How Sound is the Economy Really?

THIS week we got Chancellor Sajid Javid’s so-called spending review which is, of course, nothing more than a back-of-a-fag-packet excuse to bribe the electorate, as part of the Boris plan to win a quick General Election.

THIS week we got Chancellor Sajid Javid’s so-called spending review which is, of course, nothing more than a back-of-a-fag-packet excuse to bribe the electorate, as part of the Boris plan to win a quick General Election.*

Javid is a former investment banker and derivatives broker. His constant references to his dad’s early days as a bus driver should not distract us from the fact that the new Chancellor is in the Treasury because of his 18-year career as a senior banker. He sits in the Brexit Cabinet to provide some assurance to the pro-EU City that its interests are still paramount.

*

All week Javid has been mouthing the mantra that the Tories can afford a give-away, mini Budget because “the fundamentals of the British economy are sound”. Bollocks. Let’s look at some of the recent data.

*

First up, the latest GDP figures (for the quarter till end June) show an absolute decline of 0.2 points. The early indications for the three months to end September show a further deterioration. Two quarters of GDP decline equals a recession. The UK economy may already be in that recession. And that is before a hard Brexit. The economic fundamentals are anything but “sound”.

*

An economic downturn is often the result of one significant part of the economy faltering. In the present situation, there is a perfect storm across all the key sectors of the UK economy.

*

Start with manufacturing, which represents around a fifth of the economy. Factory output is dropping at its fastest rate in seven years.

*

Then there is construction, a key driver of growth. The UK construction industry has just suffered its steepest fall in new orders since the Bank Crash of 2008.

*

Next up, retail. Consumer spending is a care element of GDP. But retail sales are down by 0.5 per cent over the year. Worse, we have seen the first deceleration in online sales figures, which are normally buoyant. The decline in retail sales is linked to the current stagnation in house prices across the country.

*

No wonder, then, that business confidence is at its lowest level since it was first measured.

*

The Chancellor takes refuge in the fact that the jobs market remains strong. Not any longer. The latest data shows that UK unemployment rose in the second quarter. True, work force participation rates are still very high but full-time employment is down. This suggests that high part-time employment in the low wage, “gig” economy is marking problems in the core labour market.

*

*

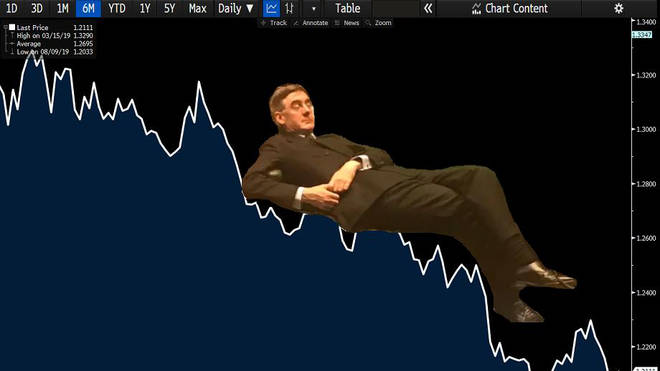

So much for internals. That about foreign confidence in the British economy? The week of the Chancellor’s spending announcement, the value of Sterling crashed through the $1.20 benchmark. Bizarrely, some of this drop is due to pro-Brexit hedge funds – who have long subsidised Boris – shorting the pound. In other words, they are betting Sterling will get cheaper.

*

Surely, you ask, a cheaper pound means UK exports will also be cheaper and more competitive? Firstly, the fall in Sterling means we pay more for imports, adding inflationary pressures to the economy. In particular household food bills will rise, reducing even further what consumers can spend on home-produced items.

*

Second, much of what we import are components and materials for our manufacturing industry. For instance, we import most of the content of our motor manufacturing output. The rise in content costs will tend to offset the fall in the pound.

*

There’s another problem. A super-cheap pound means British assets – companies and property – will be snapped up by foreigners. The amount of money spent on foreign takeovers jumped from £7.6bn in the first three months of the year to £18.4bn, according to the Office for National Statistics. This compares with £7.1bn for the second quarter of 2018.

