The Eightball of Scottish Independence Economics

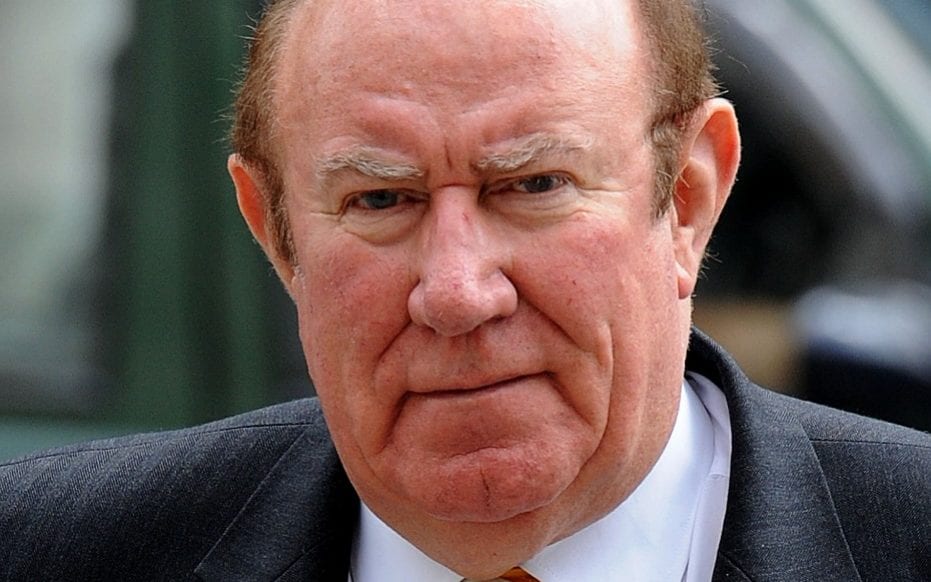

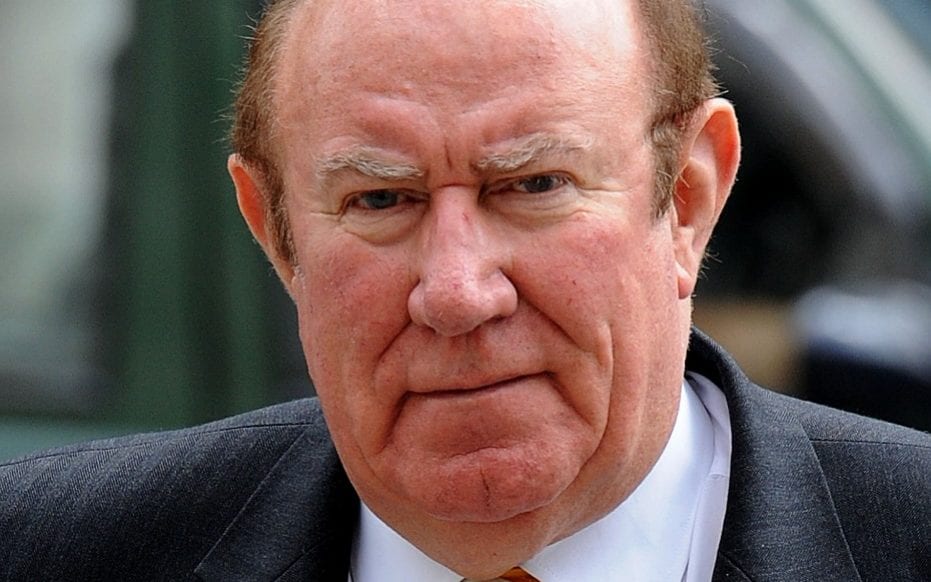

Richard Murphy’s retort to Andrew Neill (high-paid BBC employee and political campaigner) is worth a fresh look. Currency and debt is a key battleground in the next phase of the democracy movements battle for self-determination. The debate unmasks the stale economic dead-certainties of the British establishment, but also much of the conservative instincts of the SNP.

One of the funniest aspects to this is the mismatch of readings. The Unionist analysis (driven by a fair amount of self-conceit) is sure that this is the weakest link in defence against the now resurgent Scottish independence movement. The Scottish Government, still bruised by the encounter in 2014 agrees, but in doing so makes the situation far worse by advocating Sterlingisation. The Unionist don’t realise what they think their strongest card is actually their weakest. The Scottish Government doesn’t realise what they think is their weakest card is actually their highest. One side is blinded by over-confidence, the other by over-caution.

What happens next is crucial.

Richard Murphy (‘Tax justice campaigner. Visiting Professor of Accounting, Sheffield University Management School. Chartered accountant. Co-founder of the Green New Deal’) lays out his case here, Murphy writes:

“Andrew Neill posted a series of comments on Twitter yesterday, all aimed at taunting the SNP on which currency it might use after independence. He hit a target by doing so. This thread explores that issue.”

“The SNP membership rejected the leadership’s position on this at a conference. They have opted for a policy of transitioning from sterling to a Scottish currency as quickly as possible – which means weeks or a few months at most – after independence. Andrew Neil clearly thinks a Scottish currency would break Scotland, and lead to referendum defeat. He thinks the currency issue is an each way bet for him and that it kills the issue whatever option is chosen. He is wrong. History is full of examples of newly independent countries successfully launching new currencies, either on, or within weeks of, independence. The history is current, too. To claim this is not technically possible is wrong then. But is it economically feasible? Neil claims it isn’t because no one would lend to Scotland. It would, he claims, have no credit rating. But that is absurd.”

- First, Scotland may not need to borrow. It will inherit none of the UK national debt, which will belong to the rest of the UK as the successor state. And it will only contribute to UK interest costs at current low rates. So Scotland will start life without debt and with a very low interest contribution made as a gesture of goodwill, which will mean its interest spend will be exceptionally low. That’s good for credit rating.

- Second, Scotland has a strong and continuing legal system already in use and a functional tax system it can use, even if it would want to transform it (I hope). So it will have a tax revenue stream. And Andrew Neil should know that credit ratings are based on income streams, so Scotland will be in a good position. And that income stream will be entirely collected in Scottish pounds. That will be the only currency for payment.

- Third, Scotland will have foreign currency reserves on independence as people in Scotland transfer their current balances into Scottish pounds, all voluntarily, because those will be what they need.

- Whilst, fourth, debts to banks in Scotland, including mortgages, will be converted to Scottish pounds because that will be the condition for those banks continuing to operate in Scotland under Scottish banking regulation.

- And fifth, this will then let Scotland use QE if the money markets don’t play ball.

- And sixth, Scotland could then set its own interest rates, if it so wished, including differential rates for depositors and borrowers, again if it so wished.

- And seventh, Andrew Neil forgets that Scotland remains an energy powerhouse with a boom in renewables about to happen, with a neighbour on its market desperate to buy. The chance that this currency will be weak is very low in that case. The issue may be its strength.

- Eighth, that then gives no incentive at all to join the euro, even if EU membership is sought, and this situation is easily engineered and tacitly accepted by Brussels.

Andrew Neil is the personification of establishment media power in Britain, an ultra-Thatcherite former Sunday Times editor who is the BBC’s flagship political presenter, he is now being spoken about as a possible chairman of the BBC. As a Scot his views are totemic for the Unionist cause, yet on this issue he is consumed and confused by his own hubris.

Richard Murphy’s arguments will cause apoplexy amongst those who feel that the economic case for Scottish democracy is its weakest. There is a deep-seated and historically rooted set of assumptions here and with political vision and arguments in scarce supply – all is being betted on this.

But as John Warren has explained recently – much of this has already been conceded:

“The British State has already acknowledged that it was taking full responsibility for all the commitments associated with currency in the event of Scottish independence in 2014. In January, 2014 the Treasury made a statement on currency, post-independence: “In the event of Scottish independence from the United Kingdom, the continuing UK government would in all circumstances honour the contractual terms of the debt issued by the UK government”.

Warren concludes: “The solution proposed by rUK in 2014 was vital to rUK, and it suits Scotland well, because independence is de facto defined by being a currency issuer, not a currency user; currency issuance is the defining feature of modern independence.”

