On the Scottish Budget, Tax, Arts and Housing

The Scottish Budget was a mixed bag of bewildering figures as the DFM Shona Robison tried to juggle spending commitments, financial aspirations and legitimate claims on the public purse with a large black hole. Some lauded it. The Scottish Greens pointed out that among today’s key announcements were:

- £4.7 billion of total investment in climate and nature

- A £1 billion increase to social security spending, now totalling £6.3 billion

- Almost £360 million for warmer, greener homes

- Extension of the trial removing peak fares from Scotrail

- Scrapping school meal debt and the further expansion of free school meals

- Record funding of £220 million for walking, wheeling and cycling

The much heralded Income Tax rise (the creation of a new income tax rate at £75,000-£125,000) brought the inevitable shrieks of despair and denouncement. Humza Yousaf pointed out that it was supported by the: STUC, The Poverty Alliance, The Child Poverty Action Group and Oxfam. Others such as Merryn of ‘Nicola Sturgeon Stole My Skiiing Holiday‘ fame were less positive:

And… Scotland is not open for business. https://t.co/XXTwq23i2E

— Merryn Somerset Webb (@MerrynSW) December 19, 2023

The meltdown was continued across all of the Unionist commentariat. Andrew Neil claimed that people earning £75k or more were not in fact ‘rich’ at all. Others predicted a ‘brain drain’ Rishi Sunak asked for an explanation.

The Daily Record’s Political Editor Paul Hutcheon said: “Shona Robison’s Budget was the most disastrous in the history of devolution.” Others were less positive. Euan McColm said the “SNP had run out of ideas“.

The fact is that the rise in Income Tax will raise a significant if not game-changing amount of money, but it is far more useful as a point of principle and a marker than anything else. It is progressive taxation, if the Council Tax freeze (also announced) is not.

Scotland now has six tax bands

STARTER RATE (19%) £12,571 – £14,876

BASIC RATE (20%) £14,877 – £26,561

INTERMEDIATE RATE (21%) £26,562 – £43,662

HIGHER RATE (42%) £43,663 – £75,000

ADVANCED RATE (45%) £75,001 – £125,140

TOP RATE (48%) Above £125,140

Follow #scottishbudget…

— BBC Scotland News (@BBCScotlandNews) December 19, 2023

The logic around the denunciation of the tax rise are difficult to follow but they go something like this. First anyone earning £75k or more isn’t REALLY rich, and if they are they’ll find ways to avoid paying tax because they’re so clever. Second many of them aren’t from here so they’ll just return to England (or wherever). The code here is that Scots aren’t really successful or high-earners. The third is that its essential to attract ‘high earners’ (who also aren’t really high earners remember?). Also this won’t work because hardly anyone earns that much (but also its essential to attract more people at this rate …). Follow this if you can.

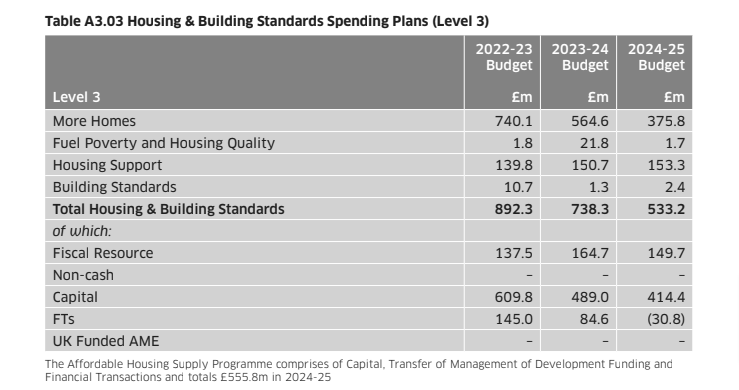

If the scrapping of the school meal debt and its further expansion are to be welcomed, other announcements are not to be. Slashing the house-building budget at a time of an unprecedented housing crisis is an unforgivable act of folly.

… and the rise in the Scottish Child Payment to £26.70 (up from £25 per week) is also to be welcomed but is also nowhere near what was promised by Humza previously (he promised during the leadership election to raise the Scottish Child Payment to £30 a week). And while its true that poverty campaigners and think-tanks have called the child payments scheme a ‘game changer’ they have also said it needs to be nearer £40 per week to do its job.