*

And that was before the recent further weakness in Sterling. In other words, “take back control” translates into “we are selling the family silver for a song”.

*

WHAT’S GONE WRONG?

*

What’s causing this erosion of the UK’s economic position? It is partly to do with business uncertainty over Brexit. That is probably behind a catastrophic fall in capital investment in the past year. But there are non-Brexit factors at work.

*

In recent years the negative impact on consumer spending caused by Tory austerity policies has been discretely offset by a whopping £36bn in PPI insurance repayments by our bad banks. That has now dried up (though we might get a bounce from late applications for recompense in August). Note: Javid’s election bung might only substitute for this loss rather than add substantially to spending.

*

But the central weakness in UK economic fundamentals is our poor productivity by international standards. British output per head flatlined after the 2008 crisis. In the past four quarters productivity has actually declined! All the part-time Uber drivers and pizza delivery bikers in the country won’t help the British economy if we can’t make things as efficiently as everyone else.

*

Why the drop in economic productivity? Because our spiv economy of rogue banks and hedge fund speculators don’t invest in plant and machinery, new technology and training workers. But then our new Chancellor comes from this spiv economy. No wonder he thinks “the fundamentals” are sound.

*

Thank you for this.

The ‘fundamentals’ as perceived by Mr Javid and his fellow hedge fund sharpsters are that the economy remains in a condition which we can pillage.

A Keynesian counter-cyclical approach would invest in the kinds of things which would improve investment in the things which raise productivity and also put more money into the pockets of people so that they can buy the products.

Are you not being a bit harsh on Javids background as an investment banker?

What kind of investment banker was Iain Blackford MP?

one of the benign sorts.

No doubt it was a Westminster conspiracy to have Mr Blackford working in finance when all the time he wanted to volunteer in a food Bank in Bellshill.

In addition there is international factor – ie, not so cheap energy. The long term trend since the 1970s has been that we’ve burnt all the easy to get energy, and are now burning the expensive to get energy. When the cost of energy extraction is higher, that leaves less money to spend in the economy.

Energy returned on Energy invested, EROEI, is the metric used. Back in the 1930s, oil was 100:1, ie it cost one gallon of oil to get 100 gallons of oil out of the ground. Which was an exceptionally good ratio.

The 1940s-50s it was 75:1. In the 1970s this dropped to less than 50:1. Now it is as low as 25:1 or less, perhaps 15:1 for some oil plays. The Saudis claim 40:1 for their oil fields, but show no proof of that, whilst all the time pumping more and more salt water into their oil fields. To run those pumps burns energy, hence EROEI goes down. Fracking is probably less than 1:1 which is why none of the US shale players actually make any profit, just good cash flow from gullible investors.

Once EROEI gets to 6:1 in any economy, it collapses to a dung/woodfall burning one, with considerably less people than exist now.

The oil crises of the 1970s has coincided with the rise of neo-liberal economics, which has morphed into a concerted effort to concentrate as much wealth as possible into the hands of as few people as possible. In this they have been very successful, so no wonder Javid can say the economy is good. Good for The Westminster that is. Whenever a Tory or Tory-lite says something like “the fundamentals of the British economy are sound”, it’s true -for him and his rich friends and backers.

The austerity drive since 2010 has been the most severe and accelerated form of this wealth transfer. And now the UK economy (outside of the Westminster bubble) has contracted so much because so many people have less discretionary spending. Looking at my own accounts, my discretionary spending has dropped from 20% of my income to effectively zero since 10 years ago. One additional factor that might be overlooked is simply the death rate – with austerity having killed 110,000+ UK citizens since 2010, current government policy is literally removing lots of spending power outright. Because even poor people used to buy consumer goods, drive cars, buy insurance etc.

As anecdotal evidence, the orders I see for a company I work for are from a declining pool of customers, or from abroad.