It’s a long way down for people still living in a fever-dream of British entitlement and exceptionalism.

There are a lot of folk in Scotland who would wish an independent Scotland to join the EU. We would not be able to do that without having a functioning central bank and a Scottish currency first. This is not explicitly stated in any rule about joining as far as I can see, but in https://ec.europa.eu/neighbourhood-enlargement/policy/conditions-membership/chapters-of-the-acquis_en, it says “The acquis in the area of economic and monetary policy contains specific rules requiring the independence of central banks in Member States” so I think we can take it as read. I think this would also rule out a currency peg, as that would prevent central bank independence and would not allow Scotland to demonstrate the required financial stability.

This can and should be pointed out to anyone in Scotland who favours EU membership, but is talking about using sterling for years or for ever like some appear to think.

Of course Andrew Neil is not in Scotland but I strongly suspect he knows this.

Disclosure: Although I voted to remain in the EU while stuck in the UK, I have strong reservations about joining the EU when we become independent. However, I suppose it would be put to a vote at some point, and I’d be over-ruled. But please, we must not not join the Eurozone (even if we have to promise to get in).

are you suggesting Scotland outrights lies to gain access to the EU? The euro is central to the EU federalising project why would you want to join if you’re not willing to take that on?

I’m not keen on joining, so don’t blame me. The rule is you have to commit to joining the Eurozone after being in the ERM.

The odd thing is that you are not forced to join in the ERM nonsense, with it’s mad economic convergence criteria on deficit and debt.

Sweden has no intention of being in the Eurozone, and the consensus is that it will continue failing to meet the joining criteria.

There are two opinions on what needs to happen to the EU organisation, as the current system is unworkable. Either the Eurozone will collapse, or they will move to a federal system with a real EU government. Why should we join such an unstable organisation?

Denmark and Sweden still have their own currency. We don’t have to lie. All we have to say is we promise to consider joining the euro, just as they did.

Latvia, Estonia, Lithuania – I believe they may be in the euro zone? But when they broke away from USSR they must have ceased using the ruble?

I was about to point out that Sweden and Denmark use their own currency.Scotland is to have a central bank! The chosen currency to be used as early as possible. Because the way Westminster has set up their own rules in what is broken Union,and some one decided on a lot of rules including the borrowing of money is not in Scotland,s remit,that everything that is borrowed is for the benefit of Westminster,that Scotland is to contribute to all these projects,means two things we have neither purchased nor borrowed.Living frugally within our means,being well within our vast resources,that we should have a favourable outcome. This attraction comes with a Triple A.A.A. rating better for borrowing,as against England,s rating A+ less favourable terms.In terms of needless expenses i.e Trident and a host of wasteful needs we would be far better off,and more responsible.There are a lot of secretive deals needing uncovered with whom,stolen goods sold on,without Scotland,s permission.

Sturgeon loves to compare Scotland to Denmark and it always amuses me. From memory, Denmark has a 2.2% fiscal surplus and, as we learned today, Scotland has just increased its deficit to more than 8% – the highest in Europe. Denmark has currency reserves of something like $61 billion and Scotland would start with none other than a pro rata share of the U.K.’ s £147 billion , which might amount to £10 to £15 billion pounds. At least half the population with no confidence in the economic skills of the SNP would move all of their currency, and most of their spoons, to places safe from the SNP where deposits are denominated in pounds sterling. In 2017, Moody’s one of the worlds three biggest credit rating agencies said that an independent Scotland would have a “junk” credit rating – in the same group as Azerbaijan and Guatemala. (Note Moody’s are neither English nor “ Toarees“)

Sixty three nations have separated from london rule !

Not one of them have encountered insuperable or even significant problems with currencies ?

And not one of them has applied to return to london dominance

Why Scotland ?

Gordon, there are numerous examples – Zimbabwe is one of the more extreme ones.

The most obvious example is the Irish Punt. They kept it at par with Sterling for a good while then let it float and subsequently went to the Euro.

All options are open as an alternative currency; the £Pound, The $Dollar, The Euro or best to start with a Scottish Pound that is, for a short time at first, kept at par with Sterling. It is and will be a decision that needs to be made then sold to the electorate.

The SNP leadership and their advisers like Andrew Wilson are many things, but they’re not dumb. They know all these arguments for a Scottish currency inside out.

So, I think the only way to read their insistence on Sterling as a post independence policy is as a marker for the kind of Scotland they envisage a few years down the line. That would be a Scotland very much thirlled to England, in matters like the currency, defence, the Head of State and an economy aligned to England rather than Europe…

It seems highly unlikely that a country using Sterling could at the same time join the EU and by doing so create a trade border at the Tweed. It makes no sense for a country in the EU to use the currency of a country outside the EU, as opposed to using the EU currency itself, the euro, does it not?

What the SNP leadership seem to want is an enhanced Treaty of Union to be negotiated after Scotland has voted to end the Union of 1707…

It is disingenuous to think Wilson, Sturgeon, Murrell and other high heid yins don’t know all this…

PS: If Sturgeon and Murrell and their “people” have come to the conclusion that the best Scotland can get following the Brexit vote is a better deal with England than the one we currently have, that would certainly explain their breezy nonchalance about our European rights being stripped away from us come the end of this year which are contained in the Charter of Fundamental Rights of the EU: https://en.wikipedia.org/wiki/Charter_of_Fundamental_Rights_of_the_European_Union

I don’t know how many of these rights exist are covered by the UK Constitution, but make no mistake, the UK is by far the most right-wing country in Europe and we will not have the same rights as citizens outside the EU as we do inside the EU and the protection under the Charter…

The Scots who vote for independence will never accept another union with England, ever. Take your opinions and suggestions on currency from there. Just being helpful. I can see you have given the matter a great deal of thought but I have to enlighten you to this fact.

Maybe so, Alison, but the current leadership might well do so. How would we stop the Charlotte Street wing of the SNP striking a deal with London after a YES vote which basically amounted to an enhanced version of federalism? Where is the emergency brake? The Charlotte Street Wing of the SNP will tell you we trade more with England than with the EU, that we have more in common with England than Europe, and they can win support from Unionist Scotland by doing so..

I am for an ndependent democratic Scottish Republic fully aligned with the EU – no ifs no bits and no opt outs. But that is hardly the point I was making…

Doug:

It strikes me as rather naive to believe the SNP has even the faintest desire to actually gain independence. That would derail their gravy train. They want to lose in a way they can blame on ‘wreckers’.

The dishonesty of the SNP leadership is clear – for example, they pretend the last general election showed great support for independence , rather than admitting the obvious truth which is that Scots had an adult alternative to Boris and Corbyn; if the SNP had put up candidates in English seats, Sturgeon would now be PM.

Dave

I can’t agree with you that the SNP don’t really want indie. I think in their own minds they do.

It’s a bit like referees always blowing penalties for the Old Firm in the last five minutes. Are all those refs Celtic fans / masons? No, probably not, but the circumstances – thousands of Celtic / Rangers fans screaming and shouting for a penalty – unduly influence them. The SNP want independence, but they also want “stability” as any establishment does and those two things don’t really go together.

Or to take another example from the world of Hollywood. In an action movie, maybe the main character has to jump over a gap, or leap over a river of molten lava or….whatever. And they lose their nerve and can’t do it. And stand their paralysed. Only after a corny pep talk by the hero do they find the will to jump (a leap of faith they call it, and for a reason. If you don’t believe you’re going to make it to the other side, you won’t…)

I agree with you that anybody at all would beat Boris Johnson in Scotland. If it were possible to stand an animal, say a one trick pony, in a safe seat against the Tories, I would vote for the pony (a one trick pony). I would like to see that happen in fact but probably the electoral law prevents animals standing….

Basically, Dave, to try to understand humans along the lines of want / don’t want doesn’t really get us far….humans are a lot more complex than that.

As we all know from our own lives, there is a difference between wanting something and having a real hunger and desire for something. Just wanting something won’t be enough probably to attain it in life.

