Oil Isn’t Worth Anything Any More

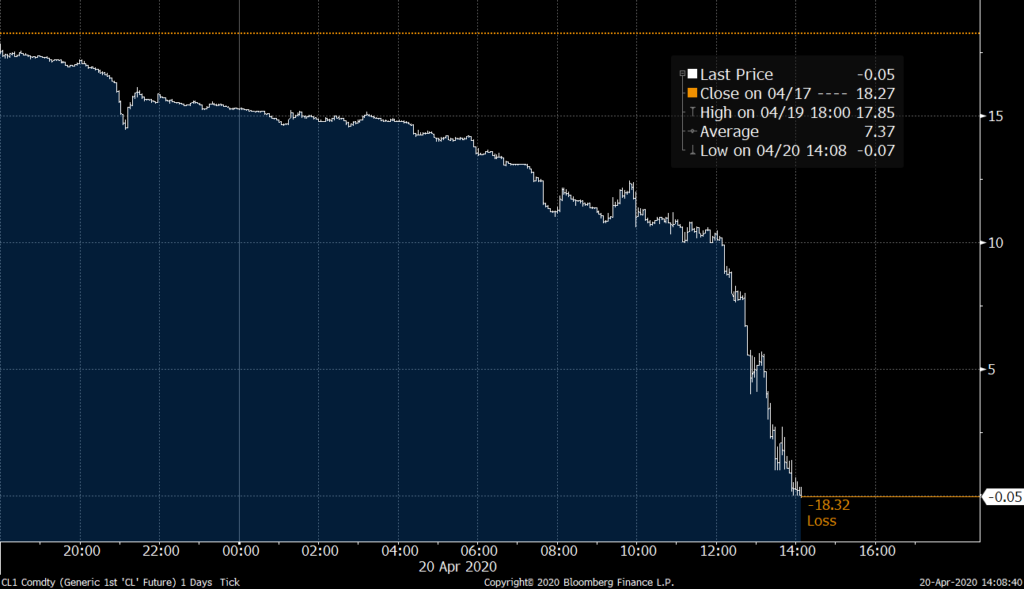

The price of oil has plummeted. US oil prices turned negative for the first time in history yesterday. North America’s oil producers ran out of space to store an unprecedented oversupply of crude oil left by the coronavirus crisis. Oil supply is now bobbing about in huge tankers outside US ports, a floating legacy to a stranded asset.

The price collapse in the US market – known in the industry as the West Texas Intermediate price (WTI) – accelerated because it is the last day oil producers can trade barrels that are scheduled for delivery next month, however the price for Brent Crude, the most widely used benchmark, fell 8% to $25.79. The geopolitical consequences of this are unclear, though they do point to us living through a seismic event, a rupture in our whole world.

The event was pounced on by Unionist commentators who suggested that an independent Scottish economy would be wrecked by such turmoil. But the economic case for independence hasn’t been based on oil figures since 2017. It doesn’t in any sense undermine the case for independence, but it does define what sort of independence we should be building. The dwindling pockets of Scottish nationalists still harbouring the idea of an independent Scotland propped up by North Sea Oil should be paying close attention. Regardless of this the depth of the crisis we are living through make independence, or one-dimensional constitutional change just one aspect of the epochal changes we are experiencing. While the crisis has shown the need for independence more acutely than ever before, we are in such new territory that the old political discussion will take some time to catch-up with the new reality.

What it also shows is that the globalised petro-chemical economy is a precarious and wildly volatile entity over which we have very little control. The LA Times reported: “Oil’s plunge into negative territory — which followed a months-long global price war started by Russia and Saudi Arabia, whose economies lean heavily on petroleum — is just one piece of a larger story playing out across the energy sector, with long-term implications for the world’s ability to phase out the fossil fuels that are responsible for rising global temperatures. The COVID-19 pandemic is at the center of that story.”