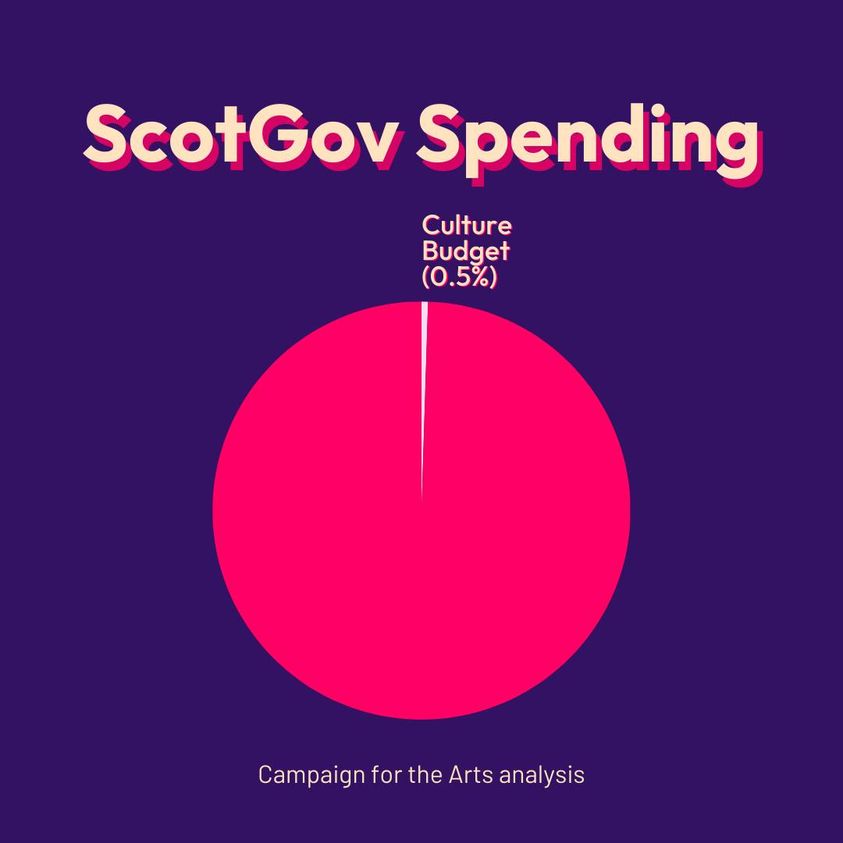

And finally the announcement of the funding for the arts Angus Robertson (Secretary for the Constitution, External Affairs & Culture) claimed: “Positive news for the Scottish culture and arts sector, increasing funding by £15.8m and aiming for a further £25m on the way to raising culture spending by £100m”.

But this is very confusing. Earlier this year, as the arts journalist Brian Ferguson explained: “At least £6.6m of this isn’t increased funding at all, it’s the restoration of Creative Scotland’s 10% cut, which was revealed a year ago, dropped in the spring, reinstated in September & now presented as “increased investment.”