Will you go the extra mile for it, will you risk everything for it, will you suffer for it, will you do the extra work? Those are the questions, and the SNP leadership clearly won’t risk everything for indie nor suffer for it in any shape of form…

If there really was an interest with the gravy train,why not join the House of Lords,an easy way to sleep through the day,enjoying an excellent lunch washed down with the drink of choice. Then a flight home. Ask those from the London Branch parties about these advantages,the S.N.P. not interested.The S.N.P. trying to do the day jobs in Westminster for their constituents, leaving out the heckling,animal noises and those that are sex pests.

Could another possibility be that they think “keeping the pound” will sound most reassuring to the soft “No”s and “Yes”‘s they need in order to win a referendum?

And that, in reality, Day 1 of independence is a new country where anything is possible?

Douglas, I’m very glad to see you bring some actual analysis to this thread. The struggle now is within the SNP. We need to get real about this 🙂

The biggest problem is the fear factor. Of course a separate Scottish currency is a no brainer but while the BBC and almost all of MSM will be pumping out stories about using the Groat and the Euro many of the voters will take the bait.

Fear can always be dissolved with the enlightenment of truth plainly written or conveyed by any other medium.

That is the task of the SNP and any other fair minded person.

I am a Scot in OZ but my soul still resides in Scotland I was removed as a boy like so many of us to reside in The Great Scottish Diaspora Scotland’s Empire. And we never forget our origin.

Scotland Forever

James Dow

As if a people whose ancestors were credited with the modern enlightenment could not manage their own nation is a ludicrous proposal.

Scots have been regarded as deep thinkers and uncommonly intellectual, something that is going to be proven by Scotland’s impressive young adults when they assent to the management of their nation. Scotland will be in very competent good hands and become a showcase to the world of just what is possible where compassion and ethics are combined for the wellbeing of a nation and its people.

I agree that fear can be overcome with inspired leadership. But we don’t have that, we have Nicola Sturgeon who is a safe pair of hands in a crisis, but has no vision, no fight and no fire in her belly….

Salmond was more spirited in that sense, but the revelations about his boozy Bute House nights show him to be weak and mediocre in my view. That’s not leadership at all. Even worse, it’s just not professional behaviour.

Where is the next leader of the SNP then? I don’t think there is a clear favourite or stand out candidate.

But I really can’t see Sturgeon and Murrell and their woke cabinet leadingg us to independence…..and even if they did get us over the line, it would be by one milimeter and no more…

Richard’s points are so obvious to those of us who have studied these issues. What I find strange is that Andrew Neill, who is no fool, has swallowed the right wing propaganda on this issue and actually believes it. However, what is most strange is that the SNP leadership should see this issue as a difficult one for them, when it is in fact the very opposite, it is one of their strongest cards if they could just pay attention and examine the issue. Many SNP members have done this and are streets ahead of the leadership on this issue.

I agree Andy – though I think Neil has created and published quite a lot of the right wing propaganda himself. As I implied in the article the shrouds of superiorism and myths about Scottish poverty and inadequacy are boosted by deep belief in economic orthodoxy by the likes of Andrew Neil and his base.

It is a strange one, the ongoing SNP insistence on sterlingisation. I suspect the electorate, or at least a large chunk of it, has moved on from 2014 and understands the requirement for a Scottish currency.

You’d think the SNP’s job was to sell that to the rest of the electorate.

Let’s face it, many of us haven’t spent a single one of 2014’s totemic ‘pounds in our pocket’ since lockdown: money is plastic and digital now and, if you use the right bank, easily convertible without charge between currencies.

Andrew Wilson is smarter than me, so I don’t know how he doesn’t get it.

The strength of a currency is based on it’s reputation. There are an abundance of economic markers that would lead you to conclude that the USA dollar should fall in value, but it’s value remains because it has been trusted as the major global currency for decades. That’s why I asked the question in this thread about new currencies that have been created in the recent past (e.g. last 30 years) on the back of a new country becoming independent which are regarded as reobust and reliable on the international stage. I honestly can’t find any but I’m really trying to as I do believe currency is the major issue.

Carolina, there are several new currencies that are reasonably respectable – you narrow the field by requiring them to be newly independent countries. (Arguably – semantics – the EU became a country when it launched the Euro…)

A couple of reasonably normal examples though: Serbia and the Czech Republic.

Fwiw, I don’t think there are any theoretical obstacles to Scotland having its own currency. The practical obstacles make it entirely moot, though, because no-one will trust the shysters running the SNP to stand by their promises. Would you accept an IOU from someone previously convicted of writing ious with no intention to pay?

To quote from the article “History is full of examples of newly independent countries successfully launching new currencies, either on, or within weeks of, independence.”

I was hoping to be pointed to an example of one of these currencies that is considered to be robust and reliable on the international stage, but I’m not sure the Koruna or the Dinar could reasonably be placed in that category?

Currency is really important, even if people don’t understand the underlying principles of how currencies work, we are all familiar with examples when it has gone very badly wrong and bankrupted a nation, e.g. Germany pre WW2 and Zimbabwe more recently. The laymen needs to be comfortable that a Scottish Pound won’t go the same way ahead of indyref2 so examples of countries who have done this well are really important

Ok – for examples in last couple decades …. Slovakia, Czech Republic, Estonia, Lithuania, Latvia, Bosnia Herzegovia, Croatia, Slovenia, Serbia, Montenegro, Israel,Ukraine, Belarus, Georgia — all set up new currencies when became independent / established and some later joined the euro.

Not rocket science.

Hi can anyone point me in the direction of the newly created currencies that have been created to support newly independent countries? Mike references them in the article as do some of the other comments but having searched for them I can’t find any from recent history. Thanks

This is a good point Carolina. I’d like to know too.

If the SNP hierarchy cant even sell the growth commission proposals to their own Indy supporters , what hope for convincing soft nos and undecided.

We (indy convinced) should be showing and leading the unconvinced to the merits of own currency . It is a no brainer and once folk understand it they will see it as the way forward.

The SNP must listen to their grassroots that will do the campaigning and promote and lead on a new Scottish currency.

‘The SNP must listen to their grass roots’?

“Is must a word to be addressed to princes? Little man, little man!…..” said Queen Elizabeth on her death bed.

I think the SNP grass roots would do better to speak directly to the electorate, than wait for their present leadership to do so.

I read many things and some of them stick. The other day there was something headlined with FUD. This is sometimes used in a derogatory way but in the instance I read it was an acronym for “Fear Uncertainty and Doubt”. This is and will remain Westminster’s main weapon against Scottish Independence; ask all sorts of questions and propound that each of them is a hurdle that the Scottish government cannot get over.

The currency is just such an obstacle. As explained fairly well in this article it is not a major problem so long as it is faced, decided and explained. At present we do not have any clear lead other than in forums like this, The Growth Commission was a sop to the frightened saying little or nothing will change. We DO want change and big time, not all tomorrow or in a disorganised way but who is taking the lead and convincing the electorate? Maybe I’m missing something but there is no leadership to take us forward into any referendum that might come along.

It seems to me that this piece misses a key point. The issue is not whether Scotland can have its own functioning currency (of course it can), but whether people believe Scotland can have its own functioning currency. Think back to 2014: If Scotland had voted Yes, of course there would have been a currency union. Better Together won not because they really would have refused a currency union, but because they were able to instill doubts in peoples’ minds about it. Just the one speech by Osborne did the trick.

Exactly the same goes today. What is needed is not so much a plan for a currency, of which there are now several, but a strategy to instill confidence we can handle the currency issue. We also need something brief we can say to that effect when on the doorstep. Just saying ‘Of course Scotland can have its own currency’ won’t convince the doubters. Or at least not yet: perhaps if Sterling goes down the tubes after Brexit this will change.

Unfortunately I hear very little about such a strategy within the Yes movement. At the risk of attracting general opprobrium, it seems to me that the Growth Commission at least sought to address this issue with its ‘We’ll use Sterling to start with and move to a new currency when it’s the right time to do so’. This has the great advantage of sounding eminently sensible and of being self-evidently true : no-one is suggesting we start using a new currency on day one, which you can be sure would scare people witless.