There are immediate ecological gains from the reduction of driving and flying and from economic activity in general, in less pollution, in C02 reduction and in air quality. But those gains are fragile, temporary and at risk. As David Roberts reports (Coronavirus stimulus money will be wasted on fossil fuels):

“The dominant narrative is still that fossil fuels are a pillar of the US economy, with giant companies like Exxon Mobil producing revenue and jobs that the US can’t afford to do without. Even among those eager to address climate change by moving past fossil fuels to clean energy — a class that includes a majority of Americans — there is a lingering mythology that US fossil fuels are, to use the familiar phrase, too big to fail. But the position of fossil fuels in the US economy is less secure than it might appear. In fact, the fossil fuel industry is facing substantial structural challenges that will be exacerbated by, but will not end with, the Covid-19 crisis. For years, the industry has been shedding value, taking on debt, losing favor among financial institutions and investors, and turning more and more to lobbying governments to survive.”

The danger is that the industries that are destroying our planet are the industries that are saved. Richard Branson’s bid to have Virgin Atlantic bailed-out is a prime example.

Whether there is a public government bailout remains to be seen, but there is evidence there’s already a private one.

Johanna Bozuwa writes (The case for public ownership of the fossil fuel industry):

“The U.S. fossil fuel industry continues to seek bailouts during the COVID-19 crisis, as global oil demand craters and crude oil floods an already oversupplied market. These twin phenomena have combined to crash the price of oil, threatening the stability of the U.S. oil and gas sector. The federal government has responded by cutting environmental and public health regulations, prioritizing corporations over frontline workers and communities, and exploring appropriating billions of dollars to purchase oil surpluses to fill the Strategic Petroleum Reserve.1 Most recently, big banks are establishing holding companies to snap up financially shaky oil and gas companies, offering an ostensible private bailout.”

While the situation lasts, no-one has anywhere to drive to and nowhere to fly to. But there is real danger in a “rush to get back to normal” and “business as usual”, and we can either be complicit in this return or oppose it and resist it.

Three Narratives of Modern Life

The are three interlocking narratives at play here. The first is that the fossil fuel industry is an inevitable part of modern life and that there is no alternative. The second is that the growth economy is the only economic model we have (or can have). The third is that we should have the right to drive and fly anywhere we like at any time, for very little cost. These assumptions are self-reliant on each other.

Each of these is being challenged by the coronavirus crisis.

The mythology about oil and national identity, its intrinsic value to the American economy and culture is profound. Oil is a form of magic. It feeds the mythology that capitalism just spurts growth and hands out prosperity from that growth. The magical thinking we’ve assumed will go on for ever is that we could just benefit from this growth for ever and ever. The fact that fossil fuels is at the heart of our climate crisis and that we have been living dangerously beyond the earths carrying capacity has been ignored for too long, and the virus is revealing how close we are both to fatal runaway climate breakdown, but also to viable and clear solutions to avoid that.

If anything the virus is showing how the system works and why it is deeply broken and dysfunctional. David Roberts points out, amazingly that:

“The petrochemical and plastics industry, which is in large part an extension of the oil and gas industry, is exploiting the crisis as well. It has lobbied the federal government to declare an official preference for single-use plastic bags and suggested that more fresh produce should be wrapped in plastic.”

This crisis needs to be salvaged from our governments who will waste the opportunities it represents by returning us back to the economy that was destroying us. Old industries must be allowed to die-off and all bailouts and salvage projects must be focused on life-giving and future-focused industries and activities.

Mike

You will not be surprised that I do not agree with your analysis. Yesterday was certainly a day of carnage for many in the oil industry, particularly in North America. But this is what happens when the World`s capitalistic economy goes into lockdown ( for perfectly justifiable reasons) Daily demand for oil has fallen from around 100 million barrels a day to circa 80 million. At the same time, we have a price war between Saudi Arabia and Russia. What has happened is predictable.