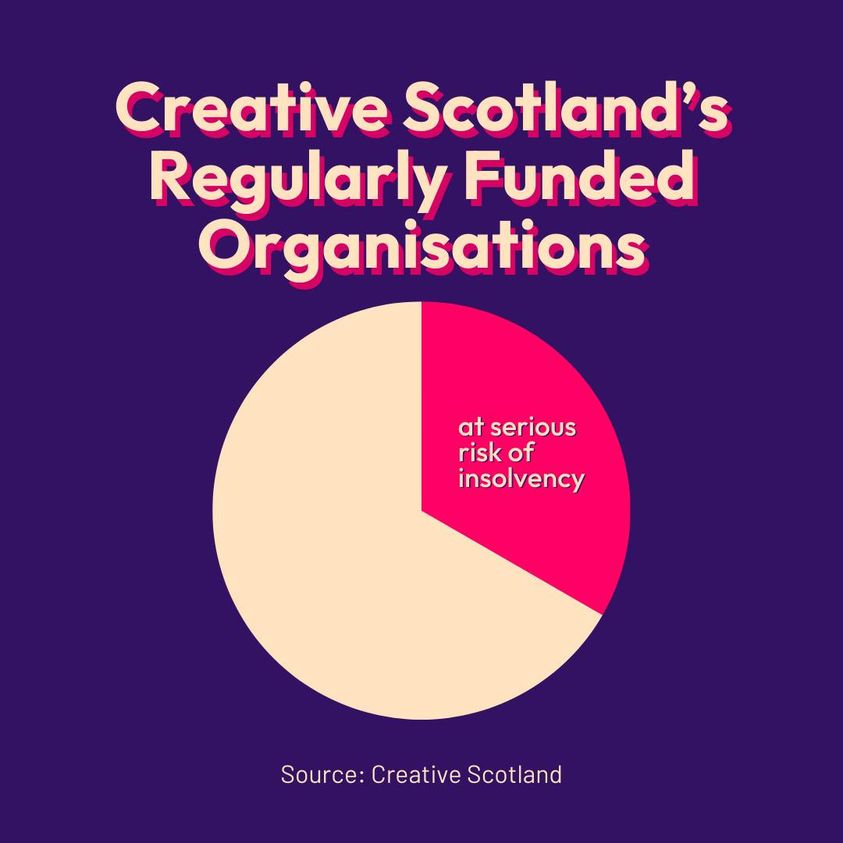

We are now faced with a situation where up to a third of Creative Scotland’s Regularly Funded Organisations are at serious risk of insolvency in the short term, and over half are financially weak (requiring redundancies or other cost savings).

Not only does this make no sense to the vibrant but struggling Scottish arts scene, which are a huge boost to the economy, it makes no sense within the SNP’s own view of the world. The ‘soft power’ of a connected arts and cultural sector that connects literature, playwriting, screenwriting with theatre tv and film industries is universally acknowledged – and can be seen across the water in Ireland where investment brings huge awards.

The budget is a microcosm of the dilemma of devolution, and the failures and successes of the present government. It speaks to their good instincts and limitations and the predicament we inhabit. For the positives they have outlined they should be applauded and for the narrowness and frankly reactionary policy decisions they should be castigated. We don’t (nobody does) have all of the details as yet, when we do we’ll have a follow up on all of this.

Time for a land tax to bridge the gap. The really rich don’t pay income tax so they are presently out of reach.

Get on with it; then let’s hear the pips squeak.

The private landowners, while small in number are immensely rich and powerful with connections to the highest echelons at Westminster and in City Money Laundering Inc. They would have all their media present us 24/7 with horror stories of how Scotland would become a desert with people starving. They would also use legal approaches to seek to bankrupt MSPs or tie up Holyrood in legal wrangles. Probably, Westminster would invoke Section 35 or pass legislation to prorogue Holyrood. They would probably foment civil disturbance.

This is not to say that we do, indeed, need to address the taxation of land and wealth, but we need to recognise that this will be a very bumpy ride. The history of the dissolution of the Empire shows that Perfidious Albion, even though it knows something is inevitable, will, out of vindictiveness seek to destroy.

Alasdair I have no doubt that your analysis of how a Tory government in Westminster would react to Holyrood proposals to implement a land tax is accurate.

The land tax would adversely effect a small number of people and be potentially beneficial to the majority of people in Scotland so this would be something that would probably carry substantial majority support of electorate in Scotland.

(people may aspire to become wealthier but few aspire to become big landowners).

Westminster may choose to fight it but may be reluctant as it could become a rallying cry for independence. Observe how Westminster backed off from a fight over drug consumption rooms – a policy with a substantial level of public support partly because it had been explained to public. A land tax policy would leave a Labour government in Westminster with an even more awkward scenario.

Either way a Land Tax policy should carry a large level of public support and be a far more popular policy to challenge any S35 from Westminster on than the GRA, which whatever the merits or otherwise of policy, would only be of benefit to a very small number of people.

Which would be better – a land tax or a wealth tax, or some combination of both? Surely what Scotland would like to see in regard to its large and barren shooting estates often owned by non-Scots, is an improvement in their ecology and diversity and an opportunity for sustainable human development. How would a land tax affect farming? A land tax returned to land owners in return for ecological advancement and an abandonment of their present reliance of deer stalking and grouse of their estates might work? Speaking for myself, I’d nationalise all land, and ownership would be by lease. Scotland has a notable lack of national parks and protected areas, that needs to be addressed as well. Coastal land is also very precocious and needs careful control, otherwise you’ll get unsightly ribbon development – I was aware of this starting in the Hebrides alongside the west coast beaches. Here in NZ it’s a huge problem though it would be true most NZers don’t actually care too much, they’ve got used to the unsightliness of careless development. . .

I agree about the Land value tax. It is badly needed to replace the unfair Council tax, which does not collect enough from wealthy owners, but also because we also need urgently a proper register of who owns land, rather than this being hidden by shady companies in tax havens. We need to know who owns what and if the owners are not prepared to give that information, thier holdings should be confiscated after due warning and time to comply. At present we seem powerless aginst land owners who flout the rules, whether by denying acces or carrying out damaging work, such as bull dozing access paths for landrovers, burning heather or killing raptors, we need ways to make them accountable.