Paddy, correct, your side are faced with mission impossible in tying to convince us that our economic future would be assured in an independent Scotland. Your own Growth Commission – which Sturgeon et al have done their best to ignore or rubbish – lays out in stark detail the bleak economic future on offer. Even more unappealing are the attempts to rubbish the GERS figures or to say that under independence, hey presto, all the problems would disappear, something Forbes did yesterday. ( By the way, does anyone, even the most hardened Nat ultra think that she is a convincing figure? Jesus!) The same goes for all of those who try to downplay the whole currency issue. The idiocy of much of what they say simply reinforces the view that most Nats don’t understand or don’t care about the economic consequences of independence for ordinary people. Or do you think people like me are prepared To risk their economic security, their savings, income, pensions etc, on the say so of people who are never happier than when they are parading about in a kilt and a lion rampant? Funny thing is, those poor deluded souls, most with hardly a penny to their name, would be the ones who would suffer most under the future laid out in the Growth Commission. Sturgeon and the rest of her well heeled tribe of professional camp followers will retain their beefstakes, their gold plated pensions, no matter hat happens. And that my friend, the reality of class politics, is something that you nationalists never understand and the reason why you will never convince me to join your crusade. Ultimately, nationalists place the ideal of the nation, a historical abstraction,above the reality of class and the class struggle. You want us to believe that our interests and the interests of the greedy exploiters who employ us are somehow the same because we inhabit the same piece of earth. That is the essence of romantic nationalism and something I saw through as soon as I could think for myself. But feel free to keep deluding yourself that you and the multi millionaire Blackford are part of the same community.

Well said

Much has been made here of the UK taking responsibility for the UK debt which is fair enough but surely as with any Partnership breakup any Financial settlement will need to include a split of Assets as well as Liabilities and I suspect in the Independence case Scotland’s share of all UK & Commonealth Assets would amount to many £bn’s if not £trn’s. I have heard so many estimates of this now so would welcome some independent assessment. Anyone?

Mr Robertson, Mr Albert,

There will not be a division of assets and liabilities, because rUK is the ‘continuator state’. This is not a dissolution of UK. rUK is the continuator state.

The terms of Scotland leaving the Union is by mutual negotiation under international law. International law has no fixed “code” beyond mutuality. The lawyers resort thereafter to soft ‘opinion’, thick in ambiguity and distinctive and very different cases, in different circumstances, leading nowhere solid.

We need not debate how this goes however, because we already know the answer. rUK is not going to negotiate. It is just assuming ‘continuator state’ status for rUK. This is not a negotiation, but a decree. rUK has taken the currency and central bank, assets and liabilities in their entirety. They have already committed to that, without any exceptions. Scotland is excluded from control over its own currency. Alex Salmond wanted joint sovereignty over the £Sterling, but the British Government, Treasury and BofE rejected the proposition. They wanted complete, sole control of the currency, BofE, and all assets and liabilities of bot,h in order to have full sovereignty as continuator state. Scotland has not rejected this, because it does not want dissolution either.

Scotland accepts that, because nobody wants dissolution. rUK is not, however free simply to have what it wants, as if it can dispense with mutuality entirely, wherever it suits rUK; and insist on mutuality wherever it suits rUK. rUK is not free to renegotiate the currency deal it has already issued to the whole world; only to manipulate the deal privately with Scotland on a pick-n-mix basis, at rUK’s exclusive option, to select what Scotland receives from this non-negotiation; and lo, all Scotland receives out of the currency settlement (surrendering all its rights in its own currency and its central bank!) is responsibility for the debt (in what will be a foreign currency – the worst of the worst) – and apart from that, use £sterling as a outside, monetary dependency of rUK and even the BofE, or do something else; whatever!

This proposition only has to be stated to be quite obviously ludicrous. The price of rUK taking everything in currency matters is written on the tin: it takes everything, including all the debt. rUK quite manifestly, and as it knows perfectly well, for good reason, wants the currency so badly, it wants it all; well, it can have it all – but only when it takes the lot: currency, central bank, all the assets and all the liabilities that go with the currency. If it doesn’t do so there is absolutely no mutuality in the agreement whatsoever.

That is the only way there can be a continuator state, and a fair, mutually acceptable agreement.

There is a lot of chatter here to the effect that Scotland can walk away “ Scot Free” from the U.K. National Debt. I think that opinion is delusional. The contrary view was acknowledged in the 2013 Independence White Paper and is well explained in the attached BBC statement. https://www.bbc.co.uk/news/uk-scotland-28541393

At that time, Salmond was trying to use acceptance of a share of the debt as a bargaining chip to set against Westminster’s willingness to agree to a currency union which, understandably, he saw as hugely preferable to the alternative – sterlingisation. The latter had been considered but was rejected because of its well known disadvantages. Now, with no alternative, it has been adopted by the Growth Commission as the only option.

Acceptance of responsibility for a share of the National Debt is also accepted by the GC in its recommendations. To quote directly from two paragraphs of the the summary report :

Annual Solidarity Payment

3.120 An agreement should be sought for a mechanism for Scotland to pay a reasonable share of the servicing of the net balance of UK debt and assets.

3.128 For the purposes of our report we take a conservative estimate based on OBR projections and the balances noted and assume an annual debt servicing charge of £3 billion (1.6% of GDP in 2021-22). However, this will fall as a percentage of GDP over time, as a result of inflation and economic growth.

In addition to the above considerations, thought needs to be given to the fact that an independent Scotland with no credit history other than that revealed by the GERS statistics, and no record of managing its own currency will not be attractive to lenders. It certainly would not help to impress lenders if one of our first acts was to renege on historical debt. In 2017 Moody’s, one of the world’s three biggest international credit rating agencies, said that an independent Scotland would have “junk” credit rating status and be on a par with Guatemala and Azerbaijan.

Mr Munro,

I do not know whether you have actually read my article, or my comment; in any case you are simply wrong. Alex Salmond made a poor judgement in 2014 (and it failed for obvious reasons, but not ones you appear to understand); the SNP has merely continued unerringly to follow the same mistake; and it has been consistently unsound on the currency issue. It is now holding them back. I suspect it is unlikely to survive as SNP policy, and it would be a serious blunder if it does survive. Your links and sources are not authorities, and your opinion is not backed by sound argument, or any evidence. I will not stoop to describing it as ‘delusional’, but the wish is clearly father of the thought. Your assertion is just that – assertion; it is not grounded in international law.

My argument is based on the clear and unequivocal statements made by the British Government, and the entitlement and responsibilities it has already claimed over currency. My argument follows both in harmony with and logically follows from that British commitment. This position is effectively supported by the Treasury and BofE, and is perfectly consistent with international law. The sovereignty of rUK over £Sterling, central bank, and all the assets and liabilities are absolute, and do not depend on anything Scotland does. That means Scotland is not responsible for the liabilities, and there are good reasons for this absolute commitment by rUK: it is the continuator state, it goes with the territory and it is what rUK both demands and requires.

You assume what you actually need now to prove; that a mutually agreed equitable settlement on currency with rUK, in which rUK takes for itself absolutely everything on its own chosen terms; and requires Scotland to surrender – for nothing, zero compensation – all its rights to its currency, its central bank, all the concomitant assets (all of which it must now provide anew), except only that it is supposed to have an inescapable, exclusive responsibility for debt liabilities of rUK; a responsibilty it will have to take on, as a foreign currency debt. That isn’t an agreement, it is a penalty: as a statment of a negotiating position it is, prima facie – madness. You require to show that this appalling state of affairs meets a plausible standard of credibility as an equitable, mutual agreement under international law.

By all means disagree, but you require to come up with a lot more than the puff you have shown; authoritative, relevant, comparative sources and rigorous demonstration are now necessary (I await with genuine interest).