There is absolutely no change in sourcing for energy. The World still uses fossil fuels for some 85% of energy. Renewables are still a tiny subsidized part of overall energy production. Windfarms still do not generate when there is no wind, or too much. Covid 19 does not change energy realities or the laws of physics.

Marginal producers will go bankrupt and their assets will be snapped up.

Scotland will not become wealthy through petroleum, but the oil industry will remain significant for decades.

“Nothing has changed”

William

“Nothing has changed”.

Gotcha. Brilliant.

Scotland doesn’t have the political ability or natural resources to become wealthy, because we control neither of those. That’s why I, and many others want Scotland to be independent from that paradigm. Renewable energy is the future wether anyone likes it or not, to begin developing in that direction only makes good sense.

Nothing is perfect, but taking steps in the right direction can be the only intelligent thing to do.

“Nothing has changed”………..ha ha ha the ghost of Theresa May is alive and well I see.

Scotland is one of the wealthiest socities on the planet regardless of fossil fuels.

The dilemma throughout human history is how to balance individual ‘need’ (however you define the term) against what is best for ‘society’ (however you define the term).

Democratic societies are always trying to balance the conflicting ‘needs’ whereas totalitarian societies (of both left and right) tell you what your ‘needs’ are.

As for fossil fuels technological advance will eventually make them redundant (like the horse and cart) but at the moment I don’t see anybody complaining that all the PPE we need is made from synthetic materials derived from oil nor that there flown in from China.. Life is not perfect and never will be and attempts at creating an ‘Utopian’ society have always ended in a sea of blood.

Keep well everybody!

It’s funny William.

A bit of me hopes you are right, because the workplace pension funds of so many of us are dependant on the healthy share price of large oil co.s. Our current economy is fully committed to using oil for energy and manufacturing.

Pain for oil co.s is pain for us all. How can we de-couple our wellbeing from the oil industry? I assume even oil companies ( or “energy” companies as they now prefer to be known) are working on this problem too?

@William Ross, how many trillions of dollars a year does the fossil fuel industry receive in state subsidies? The International Monetary Fund’s research:

“Globally, subsidies remained large at $4.7 trillion (6.3 percent of global GDP) in 2015 and are projected at $5.2 trillion (6.5 percent of GDP) in 2017.”

https://www.imf.org/en/Publications/WP/Issues/2019/05/02/Global-Fossil-Fuel-Subsidies-Remain-Large-An-Update-Based-on-Country-Level-Estimates-46509

The highly inefficient/corrupt UK fossil fuel industries get the biggest breaks in Europe, according to the EU.

And wind farms and other renewable sources can generate fuel, such as hydrogen fuel by electrolysis of water, with any surplus power input, storing energy for later use or distribution. We just need to change over the infrastructure, as is happening in some places already.

Tm Watkins adds to the narrative:

https://consciousnessofsheep.co.uk/2020/04/20/a-phoney-war-of-sorts/

Systems shocks are still be yet to come – the economy will break of it’s own accord eventually – will it be sooner than we think, or will this petri-dish of suicidal death cults we call capitalism splutter on a bit longer?

Meantime Brent Crude (which has averaged 60 – 70 dollars recently) is at £28. More relevant to the UK. Thank God oil plays a smaller part in our thinking than it does in the USA.

“The third is that we should have the right to drive and fly anywhere we like at any time, for very little cost.”

The elites of this planet want us trapped in our own dunghills unable to see whether things are better handled elsewhere or simply handled in a way we prefer.

Instead of enviously trying to stop anyone who is not rich from travelling we should be working on ways to clean up air and land travel. Or simply a UBI that means anyone can travel slowly and cleanly: airship or electric train and ferry for example, from country to country. If you only have two weeks a year for holiday you want to minimise the time travelling.

We should also ditch the protestant work ethic. It is one ot the pillars of the capitalism you condemn.

It reminds me a bit of Pandas. Only able to eat one thing; bamboo.

One thing this crisis does demonstrate is our ability to very rapidly change our behaviour and our expectations (at least in the short term). That might be useful.