Can anyone explain why the SNP are blind to land taxation? What is holding them back? The council tax freeze is also pig-ignorant, what possessed them to offer the wealthy this concession?

Tell the unelected PM that devolution means being different and being innovative. We don’t need to explain anything, least of all a tax on the rich, to a government which deprived us of our European citizenship against our will, has impoverished our people from Thatcher till now, has undermined devolution and now treats our FM and ministers as children who can’t use the ‘independence’ word in front of all these foreign dignitaries who are eager to hear about Scotland and our potential as an economic and strategic partner.

It is interesting to compare tax rates with England which are much simpler:

England

Basic rate £12,571 to £50,270 20%

Higher rate £50,271 to £125,140 40%

Additional rate over £125,140 45%

Scotland

STARTER RATE (19%) £12,571 – £14,876

BASIC RATE (20%) £14,877 – £26,561

INTERMEDIATE RATE (21%) £26,562 – £43,662

HIGHER RATE (42%) £43,663 – £75,000

ADVANCED RATE (45%) £75,001 – £125,140

TOP RATE (48%) Above £125,140

It is always at the lower end of the bands that the controversy lies. 45% of 75K is actually quite a lot but not that much different to England’s 40% but more problematic is 42% of 43K compared to Englands 20% for the same earnings (the average UK wage is 35K).

At the lowest tax rate the poorest Scots pay less something I would have thought most people would agree is a positive.

The upper middle and high earners in Scotland pay a bit more but they probably benefit more from the abolition of tuition fees and prescription fees. Is it not a case that they pay a bit more than counterparts down south but potentially benefit substantially more?

I do agree that there now appears too many middle tax bands but this may show that these earners contribute most in total taxation take and the level of political caution around taxation.

The difference is <£30/year – that's virtue signalling.

It’s a welcome statement of who we are and a statement of intent. Cynics always focus on the small stuff but £30 is £30 and will be more when we have flushed creatures like Jack out of our system.

But the Scottish tax bands, like the English ones, don’t work in the way you have described them. When you write ‘45% of 75K’ what you are actually referring to is 45% of anything earned ABOVE £75K. As Mike points out, despite what Andrew Neil claims if you earn more than £75 you are wealthy, and you still get 55% of anything you earn above that figure.

Your comparison of ‘42% of 43K’ with ‘20% for the same earnings’ is even more misleading. If it were correct the difference would indeed be indefensible as well as unsustainable. But in fact the 42% rate doesn’t kick in until you earn MORE than 43.6K and is applied only to the amount you earn between that figure and £75K.

And remember that everybody gets a tax-free personal allowance UNLESS they earn more than £125K.

The point made by other commentators, though, is really strong. Income tax is the least avoidable tax of any. The untaxed wealth of this country (in land for example) is immense. And when are we going to address the issue of tax havens, not just in distant islands in the Caribbean but much closer to home, e.g. on the Isle of Man? The likes of Messrs Barrowman & Mone don’t base themselves there just for the scenery.

You are right James, my error. Though it is all still relative between England and Scotland so the basic differences I outlined remain albeit skewed by the different salary boundaries: those at the low end of the Scottish Higher Rate will likely pay quite a lot more tax than the English at the equivalent salary and I would not regard those as especially high earners: rent / mortgages are one of the key expenses and can eat up serious money.

Don’t get me wrong – I am in favour of funding through taxation and within reason am not against a higher tax burden for what as others point out is potentially better and some free services: you get what you pay for by and large. I am not criticising the SNP just trying to compare though do think all those bands with 1% difference a bit pointless.

The question of HE tuition fees is interesting though as the Scottish system is heavily subsidised by English students paying full fees, encouraging universities to recruit them. I don’t regard the current funding system as a very good or fair one though better in some respects than in England. What is very similar is the marketisation of HE which is UK-wide and in Scotland some of that is a competition of English (and international) fee-paying students.

I do agree with you that the 1% tax bands seem unnecessarily complicated – although I guess technologically they are quite easy to administer compared to pre-electronic times.

Also agree about the terrible state of our HE institutions and how they have become businesses first, places of academic excellence second.