Mr. Warren,

In disputing your opinion I relied on the support of the 2013 White Paper, Alex Salmond’s statements at the time of the 2014 referendum, the recommendations of Andrew Wilson’s Growth Commission and the opinion of Colletta Smith. BBC Scotland Economics Correspondent. As this did not shake your faith in the contrary position I have found, with little effort, the following opinions both published in the Centre on Constitutional Change at Edinburgh University.

By David Bell :

“So much for new debt. What about existing UK debt and assets? The White Paper argues that two methods could be used for calculating this debt: the first simple one is based on a population share, the second is based on aggregating past fiscal deficits. The estimated aggregate debt based on this method depends on where you start the clock running. The White Paper chooses 1980-81, just before oil revenues start to have a major impact on UK public finances and not surprisingly comes to a favourable conclusion about the size of the debt. Then again, the UK government might argue that Scotland should bear a larger than its population share of the debt because of the extent to which financial institutions based in Scotland have been bailed out by UK taxpayers. In these circumstances, a compromise around the population method may be the most likely outcome.

The Office for Budget Responsibility forecasts that by 2016-17, UK debt will be £1.6 trillion. Debt interest charges will be £64.4bn. Using the population method, Scotland’s share of the debt would be £132bn. This will exceed 80 per cent of Scotland’s GDP.

The White Paper argues that the Scottish Government will not take legal ownership of this debt. Instead it will make payments to the UK government to meet the servicing costs of Scotland’s agreed share of the debt. Thus, because these historic debts were accumulated when Scotland was part of the UK, there will be no change in their management”

Then, by Dr. Angus Armstrong and Dr. Monique Ebell, National Institute of Economic and Social Research

“The division of the UK’s debt and assets is likely to be keenly negotiated. One of the few precedents of peaceful, and neither post-colonial nor immediately post-Soviet splits, is the ‘velvet divorce’ between the Czech and Slovak republics. The general principle was that physical assets belonged to the state in which they were situated, while the debt was divided in line with the relative population size.

In the case of the UK, we follow the precedent set by the Czech and Slovak divorce and attribute a geographic share of oil and gas to Scotland in our baseline case[2], and divide public debt on a population basis, so that Scotland would become responsible for 8.4% of the outstanding debt at independence. The resulting gross and net debt burdens for Scotland are summarized in Table 2.1, under the hypothetical assumption that the outstanding gilts could be divided up. Scotland’s initial gross debt to GDP ratio would be 86%, while the PSND measure would be 74%.”

I like to think that I take an informed interest in the independence issue and over the years since 2014 I have only come across contrary opinions from yourself and Richard Murphy. That does not mean you are wrong but it certainly does not mean you are indisputably correct. Do you think that if Mr. Wilson had sought the benefit of your advice the Growth Commission would have advanced an opinion less congruent with mine?

Denis Munro

Mr Munro,

The 2013 White Paper is not a well-sourced authority. Bell simply takes for granted its starting point on debt. The starting point of the White Paper did not prove to be sound. Your second source, Armstrong and Ebell say that the assets and debt will be “keenly negotiated”. Wrong. There is no negotiation. rUK simply decrees it takes the lot. The absence of negotiation, and therefore of mutuality is clear. The reference to the Czech and Slovak divorce gives the game away. The Czech-Slovak divorce was a dissolution. Everything was split, precisely. Right down to the art collections. Scotland-rUK is not a dissolution. It is very different: an incorporating union, acting as if it was a federal state through secession, to allow a continuator state to exist; a very distinctive case.

I have explained this, if you had read my comments and article. rUK is taking “continuator state” status. There is no split of assets and liabilities. Each country takes what is on its own territory. rUK takes absolute control of everything that is required to operate continuator state status (for UN security council, G8, IMF etc., etc., status); to establish total sovereignty as the continuing state. The most important of all these issues is the currency, which is why the British Government made its 2014 announcement. It can do this, Scotland agees ti, but rUK cannot take allof this, make all the rules up exclusively in its own interets, and then say it owns everything, and Scotland loses all mutual rights flowing from mutual agreement around the joint currency. Here mutuality in international law must be established. Scotland’s currency interets also require to be taken into account. Taking a responsibility for rUK debt in a a currency over which it has no control, and de jure becomes a foreign currency for Scotland is a catastrophic proposal: totally unacceptable. Nobody in their right mind would accept that.

Try again Mr Munro, if you wish. Not good enough.

Mr. Warren,

Today of all days your opinion, if correct, would be music to the ears of the SNP. It would make their worries over the bloated deficit a trivial matter.

I imagine that before producing the 2013 White Paper, or accepting the opinion of Andrew Wilson and his eminent group on the Growth Commission, SNP mission control would have taken a broad range of legal and constitutional advice on Scotland’s obligations to the U.K. debt. Nowhere would your opinion be more welcome and yet it has not broken through to illuminate the debate over the past 6 years. You loftily dismiss the White Paper as “ not well-sourced” ( ditto the views of Alex Salmond) and yet the conclusion expressed there has now been repeated in the Growth Commission report which I quoted to you.

You treat with equal disdain the expert opinions expressed under the auspices of the Centre on Constitutional Change which, by its own description is, “ a leading centre for the study of constitutional change and territorial politics in the United Kingdom and beyond. It was established in August 2013 to research the UK’s changing constitutional relationships. Based at the University of Edinburgh, its current fellows include academics from the Universities of Aberdeen, Cambridge, Cardiff, Stirling, and University College Cork.”

As your opinion is an outlier, positioned at a great distance from a solid cluster of eminent research with an opposite conclusion, I think I will side with the majority and move on. If your view ever escapes from a blog, here and there, I will of course reconsider my stance.

I think you are rather over-blowing the reputations of those you treat as authoritative sources: both the White Paper and Alex Salmond were simply ignored by the British Government (whom thay have not challenged), and in spite of your confidence in the Growth Commission, they have in fact moved their ground significantly, half-accepted 2014 was wrong, intend to adopt a separate Scots currency, only in an ill-judged form, and have still managed to end in the middle of nowhere, impressing nobody – from Common Weal to the membership of their own Party; but if you think all that is “authoritative”, good luck with that). Outside the narrowly sought, slightly parochial opinions you sought (for they are just highly subjective opinions), and you are obviously prepared to rely on, you offered nothing that contradicted my argument from either real precedents, factual statements (e.g., British Government, 2014) or international law. I am not prepared to rely on such thin gruel as appear to meet your criteria. Clearly your head is turned more by modest claims to “authority”, in whatever guise it comes, than either facts or sound argument. That is your prerogative of course, but I do decline to accept alleged authorities when they are in error; I just present arguments and facts. I claim no authority; I just do not accept any White Paper or Think-Tank prima facie, that airs its views; I examines the claims, and offer an opinion. I am not searching for disciples. You can take or leave it, it really is all one to me.

If your view is right, or even has a degree of plausibility, the SNP will have most to gain and will seize on it to transform the bleak story the Growth Commission had to tell. The Spring conference last year was dismayed to hear that it would take the best part of 10 years to get the deficit down to 3 % so Andrew Wilson was “ sent homeward to think again.”

I do not know why you think the SNP will be pleased to hear this; they have resisted this opinion doggedly, which incidentally is not exclusively mine. You really do need to widen your reading. The world beyond Britain, and the trite shibboleths of Unionism is very, very different.

Mr Munro,

I have answered your comment in detail in another comment, but here you have stirred my curiosity. Clearly what you see as my ‘disdain’ irritates you; for you used you last comment to pastiche the disdain: touché, if that is what floats your boat.

My curiosity is this. If you feel so strongly about both your ‘authorities’, and you are disdainful of the arguments here. What one earth are you doing here, ploughing through comments at length? I can think of Blogs and Tweeters I Disdain. I don’t go there; it is wasting my time. I didn’t ask you to waste time on my arguments; but I have wasted considerable time on you.

What a prickly individual you are : but it is consistent with your haughty dismissal of the eminent academics and institutions I cited in my comments . Your “disdain” for them astounded rather than irritated me because I thought it unlikely that your opinion, if correct, would be hiding like “the flower that is born to blush unseen” in an obscure blog. I had never heard of the blog, or you, until this week but that of course may be due to my need, as you say, to read more widely.