Poor productivity will also be due to austerity. If you have employers that are trying to cut costs, remove workers rights, have lower wages, make people work longer hours, or just have lots of part-time temporary workers, it stands to reason that this will be less efficient. The workers, will, if you treat them like shit, work like shit basically. They are not going to be enthused to work efficiently at all. 14 million people are in that position, where the work they do is for survival only, the concept of discretionary spending being a pipe-dream, and for 4 million of them, that work isn’t even making ends meet.

Javid can say what he wants. By any metric, an economy with a low growth rate is bad, but an economy with a negative growth rate is absolutely catastrophic. But unless we suddenly discover a new energy source with EROEI of 75:1 or more again, this decline is absolute and here to stay.

The blog http://consciousnessofsheep.co.uk/ has some very good studies on this.

Austerity has killed 110k citizens since 2010

How many people die in the UK each year anyway?

I would hazard a guess at 1% of 65 million.

Which is 650k .

So 10k a year “due to Austerity “.

Is hard to prove .

Mark: “The workers, will, if you treat them like shit, work like shit basically. They are not going to be enthused to work efficiently at all.”

Reminds me of a quote I heard from a Russian worker talking about the old soviet days: ” The government pretended to pay us, and we pretended to work.” ( i.e. not very productive)

My children working on zero hours contracts. Waiting at 8:30am each day for a text from the boss (gang-master?) to see if they can earn their £6:15/hour that day. My daughter paying £450/month to her landlord ( son of a well-known BBC presenter, who was given his flat by daddy ) for her share of a 4-bedroomed tenement flat.

What chance them getting started in life?

According to the Office for National Statistics at March 2019

“General government gross debt was £1,821.3 billion at the end of the financial year ending March 2019, equivalent to 85.2% of gross domestic product (GDP) and 25.2 percentage points above the reference value of 60% set out in the Protocol on the Excessive Deficit Procedure.” By most measures the UK is in recession and will it deepen under any form of brexit.

Japan destroys everything you write.

Debt to GDP ratio of 250% I bet that blows your mind with your government finances operates like a household budget nonsense.

https://m.youtube.com/watch?v=w5aE7N8Cc5Y

Which is why an independent Scotland at the heart of the EU would be economic suicide. Their crazy neoliberal fiscal rules.

with Brexit dragging on, and on, how much has the economy been damaged by the delay caused by our politicians? pretending they are fighting against a no-deal when, in truth, they are against Brexit in any shape or form. Then at the pending General Election they will be queuing up to promise the punters that their votes this time really, truly count.

This is comedy gold. As per usual only looks at one side of a balance sheet.

Let us start off with the £.

When the £ falls all other currencies get stronger against it. Next George will be telling us a strong Euro is good when you choose an export to growth model or a strong Yen. He lives in a parallel universe of reality. A strong currency will destroy exports and eat into the surplus. Just Google Irish exporters after the brexit vote and you can read what a strong Euro did for those exporters. It bankrupted the Irish mushroom farmers.

The reality of course in the real world and what MMT teaches you is when the £ drops and as imports get more expensive people cannot afford to buy them as they only get paid X amount per month. People change their spending habits when they go shopping and buy local instead giving the local economy a boost.

That means exporters to the UK then have some tough choices to make. That is if they want to keep their market share that they fought so hard to build up over the last 50 years and more.

a) reduce the wages they pay their employees.

b) sack employees

c) reduce working hours

d) reduce their prices

e) All of above

f) Go bankrupt

Normally they will reduce their prices and cut costs. In a flexible exchange rate world not a fixed exchange rate world George describes. As soon as exporters to the UK do that the exchange rate adjusts. The £ gets stronger and it will find its true level.

The rest of the piece is just as bad in George’s we are still on the gold standard fixed exchange rate world. He clearly does not understand how our monetary system works and has not kept up with major reports written about pass through inflation.

http://bilbo.economicoutlook.net/blog/?p=32922

And we’re just supposed to believe you are we? You have your theory (backed by selected experts), Mr Kerevan has his theory (no doubt backed by selected experts) while A.N.Other has their theory (backed by selected experts). It is said that in a room full of economists there are as many theories as there are economists …. and they’re all wrong.