making for an independent Scotland with a new, floating currency.

My small contribution is insignificant. The real problem for supporters of the idea is the fact that the SNP has, for the second time, examined the possibility of a Scottish currency and dismissed it.

You may well have a view of the “fatal weakness” of the case; but you have singuarly failed to make anything of it, save that it is your “view”; a view which you have, at the very same time conceded is “insignificant”.

In effect you rush to criticise (at some length, and with persistence), and to which I have no objection ;but the fly in the ointment is that you do so without having anything to say in the way of substantive argument to back it up. This is the methodology of tabloids. There is, therefore nothing very productive or illuminating in any of your endeavours here, that I can see.

More important than my personal insignificance is the dilemma those favouring a Scottish currency now face. They must create a new party or join one of the small parties, such as the Greens, which favour such a move.

Persuading people will not be easy and some individuals may have acquired habits online which are repel rather than persuade voters.

“Persuading people will not be easy and some individuals may have acquired habits online which are repel rather than persuade voters.”

That may be true, but there was no need to be coy about where the barb is directed. Think on this: I respond to comments carefully designed to be in the same spirit in which the original is issued. So my answer to you is simple: “physician heal thyself”.

This thread highlights perfectly why when we get the correct structures in place it so important to have MMT’rs at the helm of both the central bank and the Scottish treasury.

I’ve been a member of the MMT UK group for years now and talk regulary with both Bill Mitchell and Warren Mosler and others. These people know exactly what is needed and how the monetary system operates.

1) The central bank is constitutionally barred from dealing in the foreign exchange markets, and margin trading is banned.

2) Banks can only lend (i.e. create money) for the capital improvement of the country. Since traders then know that there will be no ‘patsy’ in the market and no leverage available to them, they have no effective mechanism to attack anything. They would run out of liquidity. To sell the new currency you have to have them.

3) No need of foreign currency in the central bank. The foreign currency, if any, is held by the government to allow it to make necessary purchases in an emergency. Most importantly it is never used to settle foreign financial liabilities. Any entity that cannot service foreign financial liabilities goes bankrupt and the foreign debts are wiped out by the bankruptcy process. Creditors then get paid in the new currency achieved by selling the assets. The reason for that is straightforward – when you bankrupt a foreign loan you destroy their money.

4) Banks would always be under threat of being placed in administration and their shareholders wiped out if they break the rules regarding the currency. That’s how you keep them in line. They’ll be no socialising the losses in an independent Scotland

5) You tell banks what they are allowed to do, and NOT what they are not allowed to do. When you tell banks what they are not allowed to do, they will always find something you forgot.

6) Bank lending is to be limited to public purpose, which means you cannot use financial assets as collateral. You can’t borrow against financial assets from the member banks. If somebody in the private sector wants to make a loan, that’s okay. But not the banks with insured deposits.

7) And lending is done by credit analysis and not market prices of the assets underneath. You must lend by credit analysis to serve public purpose.

8) You don’t need foreign money. Foreign firms need the custom of the Scottish people because they have nowhere else to sell their stuff. To do that they need to either take the output of Scotland, or hold the new currency. If they don’t then they won’t make the stuff, which creates space for Scotland to make it for itself.

9) There is no need to issue public debt. MMT’rs know Overt money financing is the way to go.

http://bilbo.economicoutlook.net/blog/?p=34071 – Overt Money financing.

10) Introduce a job guarentee.

11) You introduce capital controls on FPI and encourage FDI. Foreign Direct Investment (FDI) where a foreign investor provides funds to a productive enterprise in another nation, from Foreign Portfolio Investment (FPI), which represents foreign investments in a nation’s financial assets which bear no interest in an underlying productive activity in the real sector of the economy.

And you could easily just use the Ways and means account Instead of issuing public debt.

The main contention made to support Gilts is that they manage the risk profile of private pension firms. And it is true that they do. In fact Indexed-Linked Gilts were introduced in 1981 by the Thatcher government specifically to do just that. The rationale behind them is a triumph of monetarism.

Of course what that tells you straightaway is that the private pension industry is incapable of managing the risk profile of pensions on its own within the private sector. It requires permanent government assistance to do so. The question then is what is the purpose of the private pension industry if it can’t deliver the outcome that is required?