As far as I was concerned, the exchanges had concluded after your second response and I am puzzled that you should see the need to re-open them with a bad-tempered rebuke. I will take my curiosity on that point to bed but it will not delay, or disturb, my sleep.

Mr Munro,

Allow me to remind you that you dismissed my views, after I presented an argument, and more important; evidence. Clearly you did not bother to check the evidence I presented, because you disdained my evidence ‘a priori’, for your narrow “authorities”. Allow me to remind you that it was your authorities who claimed there would be keen negotiation over the currency; in fact there is none. £Sterling will belong solely to rUK. Then they appealed to the Czech-Slovak agreement in international law as the template for UK-Scotland. Czechoslovakia ceased to exist. It was a dissolution. It was nothing lik UK-Scotland; where rUK is the continuator state of UK. Your authority was wrong. You can check my facts, it is really easy to do in the modern communications age; I actually provided you with an explanation why I had drawn my conclusion, and in the thread of my own article a further explanation. Just do a little work for yoursel, and you may decide solely based on the facts – all I ever seek; but no, your minor “authorities” are all.

You quite clearly are not interested in facts or evidence; or the fact that I have gone to some trouble to provide you with an audit trail because I am more interested that people are able to check the veracity of what I say for themselves. I make no claim to impeccable authority, I may make mistakes but I tend to expect that reasonable people are prepared to meet me half way. If, when we reach the ‘nub’ I discover that the obscurity of Bella Caledonia is such that it is dismissed out of hand, ex-ante before even being read by the reader, and could not pass muster if it disagrees with the reader’s preferred unchallangeable ‘authority’, I have no idea why the reader is here. When the reader is not interested in checking evidence, but is prepared to have me waste my valuable time on the idle amusement of someone who is effectively prepared to do little more than trolling, albeit in florid, windy faux-reasonable language, I grow a little tired of the wasteful tedium of it all. You are a time-waster Mr Munro. Do you catch my drift? I hope so, because I have had my fill of this guff.

At the end of our first round of exchanges you accepted that I was free to take a different view and, at the end of the second, I did. It boiled down to the fact that (1) I have more faith in the opinions produced by the Centre on Constitutional Change, Andrew Wilson and the authors of the 2013 White Paper than I do in yours, and, (2) I was unimpressed by your imperious dismissal of these sources as “minor” and “narrow” authorities . Also, if an independent Scotland could indeed walk away from UK debt it would be such a benefit to the economic case that the SNP would have seized upon it at some stage between 2013 and now. I suspect they won’t – if you get my drift.

I can’t see why I should have to justify reading a blog which is new to me and a novel opinion written by someone I had never heard of before. That’s the whole point of blogs – to provide a platform for views that might not surface in other media. If I had concluded that you are right you would, no doubt, have been content with the outcome but, as I didn’t, you have doubled the length of our exchanges by bitter exchanges rebuking me for wasting your time.

For me, the “nub” of this experience is that I not only stumbled upon a new blog but on an extremely self-important man with a low tolerance for dissent. Like you I do hope we can end the bickering soon : unlike you, I could spare the time but the sooner this ends the sooner you can calm down.

Mr Munro,

I hate to tell you; I am calm – take it or leave it, this is how it is. By all means go your own way, it is really of little account either way to me, I promise you. I write articles, from time to time. Take them or leave them. You chose to attach a comment to me in a thread that was partially about another article I had written. Generally (not I confess always), I try to engage with commenters, answer questions or debate issues raised. I think that is a good thing to do. I have limited time, and I try to answer with care; but I expect extended engagement to imply a readiness to exchange serious information, not induce an opportunity to troll. I have replied to you at least six times. I have engaged.

If you quickly form an opinion (you have formed yours before you came here and have neither moved nor even researched the issues further), and leave, disdain, reject what you have read; whatever, that is your prerogative. I do however expect that if someone persists in pursuit and criticism of me, beyond a single comment, then although I do not mind the criticism – I am not trying to score points, I am willing to be wrong, but it is a two-way street: it must be based on a mutual desire to use rigorous proof, not unconvincing authorities (and I have now given the reasons why I do not consider them authorities, several times, and you still repeat the same opinion, but offering no proof whatsoever why they are not wrong or WHY i am wrong) – I expect the continued engagement to follow reasonable rules of proof, evidence, facts. I expect proof to be presented, not mere regurgitation that you disaprove your authorities being rejected. Really, I do not care what you think. I have no idea who you are, and have gone far beyond what may reasonably be expected of any reader engaging with a writer. You still do not even attempt to offer proof your authorities are right. You claim I am self-important. Physician, heal thyself. I have never heard of you, I have no reason whatsoever to give you the least credibility at all; you have offered nothing of substance, but at least I have tried – what I have received is a ruffled and juvenile ‘tit-for-tat’ because i do not have time to burn on you; but not serious engagement from you. You are not interested in the search for understanding or truth; I see that. You are a time-waster Mr Munro. I do not intend to waste any more time.

My questions asked why your proposals – which would have clear economic benefits for part of the UK withdrawing from the union – failed to gain the support of hard headed politicians who wanted economic prosperity for their country; Michael Collins in 1921-22, Alex Salmond in 2014 and – I could add – Nicola Sturgeon today.

You ignored this question in favour of repeating, at greater length, the position which politicians, elected to govern, have shown no interest in.

I actually spend more time than many writers I think, answering questions of commenters in detail; I think the effort and courtesy I show you deserves a little more courtesy in return than cheap attempts to score points over nothing. I have no idea why Michael Collins wasn’t interested in the monetary economics, but I speculated that such concerns were not highly rated by Irishmen seeking independence in the 1920s. Collins had his hands full after he agreed to partition. He was dead – assassinated – in 1922. He wasn’t assassinated over currency policy.

Scotland is quite different. This is Adam Smith land. Economics really matters here. I haver already said that Alex Salmond was wrong on currency in 2014. His proposal was rejected and I suggest focusing on the scale of that failure – the Growth Commission have given up on joint sovereignty, and now want a Scottish Currency; they just do not know how to deliver it. Leaders just do not like analysing their blunders, or being reminded of them. The SNP is making a mess of the currency issue. Perhaps they are struggling because they think they can bring on board some Unionists by prevaricating on currency; I do not know; but it is an unsatisfactory policy, and a bad one to misjudge; because it is the one critical policy left.

You plainly believe that Scotland could – on becoming independent – walk away from any responsibility for the UK’s National Debt. Politicians, who have to live in the real world, know differently. It is the latter who will decide Scotland’s future. Personally, I am relieved that this is so.

You frame the proposition completely erroneously. Scotland has no responsibility for the debt in international law. Period. rUK’s total responsibility follows from the framing of rUK as the continuator state; indeed it follows irrevocably from what rUK insists on. No other outcome was actually possible. The ‘waltzing away’ argument is completely false. You simply miss the whole point of secession in the framework of an incorporating union, one shared currency and central bank, and the requirement to maintain a continuator state. You need to do some work on the matter. Lazy intuition is not sufficient. The fact that you do not understand, I cannot help; but I have lost interest in your random, unfocused, unresearched questions/comments on this matter. You are now on your own. Finis.

Some questions come to mind;

1 If an independent Scotland can walk away from the National Debt accumulated when Scotland was part of the UK, why would hard-headed SNP politicians – think Alex Salmond – not support such a move ?

2 Similarly, why did the government of the impoverished Irish Free State not follow such a course in 1921 – 22 ?

3 Does George Kerevan, who has become a sort of economics guru with Bella Caledonia, support this idea ?

Is it actually more important for westminster to have Scotland continuing to use the pound than for Scotland itself?

I mean if Scotland does opt for a separate currency will this not seriously damage the confidence in sterling.

Westminster is surely shooting itself in the foot pursuing this currency argument.

It shows how desperately, deluded and panicky rUK politicians have become.

Point 5 doesn’t ring true; “…if the money markets don’t play ball”. Of course the money markets’ll play ball, because they might be able to make money out of it. This is why the FT is a good news source; the question at the front of its readers’ minds is, “Can I/we make money from this situation?”.