There’s also what is in effect a graduate tax rate added to income tax gathering in England. Student ‘loans’ for tuition fees of £9k per annum are ‘repaid’ after graduation at a rate of 6% of income above a single threshold entirely through the income tax system. Recent significant changes to interest rates and repayment terms by the Tories for England mean that the vast majority of graduates will pay this 6% marginal ‘tax liability’ for the whole of their working life – it more clearly has the characteristic of a graduate tax than a ‘repayable loan’ now.

The ‘tax’ (fee loan repayment) is based on where you were living when you started your undergraduate studies though – not where you study in the UK or live after. Graduates who lived in England before study carry on paying the ‘tax’ even if they move to Scotland or anywhere else in the world for that matter. Graduates who lived in Scotland when they commenced study (even if they study or subsequently live in England) don’t pay it. The costs for Scottish domiciled students at the time they study are met out of the Scottish government budget, whereas in England the government only pays some marginal additional costs for higher cost subjects, like physics.

The effect of the recent changes in England is to reduce the block grant for the Scottish government as the ‘charge’ to the Education budget for unpaid loans is reduced significantly and this becomes a ‘negative Barnett consequential’ – too small to make much difference now but over time as more students from England go through the new system, it will make it more difficult for the Scottish government to maintain its system without significant extra taxation.

[This is the simplified version of something extremely fiscally complex! Wales and N.Ireland are slightly different to England]

Useful summary of Scottish taxpayer v rUK taxpayer here. Difference starts to be significant from £45k upwards. https://www.icas.com/landing/tax/key-announcements-in-the-scottish-budget-2024-2025

It looks like most of their new cash will come from fiscal drag on people who are on ~£44K/year PAYE (there is little point in a £1K pay-rise – it’ll disappear).

You don’t have to be clever to drop a tax band – you just put more money in a tax-deductable private pension fund. Or you could avoid paying income tax entirely with a private limited company (eg. yer plumber Ltd). But you’ll probably still be waiting 3 years for a cateract operation, or maybe camping in an ambulance outside a hospital. I think the Scottish government is too incompetent to means-test anything much to target those in real need, and the whole carry-on about you paying quite a bit more tax, but at least you’ll save £60 on a real-terms council tax cut is strange, as is the Scottish introductory tax band (this saves most people £30/year – you could buy one shoe).

Never mind all the quibbles over tax bands. Who really cares if someone who can well afford it is asked to contribute a bit more to the public benefit? If they really leave Scotland in a huff, good riddance. WE’d be far better building up a more sustainable, circular, decentralised, self-reliant economy than depending on people with the ‘ethics’ of organised crime who care about nothing but their own wealth and power at public expense. The days of private affluence and public squalor have to be over – but still we see the opposite. Where are the politicians who will stand up for us? I hope that unelected, technocratic crook Sunak does challenge this. He has no mandate in Scotland and I hope it pushes the independence vote well over the 60%.

No what upsets me is something else. ,I am seriously shocked to see the destruction of the housing budget. Here in the rural Highlands we have a desperate need for rentable and affordable housing. It is impossible to recruit staff and those who do come find they have nowhere to live. Services are being cut, and cut, and schools are closed. We are under growing pressure to move to urban areas where, apparently it is ‘cheaper’ to deliver services (actually the public do not exist for anyone’s administrative convenience!) Gairloch High School, once a top-performing school with over 200 pupils is now struggling with 70. The young families we need are leaving, and the care homes for the elderly and vulnerable are closed. All investment goes into ‘City Regions’ and we are deliberately depopulated, our land ‘re-wilded’ – not for nature ibn fact but as a ‘wild west’ where the super-wealthy can do as they please without local opposition – whether that is private hunting grounds, spurious ‘carbon credit’ scams, or just filling the land up with industrial infrastructure such as giant turbines, massive pylons and substations, 5G infrastructure we neither need or want. Or opening gold mines, as at Gairloch, or quarries, or whatever. This so called ‘Green’ agenda is nothing of the sort. It is greenwashing the new Clearances. I used to be a Green Party member, but no more. This budget just demonstrates how little the SNP or the Greens care in the least about the rural areas or the Gaelic heritage. I will never vote for either of them again.

But that does not mean I could ever vote Unionist. After the last few years, anyone who seriously thinks we are ‘better together’ with that parcel of rogues in Westminster must be mad. We need a new political movement in Scotland that will genuinely purt the interests of Scotland’s people – rural as well as urban, before corruption and fear of corporate bullying.

If this does not happen, I confidently predict civil unrest. Which perhaps is just what Sunak, Starmer & co are trying to provoke.