A simple pension savings plan at National Savings, along the lines of the Guaranteed Income Bonds and Indexed Linked Savings Certificates, would solve the problem permanently, would be limited to individuals, and would allow them to manage their risk profile as they approach retirement (they would sell out of risky assets and transfer the money to National Savings).

Since it would be only available to individuals and there is no need to pay middlemen, it is clearly far more efficient than the current Gilt issuing system.

The Ways and Means Account is just an infinite overdraft with the Central Bank, and it grows over time to balance the net-savings of the private sector just as the Gilt stock does now.

The Scottish Treasury simply doesn’t issue any Gilts any more. Any funding of private pensions in payment should be done by offering annuities at National Savings, which would also have the neat side effect of ‘confiscating’ net savings and making the deficit go down.

It’s irrelevant what interest Bank Of Scotland charges on the ‘Ways and Means’ account since any profit the BoS makes from it goes back to the treasury anyway. So it can 50% if that gives the necessary level of satisfaction to mainstream economists and the gold standard, fixed exchange rate fiscal conservatives.

What you have is a standard intra-group loan account between a principal entity (Scottish Treasury) and its wholly-owned subsidiary. Normally those sort of loans are interest free for the fairly obvious reason that interest charging is utterly pointless, and they are perpetual for the same reason. Rolling over is totally pointless.

Any term money can then be issued to the commercial banks directly by the Bank of Scotland – up to three month Sterling bills.

If you are a member of a pension scheme then the savings of the current generation, plus the interest on Gilts and any income from the other assets owed pay the pensions of the current generation of pensioners. They are all, in effect, private taxation schemes that circulate money around the system.

You’ll note that when there was a threat of people failing to save in pensions, the government introduced compulsory retirement saving – which is of course a privatised hypothecated tax.

So in essence rather than the assets of a pension scheme being used to purchase Gilts, the assets would be used to purchase an annuity from the government dedicated to an individual. The result is that rather than the private pension receiving Gilt income from the state, to then pass onto the pensioner, the state would cut out the middleman (and their cut) and pay the pensioner directly as an addition to the state pension.

There’s a whole private pension industry out there literally doing absolutely nothing of any real value. They can’t provide a guaranteed income in retirement without state backing in the form of Gilts. So what is exactly the point of having them?

Get rid of the middlemen that take a hunge chunk of our pensions in the form of fees just for putting our money into state backed gilts. Get them do something useful in society instead.

We can treat foreigners ” savings” in the exact same way. Use the Ways and Means Account.

Warren Mosler explains clearly what you do with the commercial banks. The job of a bank is to promote the capital development of the economy. That is its public purpose; the job it is licensed to do. All other activities that conflicts with that purpose must be prevented. For banking to be effective it must be boring — bowler hat boring using the Mosler Mechanics for banking.

https://www.huffingtonpost.com/warren-mosler/proposals-for-the-banking_b_432105.html?guccounter=1

That means:

Banks can only lend directly to borrowers for capital development purposes (i.e. business credit lines and household loans), and the banks keep those loans on their books until cleared.

Banks must operate on a single balance sheet. No hiving things off into ‘off balance sheet’ subsidiaries to try and hide them.

Banks cannot accept collateral. Collateral is a fixed charge over an asset as an insurance policy and aligns the incentives of banks with those possessing assets, not ideas. It stops banks being capital developers and turns them into pawn shops. That is the wrong alignment of incentives. We want loan officers with skin in the game. Their success should depend upon the success of the borrower. Banks should line up in insolvency with the other unsecured creditors (and importantly behind the remaining preferential creditors — employees).

Depositors are protected 100% at all amounts. A depositor in a commercial bank is holding nothing more than an outsourced central bank account. They are not investors in the bank and should never be treated as such.

Regulation is provided by the bank resolution agency, which is a public body funded entirely by government. There is no charge or levy to the banks for the operation.

The job of the bank resolution agency is to ensure the banks are properly capitalised given their loan book and declare them solvent. If they are not, they take the bank over and resolve it with any excess losses absorbed by government. This aligns the incentives of the regulator. If they get the solvency calculation wrong and the capital buffers exhaust, the regulator stands the cost.

The Central Bank provides unlimited, unsecured lending to regulated banks at zero interest rates. Collateral serves no purpose since the bank has been declared solvent (and therefore there is no reason for it to be illiquid), and collateralised Central Bank lending just shifts the losses to depositors who are protected 100% anyway.