Of course Scotland would have to take responsibility for a share of the U.K. debt as it stands at the point of independence. This was recognised in the 2013 White paper and is repeated at two points in the 2018 Growth Commission report. I quote :

Annual Solidarity Payment

3.120 An agreement should be sought for a mechanism for Scotland to pay a reasonable share of the servicing of the net balance of UK debt and assets.

3.139 The Annual Solidarity Payment is modelled at around £5 billion including debt servicing contributions, 0.7% GNP contribution for foreign aid and a further £1bn set aside for other shared services.

All of this is academic of course because, as the GERS statistics will reveal tomorrow independence would have to be based on voodo economics.

It’s not acceptable or fashionable to characterise other voters as stupid and ignorant but my experience has shown me that many can behave as if they were. There are people who will worry that they are going to lose their pension, lose their savings, not get paid etc. if Scotland creates a new currency.

Although coinage and notes and bank balances are simply tokens to those who study this stuff, to many people the Pound is what they need in order to buy stuff. Take it away and they will have no money, no pension, no savings. Even people who have travelled abroad for holidays and converted their Pounds to Euros remain convinced that losing the pound will leave them penniless. I spoke to people like this in 2014 who could not understand that they would still get their UK pension in an independent Scotland, even when asked “How come a UK pensioner living in Spain still gets their UK pension then?”

A campaign of basic education is needed about the basics of becoming a real, actual country.

The thought of a Scots Pound is very exciting indeed. It puts a fire in my belly.

It would be a strong signal that this time we mean business. It could embolden people to begin to imagine a new and different Scotland. I think politicians underestimate our desire for real change and our capacity to get on board with radical ideas once the benefits are explained. Keeping the pound means more of the same.

Wul

I am afraid I cannot agree with you on the intelligence of your interviewee from 2014 who doubted that they would receive their UK pension in a post-independent Scotland. The case of UK pensioners in Spain is entirely inapposite. UK pensioners are nationals of the UK state and as a UK citizen, one does not need to reside in the UK to receive a UK pension. The point about being a (newly minted) Scottish citizen is that one is no longer a UK citizen. Naturally, a Scottish citizen would have the right to a Scottish pension, but will that be similar and in what currency will it be paid in? Do you believe that new-minted Scottish citizens will continue to enjoy access to UK social security?

Though the SNP formula of a shared currency in 2014 would have limited our independence, it is in my view the most workable option. It is just a pity that the English would not play. Massive dangers attend both sterlingisation ( which looks to be the current policy — but I am not absolutely sure??) and our own currency.

The author and commentators are generally very relaxed about how a Scottish currency would function. I lived through the effects of the plunging Brazilian real in the Summer of 2002 so I am sensitive as to what happens when currency goes wrong. In one sense this site is absolutely right, the currency is the key issue in the indy debate. See attached a useful article which discusses issues arising in notorious cases https://www.businessinsider.com/what-is-a-currency-peg-2016-8?r=US&IR=T

And remember the disaster of Greece. My old friend Michael Fry describes currency as being merely a “fetish”. Michael is way out here. Currency is destiny.

It must be the hope of this site and writers such as Robin MacAlpine that there will be a volte-face and the Yes movement will go into Indy ref 2 promoting our own currency as official policy. There is absolutely no sign of this happening. Will leftists actually support sterlingisation when it comes down to it?

Caroline asks what examples are there of successful currencies being created in recent years by countries formed by succession such as Scotland would be? If you are looking for a country becoming independent from a highly advanced and wealthy capitalist economy with high levels of welfare and personal indebtedness the answer is none. In fact, there is no genuine economic precedent for what would happen if Scotland becomes independent for no advanced economy ( no the Velvet divorce is not a precedent) has ever broken up.

We have no credible currency policy and thus we are entering stormy and risky waters.

William

Thank you for your reply William.

I realised after posting that UK pensioner abroad is not the same thing as a new Scottish citizen (maybe it’s me that’s stupid).

You asked “Do you believe that new-minted Scottish citizens will continue to enjoy access to UK social security?” No, I don’t. But if someone has paid their NI contributions to the UK treasury for decades then I think it’s reasonable to expect the UK treasury to honour their entitlement. I seem to remember this was confirmed by UK Gov. in 2014.

So; “It will work, it’s easy, it will be a success” OR “It cannae work, it will be a disaster, the economy will crash”.

An interesting point about about ex-pats and pensions . Will there be an option in the independence settlement for UK citizens in iScotland to become ex-pats and thereby continue to claim UK pensions. After all, if we’ve paid exactly the same taxes/NI contributions etc.

and through no fault of our own are no longer UK citizens don’t we have the same rights as those who chose to become ex-pats in other counttries ?

If you are going to set up an independent country, there are going to be risks – and here the SNP have been duplicitous not to say cowardly with Scottish voters because they pretend otherwise.

But becoming a vassal state of Boris Johnson’s Empire II project is much more dangerous and infinitely worse.

The SNP, instead of galvanising voters by pointing to the fundamental question of Scottish sovereignty being ignored time and time again by the English majority – from Trident, to the Poll Tax to Brexit – and being honest with voters about the relative risks of a setting up new country (and currency), shy away from anything which might be seen as “destabilising” or cause even short term turbulence.

The SNP position is logically unsustainable. You can not argue for fundamental change and stability at the same time as the SNP does.

Frankly, the Scots have to decide whether they want to be gradually assimilated into England over the next fifty years and cease to exist as a sovereign country in all but name, or else become a fully-fledged sovereign European nation, which means integrating into Europe, either in EFTA or the EU.

By the way, it seems quite likely to me that the Brexit project will fail if Scotland votes to become independent in Europe.

England will be locked out out the biggest market in the world and will be left without a single ally in the whole continent.

Why would any Scottish voter choose to stay aligned to an isolated England when you could be like Ireland and align with 27 European nations, including of course, the two biggest economies in the continent, Germany and France… ??

That makes sense Douglas, thanks.

It outlines what I feel; the bigger risk is in staying, because the future is guaranteed to be shit. Whereas with independence there’s hope of a better way to run a country.

While agreeing that being bound to the pound sterling is not really independence and wishing for a more aggressive line on currency from the SNP there has been little mention of the growth of digital currencies.

I’m only beginning to research this complicated subject, however it appears to me that the days of central banks and national currencies may well be numbered.

Whether this is a good thing or not is highly debatable, however it may be a reality that the planners of a future Scottish currency may have to consider.

Wul

The UK state pension system like social security system is not an entitlement system. These do not operate as say private pensions do. They are in effect taxes and pensions and social security payments are paid out of general funds. Scottish citizens will receive no pension or social security emoulments out of UK funds after independence.

I don’t normally comment on what Douglas Wilson writes but let me quote this: “England will be locked out out the biggest market in the world and will be left without a single ally in the whole continent.” This is pure fantasy. Once Brexit happens the UK will trade with the EU either under a trade deal or under WTO terms. We will still massively trade with the EU and they with us. What do you think the Americans and Chinese are doing with the EU in terms of trade? And while England may have not a “single ally” on the continent it will remain, through NATO, as one of the leading defenders of the continent behind only the USA. But who’d have thocht it?

William

I don’t understand the snide remark William, but I think you, like the Brexiters, misread how much resentment there is building in Europe to England.

Frankly, no one in Europe can wait to get rid of England as far as I can see.

Obviously there will still be some trade on WTO terms, but England will be just another third party country and will drop drastically down the list of priorities and no longer benefit from EU solidarity which is of the essence of the Treaties.

Like the Brexiter you are, you claim this will have little or no effect on England’s standing in the world.

Well, of course it will.

In terms of NATO and military alliances, Trump and Boris will get on just fine I except because they share the same racist white nationalist project, but again I don’t see the Europeans identifying themselves with that at all.

With a bit of luck, the EU will react to the Anglo American white nationalist project and go ahead and create a fully functional European Defence Force which should have been done years ago…

@William The UK state pension is indeed paid out of “general funds”, but the concept of entitlement is alive and well.