Sitting outside at the weekend in the quiet, I remembered when every Sunday was like that: shops shut, everyone off work and at home. It made me think we have given up so much in our desire (was it our desire?) to have 24/7 retail available to all.

Wul,

Like you, I have found closed shops an unexpected bonus (not forgetting the cost in lives lost). The relentless pressure to buy ‘stuff’ aimed largely at women – stuff we do not need – is entirely manufactured by the owners of capital – driven by the usurer economy of fictitious capital seeking rents, and pressuring environmental destruction. I really HATE shops and shopping.

There is a simpler, more leisured life out there – we need to get off the treadmill. There is enough real wealth to go round – and an abundance of time to be claimed back. As a wise man once said: “The rat race is for rats”.

You mean we won’t be able to sell arms to Saudi Arabia anymore, how terrible.

And the link between oil and Covid-19… the Guardian reports on a recent study that suggests that: “Air pollution may be ‘key contributor’ to Covid-19 deaths. Research shows almost 80% of deaths across four countries were in most polluted regions”: https://www.theguardian.com/environment/2020/apr/20/air-pollution-may-be-key-contributor-to-covid-19-deaths-study

Could that not be because the most polluted regions also have the most densely packed populations? There may be no connection what-so-ever. It may be just coincidence. Its a bit early to make that call.

Dear All

I concluded my comment with ” Nothing has Changed” to see if I could “get a rise”. Some of us obliged!

To sum up, what we have seen is an unprecedented oil demand crunch occurring simultaneously with a violent supply surge. That effect is what gave us the events of 20 April. None of this changes in any way fundamental energy realities. What more can I say?

William

William, how do you think the large oil companies will manage this crash in demand?

I’m assuming that something as complex as an oil field can’t just be switched off like a light bulb.

Exactly. Many marginal fields will be shut down and may never recover. Many companies will start to see the volatility and of the oil industry as another sign to transition. Most of the big oil companies are already transitioning, this will certainly speed that transition up.

Once pension funds stop seeing oil as a “safe bet”….

Wul

Thanks for the question. Potential shut-ins are a difficult question for producers of all sizes especially where, as in the USA, there is no buyer for the oil nor even available storage. In the very short term this can afflict fields of all sizes. In fact with preparation and contingency planning it is possible to shut down most fields over a period of days and weeks and executives should have been on notice.

There is no doubt that there will be corporate casualties and we are seeing a lot of arguments about whether oil industry players are in force majeure. I had quite a discussion today about that.

Regards

William

Thank you for your reply William.

Interesting times. I’ve read that low demand for electricity is creating problems for grid managers too. I hope you and your colleagues stay safe.

William, you wrote “we are seeing a lot of arguments about whether oil industry players are in force majeure. I had quite a discussion today about that.” Would you like to expand?

George

Thanks for your question. Force majeure ( or lack thereof) is indeed the talk of the steamie in the oilpatch.

As I was saying, the real reasons for the oil price collapse are two- fold :(1) the crushing fall in demand caused by Covid and the lockdowns; and (2) the simultaneous surge in supply caused by the price war. This is a black swan event scenario and its effect is to dramatically cut revenue to oil producers and imperil their short to medium economic prospects. The fact that underlying energy realities are unaffected is neither here nor there in immediate terms.

Most oil and gas contracts whether between oil companies and governments, between oil companies and other oil companies, and between oil companies and service providers such as drilling contractors have so -called force majeure clauses. The concept behind force majeure is that a contracting party cannot perform because of events beyond their control such as civil war, earthquakes, sanctions etc. However, mere inability to pay is by definition not force majeure. If parties could argue that the pandemic itself was stopping operations then there would be a force majeure argument. But here the problem is not the pandemic but inability to pay. Inability to pay leads to payment default which can in turn lead to rapid loss of licences/contracts etc. It concentrates the mind!

The oil business and force majeure have a long history…

William