See for example – https://www.gov.uk/government/publications/your-new-state-pension-explained/your-state-pension-explained

“National Insurance credits help to build up your National Insurance record and so protect your entitlement to the State Pension.”

Thanks for your response, Douglas. I have been an independence supporter all my life but also a Brexiteer. That puts me in a YES/Leave club of close to half a million Scots.

So the Europeans want to get “rid of England” Perhaps they will embargo us? A rules-based organisation? What about our £100 billion trade deficit with the EU? European solidarity? Greece? Catalonia? Italy?

A fully functional “European Defence Force”? I would say that force could keep Putin out of Vilnius for about 20 minutes. That would be just enough time for the Russians to stop laughing.

Dream on

William

No, the Europeans will not embargo England, but they will do everything required to protect the integrity of the Single Market, as they rightly should and as individual member States they are bound to uphold by Treaty.

It is simply delusional to suggest that Brexit will not have an adverse effect on UK-EU trade.

Just as it is simply delusional to suggest that UK relations with European countries will not suffer because of Brexit.

I am pretty sure that many Europeans will look elsewhere for things they would once have bought in the UK, partly because there will be plenty of European entrepreneurs preparing to fill the hole in the market once occupied by UK based companies.

The EU is now, for the first time ever, 100% behind Spain’s entirely justified claim on Gibraltar.

Recent border polls in Ireland suggest re-unification of North and South is a matter of time.

In Scotland, support for independence has risen sharply since Brexit.

And all of this before we are even out the EU…

You Brexiters, William, are like the knight in Monty Python’s “The Holy Grail” who, as his limbs are lopped off in a duel, keeps making light of his injuries as “just a flesh wound”…

George

Nice try. But your “entitlement” only applies to the system as it currently operates. If the UK changed the rules on contributions, for example, the people formerly having an “entitlement” could not successfully bring suit. Remember the example of the WASPI women. When Scots become Scottish citizens “entitlement” to UK pensions end.

Douglas

I enjoy your responses. The EU will preserve the integrity of the Single Market ( less than 15% of entire World GDP and declining) — big surprise. Brexit will have an “adverse effect” on UK-EU trade? Well yes, a rather small one. But we will become an independent sovereign country free to run our own trade policy. European entrepreneurship will flower? About time. The EU is “100% behind Spain…” Well yes, they know that in Barcelona. Re-unification of Ireland is now definite — get your chequebook ready Dublin!

William

Very good, William, you’re quick on your feet…

I am sure we can agree that it is deeply ironic that an English nationalist project known as “Brexit” is going to finally put an end to Great Britain itself, a political project which dates back to 1603 and as a political reality, since 1707?

What are they going to call it once Scotland is independent and free to re-join? Engxit? It’s unpronounceable..

Or will English people just continue calling themselves British (the only natives of these idles who do so) when they travel abroad, much like football teams wear an away strip on occasions?

Engxit sounds like a nasty skin disease….

William: All they have changed is the pension age, the entitlement remains. Perhaps they’ll change the pension age for Scots to infinity (I hear you say), but not for their favourites the ex-pats. What would they do for anyone who moves to Scotland after independence?

In reality, the details will be subject to negotiation – do you really think the rUK will be vindictive on this point when there are other issues to resolve? On many of those other issues, Scotland has significant bargaining power.

Douglas

I just hate to think of all these poor people in the USA, Canada, New Zealand, Brazil and elsewhere who live in independent sovereign countries and do not seem to need German supervision to run their own affairs. Still, it is rather difficult to understand why a “nationalist” would wish to swap London rule for Brussels rule. What would Michael Collins say?

William

Now you lose all credibility I’m afraid, William, by resorting to the crude lies from the Brexit campaign…

As we have all been watching on our TV screens to the point of tedium for five years now, England is leaving the EU precisely because it is a fully sovereign nation, just as much as the USA or Canada or New Zealand or Australia are sovereign.

No country is forced to join the EU against its will.

England/UK joined after a referendum almost fifty years ago, and voted to leave in another referendum just five years ago.

In both these processes, England has been free to follow the national will (not Scotland though, the Scots being second class European citizens, a view apparently endorsed in the shape of passive acceptance by FM Sturgeon)

To forgo or suspend unilateral decision making powers on certain issues is not the same thing as to give up national sovereignty at all.

So why do you people keep insisting it is?

In any case, under it all lies Germanophobia, as you make clear in your comment, which is very common in Tory England, but much less so in Scotland..

The idea that the French or the Dutch would agree to live under “German supervision” after the vents of 20th century European history is too absurd for words.

As is the idea that the 27 members of the EU all pursue different trade policies and live under totally different rules and regulations…

Douglas

After what you said about the English today I think it unfitting that you accuse me of being German-phobic. On the contrary, I have high respect for the Germans, I just do not want to be ruled by them.

We certainly did ratify joining the EEC in 1975 via a referendum even though Ted Heath lied through his teeth (typical Remainer). We left the EU in 2016 as a United Kingdom, responding to a specific UK question. However, the UK during the EU years was not an independent sovereign country in the way that the USA and Australia were and are independent and sovereign. Since the advent of the Lisbon Treaty, more than 85% of EU law is enacted through QMV voting meaning that the UK has no guaranteed veto over most EU legislation. A study carried out by Channel 4 before the Brexit referendum showed that around 60% of new UK law was coming directly from Brussels. The EU is a Confederation which seeks its own army as you rightly pointed out. The UK lost control over its trade policy and much else. Thankfully, we were never part of the catastrophic euro. Regarding German domination, you might want to read the work of Paul Lever, who was British Ambassador in Germany during the 1990s and is staunchly anti-Brexit. His book is simply called “Germany Rules”. It is a very interesting and balanced read.

If you want to see German power in action you may wish to read Varoufakis’s book entitled “Adults in the Room”.

What a great relief that we are exiting this hopeless Confederation. The Europeans have created fake institutions, with fake parties offering fake citizenship. But they cannot create a fake single nationality. “European” democracy is a complete sham.

William

Sorry, the title of Lever’s book is actually “Berlin Rules”

William, you will forgive me, but I see no point in carrying on this exchange. Clearly there were some very serious mistakes made by the Eurogroup back at the time of the Greek debt crisis, clearly too the decision just last month to effectively mutulize some debt by the EU is a huge step forward.

In any case, as a Brexiter, you won. The utterly pathetic, lame and spineless English liberal classes were swept aside by a lager lout like Farage and you got free of the dreaded Europeans.

You have severely reduced the rights of millions of EU citizens in the UK and UK citizens in Europe, in exchange for exactly what I don’t know. Did you get a cheque in the post from Boris? A pay rise at work? The right to go and live and work in some other continent instead of Europe? We were promised there would be great spoils to this victory, but I have seen none at all.

In terms of the rights and liberties of citizens, Brexit amounts to a transfer from the individual to the State like no other in our time. We as citizens lose the right to live and work in Europe, in exchange for the British State accruing the power to deport, expel and refuse entry to our European friends and colleagues. That’s what it amounts to.

As for Tory England, I want as little to do with them as at all possible and if there has to be a hard, physical border at Berwick, that is absolutely fine by me….

England is not free to leave the EU. England would have to be standing on it’s own to leave the EU. it is a major part of the UK. It can never be England unless it becomes Free of the Nations that support her.

Economic policy and theory are all very well but they are just policies and theories. It is stupid to determine what policies would need to be employed in any new Independent country. But in both Scotland and rUK’s case it maybe sensible to continue with the same currency or it may not be. Even the best economists in the world could not predict what currency either state will be using a year after Scottish Independence. Who can honestly say rUK will not be using the American dollar a year after Scotland becomes Independent.

Reading the above article I began to feel overwhelmed by the essence of bubbling shite.

John S Warren

re; your comment 28 August 10.54. pm

You are correct, if you frame the problem in legal terms.

In reality, it is a political problem. The politicians, who anticipate having to deal with this in the future, know this and avoid discussing it in legal terms.